Future low carbon energy systems - Copenhagen Cleantech Cluster

Future low carbon energy systems - Copenhagen Cleantech Cluster

Future low carbon energy systems - Copenhagen Cleantech Cluster

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

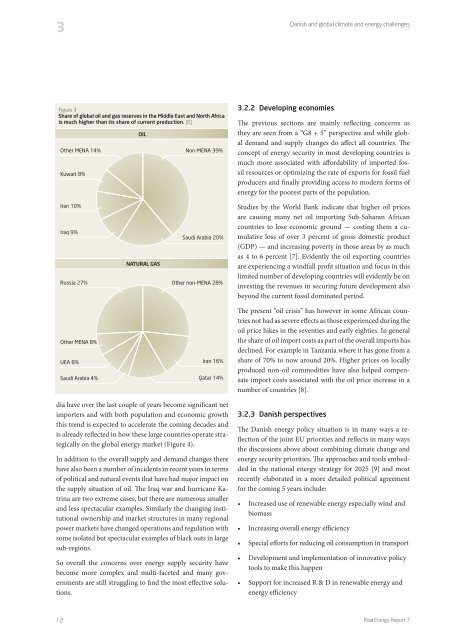

3Danish and global climate and <strong>energy</strong> challengesFigure 3Share of global oil and gas reserves in the Middle East and North Africais much higher than its share of current production. [6]Other MENA 14%Kuwait 8%OILNon-MENA 39%3.2.2 Developing economiesThe previous sections are mainly reflecting concerns asthey are seen from a “G8 + 5” perspective and while globaldemand and supply changes do affect all countries. Theconcept of <strong>energy</strong> security in most developing countries ismuch more associated with affordability of imported fossilresources or optimizing the rate of exports for fossil fuelproducers and finally providing access to modern forms of<strong>energy</strong> for the poorest parts of the population.Iran 10%Iraq 9%Russia 27%NATURAL GASSaudi Arabia 20%Other non-MENA 28%Studies by the World Bank indicate that higher oil pricesare causing many net oil importing Sub-Saharan Africancountries to lose economic ground — costing them a cumulativeloss of over 3 percent of gross domestic product(GDP) — and increasing poverty in those areas by as muchas 4 to 6 percent [7]. Evidently the oil exporting countriesare experiencing a windfall profit situation and focus in thislimited number of developing countries will evidently be oninvesting the revenues in securing future development alsobeyond the current fossil dominated period.Other MENA 8%UEA 8%Saudi Arabia 4%Iran 16%Qatar 14%The present “oil crisis” has however in some African countriesnot had as severe effects as those experienced during theoil price hikes in the seventies and early eighties. In generalthe share of oil import costs as part of the overall imports hasdeclined. For example in Tanzania where it has gone from ashare of 70% to now around 20%. Higher prices on locallyproduced non-oil commodities have also helped compensateimport costs associated with the oil price increase in anumber of countries [8].dia have over the last couple of years become significant netimporters and with both population and economic growththis trend is expected to accelerate the coming decades andis already reflected in how these large countries operate strategicallyon the global <strong>energy</strong> market (Figure 4).In addition to the overall supply and demand changes therehave also been a number of incidents in recent years in termsof political and natural events that have had major impact onthe supply situation of oil. The Iraq war and hurricane Katrinaare two extreme cases, but there are numerous smallerand less spectacular examples. Similarly the changing institutiona<strong>low</strong>nership and market structures in many regionalpower markets have changed operations and regulation withsome isolated but spectacular examples of black outs in largesub-regions.So overall the concerns over <strong>energy</strong> supply security havebecome more complex and multi-faceted and many governmentsare still struggling to find the most effective solutions.3.2.3 Danish perspectivesThe Danish <strong>energy</strong> policy situation is in many ways a reflectionof the joint EU priorities and reflects in many waysthe discussions above about combining climate change and<strong>energy</strong> security priorities. The approaches and tools embeddedin the national <strong>energy</strong> strategy for 2025 [9] and mostrecently elaborated in a more detailed political agreementfor the coming 5 years include:biomasstools to make this happen<strong>energy</strong> efficiency12Risø Energy Report 7