apr-11.pdf (2.07 MB) - Crown Ownership Monitoring Unit

apr-11.pdf (2.07 MB) - Crown Ownership Monitoring Unit

apr-11.pdf (2.07 MB) - Crown Ownership Monitoring Unit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

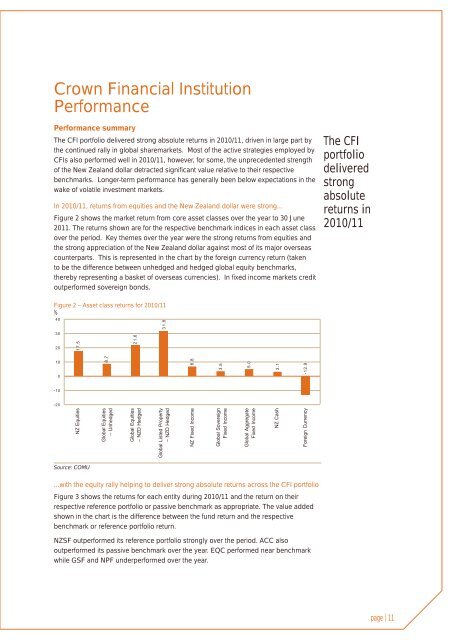

<strong>Crown</strong> Financial InstitutionPerformancePerformance summaryThe CFI portfolio delivered strong absolute returns in 2010/11, driven in large part bythe continued rally in global sharemarkets. Most of the active strategies employed byCFIs also performed well in 2010/11, however, for some, the unprecedented strengthof the New Zealand dollar detracted significant value relative to their respectivebenchmarks. Longer-term performance has generally been below expectations in thewake of volatile investment markets.In 2010/11, returns from equities and the New Zealand dollar were strong...Figure 2 shows the market return from core asset classes over the year to 30 June2011. The returns shown are for the respective benchmark indices in each asset classover the period. Key themes over the year were the strong returns from equities andthe strong appreciation of the New Zealand dollar against most of its major overseascounterparts. This is represented in the chart by the foreign currency return (takento be the difference between unhedged and hedged global equity benchmarks,thereby representing a basket of overseas currencies). In fixed income markets creditoutperformed sovereign bonds.The CFIportfoliodeliveredstrongabsolutereturns in2010/11Figure 2 – Asset class returns for 2010/11%Source: COMU...with the equity rally helping to deliver strong absolute returns across the CFI portfolioFigure 3 shows the returns for each entity during 2010/11 and the return on theirrespective reference portfolio or passive benchmark as appropriate. The value addedshown in the chart is the difference between the fund return and the respectivebenchmark or reference portfolio return.NZSF outperformed its reference portfolio strongly over the period. ACC alsooutperformed its passive benchmark over the year. EQC performed near benchmarkwhile GSF and NPF underperformed over the year.page | 11