'07 4Q - Boston

'07 4Q - Boston

'07 4Q - Boston

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

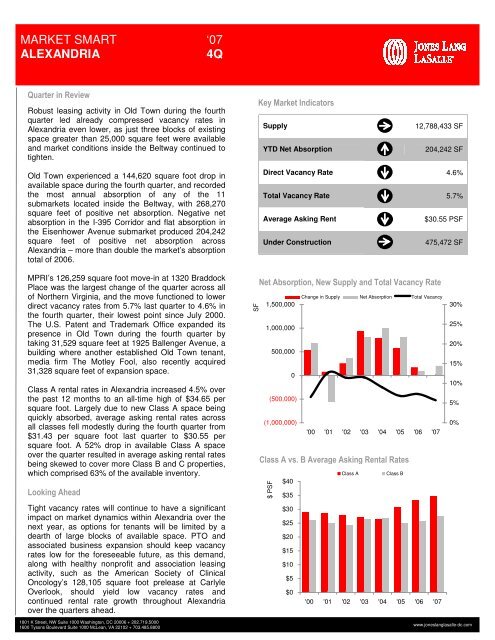

MARKET SMARTALEXANDRIA‘07<strong>4Q</strong>Quarter in ReviewRobust leasing activity in Old Town during the fourthquarter led already compressed vacancy rates inAlexandria even lower, as just three blocks of existingspace greater than 25,000 square feet were availableand market conditions inside the Beltway continued totighten.Key Market IndicatorsSupplyYTD Net Absorption12,788,433 SF204,242 SFOld Town experienced a 144,620 square foot drop inavailable space during the fourth quarter, and recordedthe most annual absorption of any of the 11submarkets located inside the Beltway, with 268,270square feet of positive net absorption. Negative netabsorption in the I-395 Corridor and flat absorption inthe Eisenhower Avenue submarket produced 204,242square feet of positive net absorption acrossAlexandria – more than double the market’s absorptiontotal of 2006.Direct Vacancy Rate 4.6%Total Vacancy Rate 5.7%Average Asking Rent$30.55 PSFUnder Construction475,472 SFMPRI’s 126,259 square foot move-in at 1320 BraddockPlace was the largest change of the quarter across allof Northern Virginia, and the move functioned to lowerdirect vacancy rates from 5.7% last quarter to 4.6% inthe fourth quarter, their lowest point since July 2000.The U.S. Patent and Trademark Office expanded itspresence in Old Town during the fourth quarter bytaking 31,529 square feet at 1925 Ballenger Avenue, abuilding where another established Old Town tenant,media firm The Motley Fool, also recently acquired31,328 square feet of expansion space.Class A rental rates in Alexandria increased 4.5% overthe past 12 months to an all-time high of $34.65 persquare foot. Largely due to new Class A space beingquickly absorbed, average asking rental rates acrossall classes fell modestly during the fourth quarter from$31.43 per square foot last quarter to $30.55 persquare foot. A 52% drop in available Class A spaceover the quarter resulted in average asking rental ratesbeing skewed to cover more Class B and C properties,which comprised 63% of the available inventory.Looking AheadTight vacancy rates will continue to have a significantimpact on market dynamics within Alexandria over thenext year, as options for tenants will be limited by adearth of large blocks of available space. PTO andassociated business expansion should keep vacancyrates low for the foreseeable future, as this demand,along with healthy nonprofit and association leasingactivity, such as the American Society of ClinicalOncology’s 128,105 square foot prelease at CarlyleOverlook, should yield low vacancy rates andcontinued rental rate growth throughout Alexandriaover the quarters ahead.SFNet Absorption, New Supply and Total Vacancy RateChange in Supply Net Absorption Total Vacancy1,500,0001,000,000500,0000(500,000)(1,000,000)'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>Class A vs. B Average Asking Rental Rates$ PSFClass AClass B$40$35$30$25$20$15$10$5$0'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>30%25%20%15%10%5%0%1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800www.joneslanglasalle-dc.com