Download the MiDA Newsletter, 8th Edition - MiDA Ghana

Download the MiDA Newsletter, 8th Edition - MiDA Ghana

Download the MiDA Newsletter, 8th Edition - MiDA Ghana

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

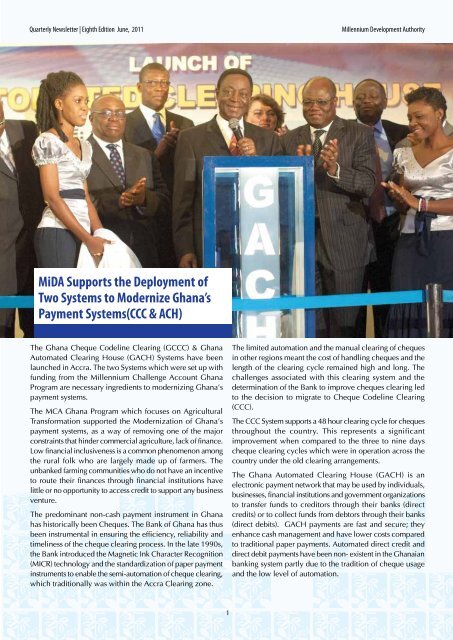

Quarterly <strong>Newsletter</strong> | Eighth <strong>Edition</strong> June, 2011Millennium Development Authority<strong>MiDA</strong> Supports <strong>the</strong> Deployment ofTwo Systems to Modernize <strong>Ghana</strong>’sPayment Systems(CCC & ACH)The <strong>Ghana</strong> Cheque Codeline Clearing (GCCC) & <strong>Ghana</strong>Automated Clearing House (GACH) Systems have beenlaunched in Accra. The two Systems which were set up withfunding from <strong>the</strong> Millennium Challenge Account <strong>Ghana</strong>Program are necessary ingredients to modernizing <strong>Ghana</strong>’spayment systems.The MCA <strong>Ghana</strong> Program which focuses on AgriculturalTransformation supported <strong>the</strong> Modernization of <strong>Ghana</strong>’spayment systems, as a way of removing one of <strong>the</strong> majorconstraints that hinder commercial agriculture, lack of finance.Low financial inclusiveness is a common phenomenon among<strong>the</strong> rural folk who are largely made up of farmers. Theunbanked farming communities who do not have an incentiveto route <strong>the</strong>ir finances through financial institutions havelittle or no opportunity to access credit to support any businessventure.The predominant non-cash payment instrument in <strong>Ghana</strong>has historically been Cheques. The Bank of <strong>Ghana</strong> has thusbeen instrumental in ensuring <strong>the</strong> efficiency, reliability andtimeliness of <strong>the</strong> cheque clearing process. In <strong>the</strong> late 1990s,<strong>the</strong> Bank introduced <strong>the</strong> Magnetic Ink Character Recognition(MICR) technology and <strong>the</strong> standardization of paper paymentinstruments to enable <strong>the</strong> semi-automation of cheque clearing,which traditionally was within <strong>the</strong> Accra Clearing zone.The limited automation and <strong>the</strong> manual clearing of chequesin o<strong>the</strong>r regions meant <strong>the</strong> cost of handling cheques and <strong>the</strong>length of <strong>the</strong> clearing cycle remained high and long. Thechallenges associated with this clearing system and <strong>the</strong>determination of <strong>the</strong> Bank to improve cheques clearing ledto <strong>the</strong> decision to migrate to Cheque Codeline Clearing(CCC).The CCC System supports a 48 hour clearing cycle for chequesthroughout <strong>the</strong> country. This represents a significantimprovement when compared to <strong>the</strong> three to nine dayscheque clearing cycles which were in operation across <strong>the</strong>country under <strong>the</strong> old clearing arrangements.The <strong>Ghana</strong> Automated Clearing House (GACH) is anelectronic payment network that may be used by individuals,businesses, financial institutions and government organizationsto transfer funds to creditors through <strong>the</strong>ir banks (directcredits) or to collect funds from debtors through <strong>the</strong>ir banks(direct debits). GACH payments are fast and secure; <strong>the</strong>yenhance cash management and have lower costs comparedto traditional paper payments. Automated direct credit anddirect debit payments have been non- existent in <strong>the</strong> <strong>Ghana</strong>ianbanking system partly due to <strong>the</strong> tradition of cheque usageand <strong>the</strong> low level of automation.1