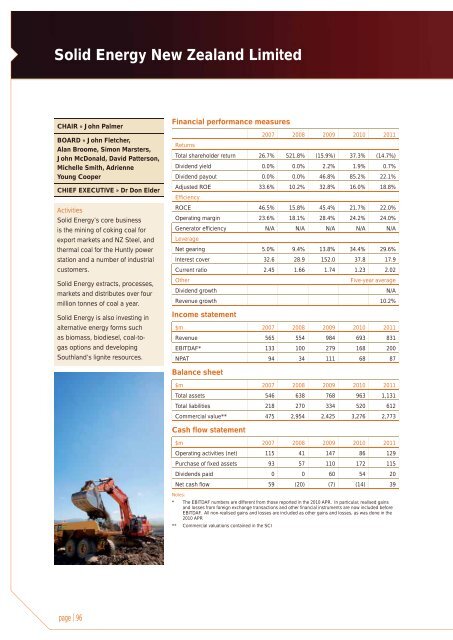

Solid Energy New Zealand LimitedCHAIR » John PalmerBOARD » John Fletcher,Alan Broome, Simon Marsters,John McDonald, David Patterson,Michelle Smith, AdrienneYoung CooperCHIEF EXECUTIVE » Dr Don ElderActivitiesSolid Energy’s core businessis the mining of coking coal forexport markets and NZ Steel, andthermal coal for the Huntly powerstation and a number of industrialcustomers.Solid Energy extracts, processes,markets and distributes over fourmillion tonnes of coal a year.Solid Energy is also investing inalternative energy forms suchas biomass, biodiesel, coal-togasoptions and developingSouthland’s lignite resources.Financial performance measures2007 2008 2009 2010 2011ReturnsTotal shareholder return 26.7% 521.8% (15.9%) 37.3% (14.7%)Dividend yield 0.0% 0.0% 2.2% 1.9% 0.7%Dividend payout 0.0% 0.0% 46.8% 85.2% 22.1%Adjusted ROE 33.6% 10.2% 32.8% 16.0% 18.8%EfficiencyROCE 46.5% 15.8% 45.4% 21.7% 22.0%Operating margin 23.6% 18.1% 28.4% 24.2% 24.0%Generator efficiency N/A N/A N/A N/A N/ALeverageNet gearing 5.0% 9.4% 13.8% 34.4% 29.6%Interest cover 32.6 28.9 152.0 37.8 17.9Current ratio 2.45 1.66 1.74 1.23 2.02OtherFive-year averageDividend growthN/ARevenue growth 10.2%Income statement$m 2007 2008 2009 2010 2011Revenue 565 554 984 693 831EBITDAF* 133 100 279 168 200NPAT 94 34 111 68 87Balance sheet$m 2007 2008 2009 2010 2011Total assets 546 638 768 963 1,131Total liabilities 218 270 334 520 612Commercial value** 475 2,954 2,425 3,276 2,773Cash flow statement$m 2007 2008 2009 2010 2011Operating activities (net) 115 41 147 86 129Purchase of fixed assets 93 57 110 172 115Dividends paid 0 0 60 54 20Net cash flow 59 (20) (7) (14) 39Notes:* The EBITDAF numbers are different from those reported in the 2010 APR. In particular, realised gainsand losses from foreign exchange transactions and other financial instruments are now included beforeEBITDAF. All non-realised gains and losses are included as other gains and losses, as was done in the2010 APR** Commercial valuations contained in the SCIpage | 96

OperationsThis year was a particularly challenging year for Solid Energy owing to theCanterbury earthquakes and the support provided by Solid Energy to theprivately-owned Pike River Coal Company after the mine explosions. Theseevents have significantly impacted Solid Energy, its staff, business partnersand the community.With the support of port and rail partners, the supply chain throughChristchurch and Lyttelton was quickly restored following the September 2010and February 2011 earthquakes.2010/11 was a year of mixed fortunes for Solid Energy. Solid Energy achievedhigher than forecast export coal prices, in part owing to continuing Australiancoal shortages following the Queensland floods, which improved exportcoal margins. However, the Canterbury earthquakes resulted in a reductionto the planned export coal volumes owing to damage to the Lyttlelton Portinfrastructure (to both the wharf and the coal loader). As a result, threeplanned shipments were cancelled. However, total coal sales of 4.1 milliontonnes were still 8% above last year’s sales of 3.8 million tonnes.Solid Energy has continued development and investment in a range ofprojects, such as coal seam gas, an underground coal gasification trial in theWaikato and the advancement of Southland lignite projects.Financial performanceEBITDAF for the 2010/11 year was $200 million, an increase of 19% from$168 million in 2009/10. Stronger than expected coal prices boostedunderlying EBITDAF by $85 million for the 2010/11 year. The cash flow fromoperations was $129 million compared with $86 million in 2009/10. The strongpositive operating cash flow was driven by international sales being up by 14%and international <strong>Unit</strong>ed States dollar pricing up 20%. Solid Energy producedNPAT of $87.2 million for the 2010/11 year being $19.4 million higher than the2009/10 year.The Solid Energy Board has assessed the commercial value of the company, inits SCI, as being $2.8 billion. This is significantly higher than the independentvaluation commissioned by COMU, of $1.7 billion, owing to the independentvaluer's view on commodity prices and the value of Solid Energy's futuredevelopments differing to Solid Energy's view.Performance against planRevenue and EBITDAF at year end were both above forecast largely owing tostronger than expected coal prices. Solid Energy’s NPAT of $87.2 million forthe 2010/11 year was $21.1 million higher than plan.DividendsFor the 2010/11 financial year, Solid Energy paid an interim dividend of$20 million on 31 March 2011 and declared a final dividend of $30 million afterthe year end, which was paid on 30 September 2011.Major investmentsDuring the year Solid Energy spent$115 million on capital expenditure.This expenditure includedcompleting the Stockton coalprocessing plant, starting work ona new Huntly East Mine ventilationshaft and safety and performanceimprovements at Spring CreekMine.Non-financial performanceThe downward trend Solid Energyachieved in lost-time injury and allinjury frequency rates in 2009/10flattened in the 2010/11 year,although the injury severity ratecontinued to fall.Solid Energy’s environmentalperformance remains good with noincidents resulting in abatementor enforcement notices. This year,for the first time in seven years,Solid Energy fell just short ofmeeting its environmental objectiveof having net positive effect onthe environment. Based on thecompany’s own assessment, its netenvironmental impact was -1 for2010/11 which compares with +11in the 2009/10 year.Corporate social responsibilitySolid Energy supports ($2.7 millionin 2010/11) a range of activitieswith a focus on youth anddevelopment, communityinfrastructure and heritage. Afterthe September earthquake SolidEnergy joined its export supplychain partners KiwiRail andLyttelton Port of Christchurch, andTourism West Coast to offer 1,000Canterbury residents a “Break fromthe Quake” on the West Coast.page | 97