Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

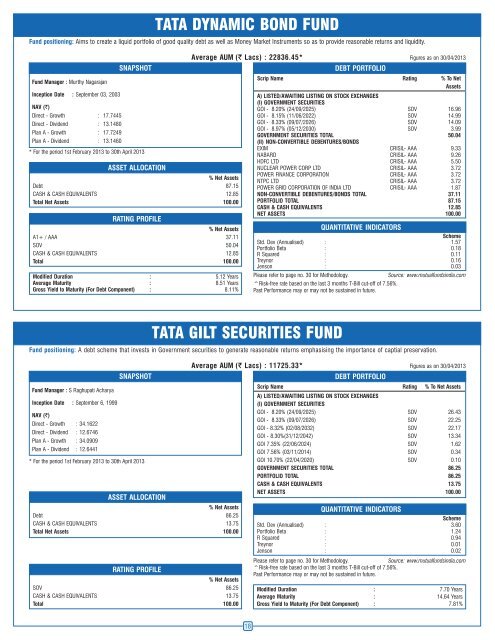

<strong>Fund</strong> positioning: Aims to create a liquid portfolio of good quality debt as well as Money Market Instruments so as to provide reasonable returns and liquidity.<strong>Fund</strong> Manager : Murthy NagarajanInception Date : September 03, 2003SNAPSHOTNAV (`)Direct - Growth : 17.7445Direct - Dividend : 13.1480Plan A - Growth : 17.7249Plan A - Dividend : 13.1460* For the period 1st February 2013 to 30th <strong>April</strong> 2013ASSET ALLOCATION% Net AssetsDebt 87.15CASH & CASH EQUIVALENTS 12.85Total Net Assets 100.00RATING PROFILE% Net AssetsA1+ / AAA 37.11SOV 50.04CASH & CASH EQUIVALENTS 12.85Total 100.00Modified Duration : 5.12 YearsAverage Maturity : 8.51 YearsGross Yield to Maturity (For Debt Component) : 8.11%TATA DYNAMIC BOND FUNDAverage AUM (` Lacs) : 22836.45*DEBT PORTFOLIOFigures as on 30/04/2013Scrip Name Rating % To NetAssetsA) LISTED/AWAITING LISTING ON STOCK EXCHANGES(I) GOVERNMENT SECURITIESGOI - 8.20% (24/09/2025) SOV 16.96GOI - 8.15% (11/06/2022) SOV 14.99GOI - 8.33% (09/07/2026) SOV 14.09GOI - 8.97% (05/12/2030) SOV 3.99GOVERNMENT SECURITIES TOTAL 50.04(II) NON-CONVERTIBLE DEBENTURES/BONDSEXIM CRISIL- AAA 9.33NABARD CRISIL- AAA 9.26HDFC LTD CRISIL- AAA 5.50NUCLEAR POWER CORP LTD CRISIL- AAA 3.72POWER FINANCE CORPORATION CRISIL- AAA 3.72NTPC LTD CRISIL- AAA 3.72POWER GRID CORPORATION OF INDIA LTD CRISIL- AAA 1.87NON-CONVERTIBLE DEBENTURES/BONDS TOTAL 37.11PORTFOLIO TOTAL 87.15CASH & CASH EQUIVALENTS 12.85NET ASSETS 100.00QUANTITATIVE INDICATORSSchemeStd. Dev (Annualised) : 1.57Portfolio Beta : 0.18R Squared : 0.11Treynor : 0.16Jenson : 0.03Please refer to page no. 30 for Methodology.Source: www.mutualfundsindia.com^Risk-free rate based on the last 3 months T-Bill cut-off of 7.56%.Past Performance may or may not be sustained in future.TATA GILT SECURITIES FUND<strong>Fund</strong> positioning: A debt scheme that invests in Government securities to generate reasonable returns emphasising the importance of captial preservation.<strong>Fund</strong> Manager : S Raghupati AcharyaInception Date : September 6, 1999NAV (`)Direct - Growth : 34.1622Direct - Dividend : 12.6746Plan A - Growth : 34.0909Plan A - Dividend : 12.6441SNAPSHOT* For the period 1st February 2013 to 30th <strong>April</strong> 2013ASSET ALLOCATION% Net AssetsDebt 86.25CASH & CASH EQUIVALENTS 13.75Total Net Assets 100.00RATING PROFILE% Net AssetsSOV 86.25CASH & CASH EQUIVALENTS 13.75Total 100.00Average AUM (` Lacs) : 11725.33*DEBT PORTFOLIOFigures as on 30/04/2013Scrip Name Rating % To Net AssetsA) LISTED/AWAITING LISTING ON STOCK EXCHANGES(I) GOVERNMENT SECURITIESGOI - 8.20% (24/09/2025) SOV 26.43GOI - 8.33% (09/07/2026) SOV 22.25GOI - 8.32% (02/08/2032) SOV 22.17GOI - 8.30%(31/12/2042) SOV 13.34GOI 7.35% (22/06/2024) SOV 1.62GOI 7.56% (03/11/2014) SOV 0.34GOI 10.70% (22/04/2020) SOV 0.10GOVERNMENT SECURITIES TOTAL 86.25PORTFOLIO TOTAL 86.25CASH & CASH EQUIVALENTS 13.75NET ASSETS 100.00QUANTITATIVE INDICATORSSchemeStd. Dev (Annualised) : 3.60Portfolio Beta : 1.24R Squared : 0.94Treynor : 0.01Jenson : 0.02Please refer to page no. 30 for Methodology.Source: www.mutualfundsindia.com^Risk-free rate based on the last 3 months T-Bill cut-off of 7.56%.Past Performance may or may not be sustained in future.Modified Duration : 7.70 YearsAverage Maturity : 14.64 YearsGross Yield to Maturity (For Debt Component) : 7.81%18