'07 4Q - Boston

'07 4Q - Boston

'07 4Q - Boston

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

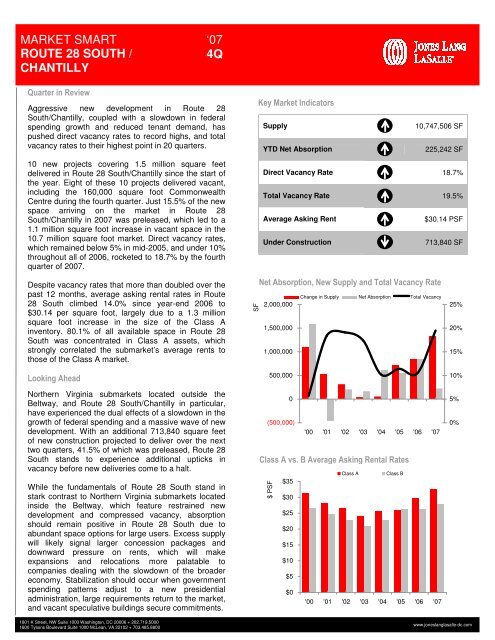

MARKET SMARTROUTE 28 SOUTH /CHANTILLY‘07<strong>4Q</strong>Quarter in ReviewAggressive new development in Route 28South/Chantilly, coupled with a slowdown in federalspending growth and reduced tenant demand, haspushed direct vacancy rates to record highs, and totalvacancy rates to their highest point in 20 quarters.10 new projects covering 1.5 million square feetdelivered in Route 28 South/Chantilly since the start ofthe year. Eight of these 10 projects delivered vacant,including the 160,000 square foot CommonwealthCentre during the fourth quarter. Just 15.5% of the newspace arriving on the market in Route 28South/Chantilly in 2007 was preleased, which led to a1.1 million square foot increase in vacant space in the10.7 million square foot market. Direct vacancy rates,which remained below 5% in mid-2005, and under 10%throughout all of 2006, rocketed to 18.7% by the fourthquarter of 2007.Despite vacancy rates that more than doubled over thepast 12 months, average asking rental rates in Route28 South climbed 14.0% since year-end 2006 to$30.14 per square foot, largely due to a 1.3 millionsquare foot increase in the size of the Class Ainventory. 80.1% of all available space in Route 28South was concentrated in Class A assets, whichstrongly correlated the submarket’s average rents tothose of the Class A market.SFKey Market IndicatorsSupply10,747,506 SFYTD Net Absorption225,242 SFDirect Vacancy Rate 18.7%Total Vacancy Rate 19.5%Average Asking Rent$30.14 PSFUnder Construction713,840 SFNet Absorption, New Supply and Total Vacancy RateChange in Supply Net Absorption Total Vacancy2,000,00025%1,500,00020%1,000,00015%Looking AheadNorthern Virginia submarkets located outside theBeltway, and Route 28 South/Chantilly in particular,have experienced the dual effects of a slowdown in thegrowth of federal spending and a massive wave of newdevelopment. With an additional 713,840 square feetof new construction projected to deliver over the nexttwo quarters, 41.5% of which was preleased, Route 28South stands to experience additional upticks invacancy before new deliveries come to a halt.While the fundamentals of Route 28 South stand instark contrast to Northern Virginia submarkets locatedinside the Beltway, which feature restrained newdevelopment and compressed vacancy, absorptionshould remain positive in Route 28 South due toabundant space options for large users. Excess supplywill likely signal larger concession packages anddownward pressure on rents, which will makeexpansions and relocations more palatable tocompanies dealing with the slowdown of the broadereconomy. Stabilization should occur when governmentspending patterns adjust to a new presidentialadministration, large requirements return to the market,and vacant speculative buildings secure commitments.500,0000(500,000)'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>Class A vs. B Average Asking Rental Rates$ PSFClass AClass B$35$30$25$20$15$10$5$0'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>10%5%0%1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800www.joneslanglasalle-dc.com