Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

Fact Sheet April - 2013.cdr - Tata Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

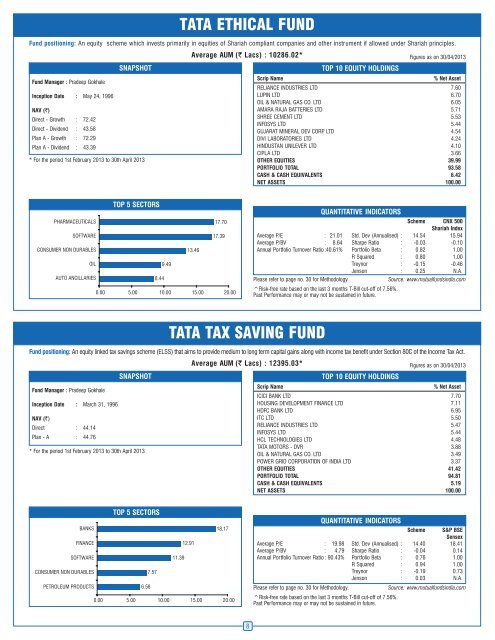

<strong>Fund</strong> positioning: An equity scheme which invests primarily in equities of Shariah compliant companies and other instrument if allowed under Shariah principles.<strong>Fund</strong> Manager : Pradeep GokhaleInception Date : May 24, 1996SNAPSHOTNAV (`)Direct - Growth : 72.42Direct - Dividend : 43.58Plan A - Growth : 72.29Plan A - Dividend : 43.39* For the period 1st February 2013 to 30th <strong>April</strong> 2013TATA ETHICAL FUNDAverage AUM (` Lacs) : 10286.02*TOP 10 EQUITY HOLDINGSFigures as on 30/04/2013Scrip Name% Net AssetRELIANCE INDUSTRIES LTD 7.60LUPIN LTD 6.70OIL & NATURAL GAS CO. LTD 6.05AMARA RAJA BATTERIES LTD 5.71SHREE CEMENT LTD 5.53INFOSYS LTD 5.44GUJARAT MINERAL DEV CORP LTD 4.54DIVI LABORATORIES LTD 4.24HINDUSTAN UNILEVER LTD 4.10CIPLA LTD 3.66OTHER EQUITIES 39.99PORTFOLIO TOTAL 93.58CASH & CASH EQUIVALENTS 6.42NET ASSETS 100.00TOP 5 SECTORSPHARMACEUTICALSSOFTWARE17.7017.39CONSUMER NON DURABLES13.46OILAUTO ANCILLARIES9.498.440.00 5.00 10.00 15.00 20.00QUANTITATIVE INDICATORSScheme CNX 500Shariah IndexAverage P/E : 21.01 Std. Dev (Annualised) : 14.54 15.94Average P/BV : 8.64 Sharpe Ratio : -0.03 -0.10Annual Portfolio Turnover Ratio :40.61% Portfolio Beta : 0.82 1.00R Squared : 0.80 1.00Treynor : -0.15 -0.46Jenson : 0.25 N.A.Please refer to page no. 30 for Methodology.Source: www.mutualfundsindia.com^Risk-free rate based on the last 3 months T-Bill cut-off of 7.56%.Past Performance may or may not be sustained in future.TATA TAX SAVING FUND<strong>Fund</strong> positioning: An equity linked tax savings scheme (ELSS) that aims to provide medium to long term capital gains along with income tax benefit under Section 80C of the Income Tax Act.Average AUM (` Lacs) : 12395.03*Figures as on 30/04/2013SNAPSHOTTOP 10 EQUITY HOLDINGS<strong>Fund</strong> Manager : Pradeep GokhaleScrip Name% Net AssetICICI BANK LTD 7.70Inception Date : March 31, 1996HOUSING DEVELOPMENT FINANCE LTD 7.11HDFC BANK LTD 6.95NAV (`)ITC LTD 5.50Direct : 44.14RELIANCE INDUSTRIES LTD 5.47INFOSYS LTD 5.44Plan - A : 44.76HCL TECHNOLOGIES LTD 4.48* For the period 1st February 2013 to 30th <strong>April</strong> 2013TATA MOTORS - DVR 3.88OIL & NATURAL GAS CO. LTD 3.49POWER GRID CORPORATION OF INDIA LTD 3.37OTHER EQUITIES 41.42PORTFOLIO TOTAL 94.81CASH & CASH EQUIVALENTS 5.19NET ASSETS 100.00TOP 5 SECTORSBANKS18.17FINANCESOFTWARE12.9111.39CONSUMER NON DURABLESPETROLEUM PRODUCTS7.576.580.00 5.00 10.00 15.00 20.00QUANTITATIVE INDICATORSScheme S&P BSESensexAverage P/E : 19.98 Std. Dev (Annualised) : 14.40 18.41Average P/BV : 4.79 Sharpe Ratio : -0.04 0.14Annual Portfolio Turnover Ratio : 90.43% Portfolio Beta : 0.76 1.00R Squared : 0.94 1.00Treynor : -0.19 0.73Jenson : 0.03 N.A.Please refer to page no. 30 for Methodology.Source: www.mutualfundsindia.com^Risk-free rate based on the last 3 months T-Bill cut-off of 7.56%.Past Performance may or may not be sustained in future.8