An estimated dynamic stochastic general equilibrium model of the ...

An estimated dynamic stochastic general equilibrium model of the ...

An estimated dynamic stochastic general equilibrium model of the ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

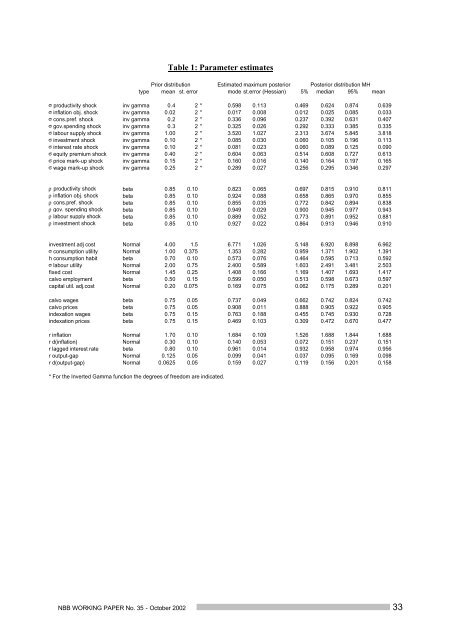

Table 1: Parameter estimatesPrior distribution Estimated maximum posterior Posterior distribution MHtype mean st. error mode st.error (Hessian) 5% median 95% meanσ productivity shock inv gamma 0.4 2 * 0.598 0.113 0.469 0.624 0.874 0.639σ inflation obj. shock inv gamma 0.02 2 * 0.017 0.008 0.012 0.025 0.085 0.033σ cons.pref. shock inv gamma 0.2 2 * 0.336 0.096 0.237 0.392 0.631 0.407σ gov.spending shock inv gamma 0.3 2 * 0.325 0.026 0.292 0.333 0.385 0.335σ labour supply shock inv gamma 1.00 2 * 3.520 1.027 2.313 3.674 5.845 3.818σ investment shock inv gamma 0.10 2 * 0.085 0.030 0.060 0.105 0.196 0.113σ interest rate shock inv gamma 0.10 2 * 0.081 0.023 0.060 0.089 0.125 0.090σ equity premium shock inv gamma 0.40 2 * 0.604 0.063 0.514 0.608 0.727 0.613σ price mark-up shock inv gamma 0.15 2 * 0.160 0.016 0.140 0.164 0.197 0.165σ wage mark-up shock inv gamma 0.25 2 * 0.289 0.027 0.256 0.295 0.346 0.297ρ productivity shock beta 0.85 0.10 0.823 0.065 0.697 0.815 0.910 0.811ρ inflation obj. shock beta 0.85 0.10 0.924 0.088 0.658 0.865 0.970 0.855ρ cons.pref. shock beta 0.85 0.10 0.855 0.035 0.772 0.842 0.894 0.838ρ gov. spending shock beta 0.85 0.10 0.949 0.029 0.900 0.945 0.977 0.943ρ labour supply shock beta 0.85 0.10 0.889 0.052 0.773 0.891 0.952 0.881ρ investment shock beta 0.85 0.10 0.927 0.022 0.864 0.913 0.946 0.910investment adj cost Normal 4.00 1.5 6.771 1.026 5.148 6.920 8.898 6.962σ consumption utility Normal 1.00 0.375 1.353 0.282 0.959 1.371 1.902 1.391h consumption habit beta 0.70 0.10 0.573 0.076 0.464 0.595 0.713 0.592σ labour utility Normal 2.00 0.75 2.400 0.589 1.603 2.491 3.481 2.503fixed cost Normal 1.45 0.25 1.408 0.166 1.169 1.407 1.693 1.417calvo employment beta 0.50 0.15 0.599 0.050 0.513 0.598 0.673 0.597capital util. adj.cost Normal 0.20 0.075 0.169 0.075 0.062 0.175 0.289 0.201calvo wages beta 0.75 0.05 0.737 0.049 0.662 0.742 0.824 0.742calvo prices beta 0.75 0.05 0.908 0.011 0.888 0.905 0.922 0.905indexation wages beta 0.75 0.15 0.763 0.188 0.455 0.745 0.930 0.728indexation prices beta 0.75 0.15 0.469 0.103 0.309 0.472 0.670 0.477r inflation Normal 1.70 0.10 1.684 0.109 1.526 1.688 1.844 1.688r d(inflation) Normal 0.30 0.10 0.140 0.053 0.072 0.151 0.237 0.151r lagged interest rate beta 0.80 0.10 0.961 0.014 0.932 0.958 0.974 0.956r output-gap Normal 0.125 0.05 0.099 0.041 0.037 0.095 0.169 0.098r d(output-gap) Normal 0.0625 0.05 0.159 0.027 0.119 0.156 0.201 0.158* For <strong>the</strong> Inverted Gamma function <strong>the</strong> degrees <strong>of</strong> freedom are indicated.NBB WORKING PAPER No. 35 - October 2002 33