'07 4Q - Boston

'07 4Q - Boston

'07 4Q - Boston

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

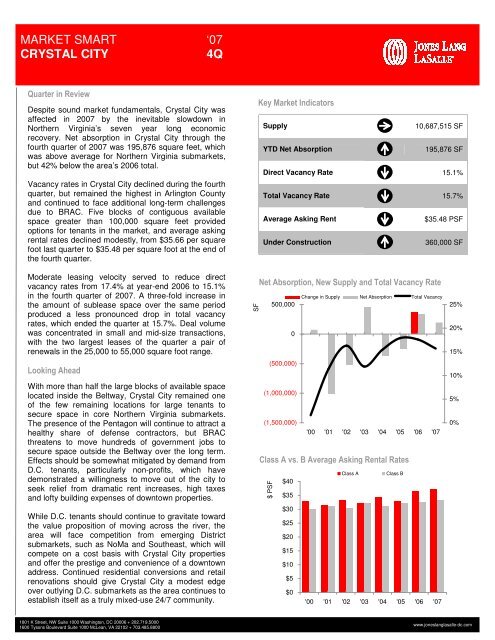

MARKET SMARTCRYSTAL CITY‘07<strong>4Q</strong>Quarter in ReviewDespite sound market fundamentals, Crystal City wasaffected in 2007 by the inevitable slowdown inNorthern Virginia’s seven year long economicrecovery. Net absorption in Crystal City through thefourth quarter of 2007 was 195,876 square feet, whichwas above average for Northern Virginia submarkets,but 42% below the area’s 2006 total.Vacancy rates in Crystal City declined during the fourthquarter, but remained the highest in Arlington Countyand continued to face additional long-term challengesdue to BRAC. Five blocks of contiguous availablespace greater than 100,000 square feet providedoptions for tenants in the market, and average askingrental rates declined modestly, from $35.66 per squarefoot last quarter to $35.48 per square foot at the end ofthe fourth quarter.Key Market IndicatorsSupply10,687,515 SFYTD Net Absorption195,876 SFDirect Vacancy Rate 15.1%Total Vacancy Rate 15.7%Average Asking Rent$35.48 PSFUnder Construction360,000 SFModerate leasing velocity served to reduce directvacancy rates from 17.4% at year-end 2006 to 15.1%in the fourth quarter of 2007. A three-fold increase inthe amount of sublease space over the same periodproduced a less pronounced drop in total vacancyrates, which ended the quarter at 15.7%. Deal volumewas concentrated in small and mid-size transactions,with the two largest leases of the quarter a pair ofrenewals in the 25,000 to 55,000 square foot range.Looking AheadWith more than half the large blocks of available spacelocated inside the Beltway, Crystal City remained oneof the few remaining locations for large tenants tosecure space in core Northern Virginia submarkets.The presence of the Pentagon will continue to attract ahealthy share of defense contractors, but BRACthreatens to move hundreds of government jobs tosecure space outside the Beltway over the long term.Effects should be somewhat mitigated by demand fromD.C. tenants, particularly non-profits, which havedemonstrated a willingness to move out of the city toseek relief from dramatic rent increases, high taxesand lofty building expenses of downtown properties.While D.C. tenants should continue to gravitate towardthe value proposition of moving across the river, thearea will face competition from emerging Districtsubmarkets, such as NoMa and Southeast, which willcompete on a cost basis with Crystal City propertiesand offer the prestige and convenience of a downtownaddress. Continued residential conversions and retailrenovations should give Crystal City a modest edgeover outlying D.C. submarkets as the area continues toestablish itself as a truly mixed-use 24/7 community.SFNet Absorption, New Supply and Total Vacancy RateChange in Supply Net Absorption Total Vacancy500,0000(500,000)(1,000,000)(1,500,000)'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>Class A vs. B Average Asking Rental Rates$ PSFClass AClass B$40$35$30$25$20$15$10$5$0'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>25%20%15%10%5%0%1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800www.joneslanglasalle-dc.com