detailed - Chennai Telephones - BSNL

detailed - Chennai Telephones - BSNL

detailed - Chennai Telephones - BSNL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

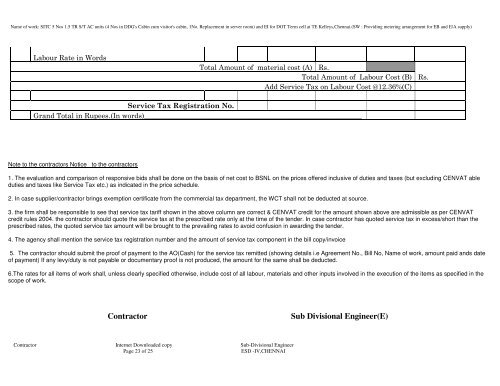

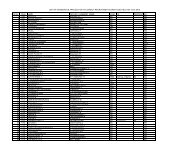

Name of work: SITC 5 Nos 1.5 TR S/T AC units (4 Nos in DDG's Cabin cum visitor's cabin, 1No. Replacement in server room) and EI for DOT Term cell at TE Kelleys,<strong>Chennai</strong>.(SW : Providing metering arrangement for EB and E/A supply)Labour Rate in WordsTotal Amount of material cost (A) Rs.Total Amount of Labour Cost (B)Add Service Tax on Labour Cost @12.36%(C)Rs.Service Tax Registration No.Grand Total in Rupees.(In words)_____________________________________________________________Note to the contractors Notice to the contractors1. The evaluation and comparison of responsive bids shall be done on the basis of net cost to <strong>BSNL</strong> on the prices offered inclusive of duties and taxes (but excluding CENVAT ableduties and taxes like Service Tax etc.) as indicated in the price schedule.2. In case supplier/contractor brings exemption certificate from the commercial tax department, the WCT shall not be deducted at source.3. the firm shall be responsible to see that service tax tariff shown in the above column are correct & CENVAT credit for the amount shown above are admissible as per CENVATcredit rules 2004. the contractor should quote the service tax at the prescribed rate only at the time of the tender. In case contractor has quoted service tax in excess/short than theprescribed rates, the quoted service tax amount will be brought to the prevailing rates to avoid confusion in awarding the tender.4. The agency shall mention the service tax registration number and the amount of service tax component in the bill copy/invoice5. The contractor should submit the proof of payment to the AO(Cash) for the service tax remitted (showing details i.e Agreement No., Bill No, Name of work, amount paid ands dateof payment) If any levy/duty is not payable or documentary proof is not produced, the amount for the same shall be deducted.6.The rates for all items of work shall, unless clearly specified otherwise, include cost of all labour, materials and other inputs involved in the execution of the items as specified in thescope of work.Contractor Sub Divisional Engineer(E)Contractor Internet Downloaded copy Sub-Divisional EngineerPage 23 of 25 ESD -IV,CHENNAI