'07 4Q - Boston

'07 4Q - Boston

'07 4Q - Boston

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

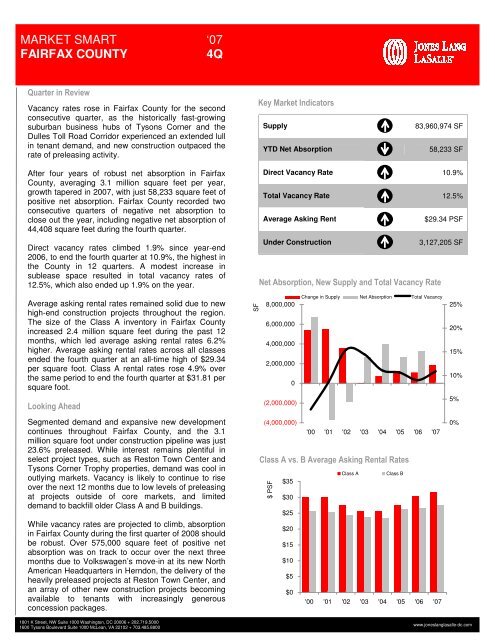

MARKET SMARTFAIRFAX COUNTY‘07<strong>4Q</strong>Quarter in ReviewVacancy rates rose in Fairfax County for the secondconsecutive quarter, as the historically fast-growingsuburban business hubs of Tysons Corner and theDulles Toll Road Corridor experienced an extended lullin tenant demand, and new construction outpaced therate of preleasing activity.Key Market IndicatorsSupplyYTD Net Absorption83,960,974 SF58,233 SFAfter four years of robust net absorption in FairfaxCounty, averaging 3.1 million square feet per year,growth tapered in 2007, with just 58,233 square feet ofpositive net absorption. Fairfax County recorded twoconsecutive quarters of negative net absorption toclose out the year, including negative net absorption of44,408 square feet during the fourth quarter.Direct vacancy rates climbed 1.9% since year-end2006, to end the fourth quarter at 10.9%, the highest inthe County in 12 quarters. A modest increase insublease space resulted in total vacancy rates of12.5%, which also ended up 1.9% on the year.Average asking rental rates remained solid due to newhigh-end construction projects throughout the region.The size of the Class A inventory in Fairfax Countyincreased 2.4 million square feet during the past 12months, which led average asking rental rates 6.2%higher. Average asking rental rates across all classesended the fourth quarter at an all-time high of $29.34per square foot. Class A rental rates rose 4.9% overthe same period to end the fourth quarter at $31.81 persquare foot.Looking AheadSegmented demand and expansive new developmentcontinues throughout Fairfax County, and the 3.1million square foot under construction pipeline was just23.6% preleased. While interest remains plentiful inselect project types, such as Reston Town Center andTysons Corner Trophy properties, demand was cool inoutlying markets. Vacancy is likely to continue to riseover the next 12 months due to low levels of preleasingat projects outside of core markets, and limiteddemand to backfill older Class A and B buildings.While vacancy rates are projected to climb, absorptionin Fairfax County during the first quarter of 2008 shouldbe robust. Over 575,000 square feet of positive netabsorption was on track to occur over the next threemonths due to Volkswagen’s move-in at its new NorthAmerican Headquarters in Herndon, the delivery of theheavily preleased projects at Reston Town Center, andan array of other new construction projects becomingavailable to tenants with increasingly generousconcession packages.1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800SFDirect Vacancy Rate 10.9%Total Vacancy Rate 12.5%Average Asking Rent$29.34 PSFUnder Construction3,127,205 SFNet Absorption, New Supply and Total Vacancy RateChange in Supply Net Absorption Total Vacancy8,000,0006,000,00025%20%4,000,00015%2,000,00010%0(2,000,000)5%(4,000,000)0%'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>Class A vs. B Average Asking Rental Rates$ PSFClass AClass B$35$30$25$20$15$10$5$0'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>www.joneslanglasalle-dc.com