'07 4Q - Boston

'07 4Q - Boston

'07 4Q - Boston

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

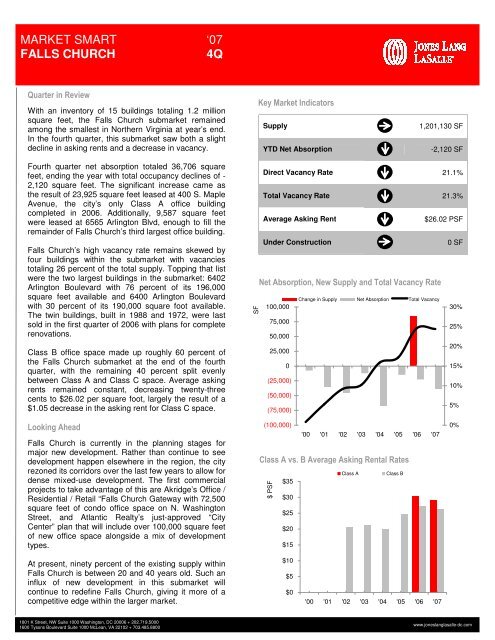

MARKET SMARTFALLS CHURCH‘07<strong>4Q</strong>Quarter in ReviewWith an inventory of 15 buildings totaling 1.2 millionsquare feet, the Falls Church submarket remainedamong the smallest in Northern Virginia at year’s end.In the fourth quarter, this submarket saw both a slightdecline in asking rents and a decrease in vacancy.Key Market IndicatorsSupplyYTD Net Absorption1,201,130 SF-2,120 SFFourth quarter net absorption totaled 36,706 squarefeet, ending the year with total occupancy declines of -2,120 square feet. The significant increase came asthe result of 23,925 square feet leased at 400 S. MapleAvenue, the city’s only Class A office buildingcompleted in 2006. Additionally, 9,587 square feetwere leased at 6565 Arlington Blvd, enough to fill theremainder of Falls Church’s third largest office building.Falls Church’s high vacancy rate remains skewed byfour buildings within the submarket with vacanciestotaling 26 percent of the total supply. Topping that listwere the two largest buildings in the submarket: 6402Arlington Boulevard with 76 percent of its 196,000square feet available and 6400 Arlington Boulevardwith 30 percent of its 190,000 square foot available.The twin buildings, built in 1988 and 1972, were lastsold in the first quarter of 2006 with plans for completerenovations.Class B office space made up roughly 60 percent ofthe Falls Church submarket at the end of the fourthquarter, with the remaining 40 percent split evenlybetween Class A and Class C space. Average askingrents remained constant, decreasing twenty-threecents to $26.02 per square foot, largely the result of a$1.05 decrease in the asking rent for Class C space.SFDirect Vacancy Rate 21.1%Total Vacancy Rate 21.3%Average Asking Rent$26.02 PSFUnder Construction0 SFNet Absorption, New Supply and Total Vacancy RateChange in Supply Net Absorption Total Vacancy100,00030%75,00025%50,00025,00020%015%(25,000)10%(50,000)(75,000)5%Looking AheadFalls Church is currently in the planning stages formajor new development. Rather than continue to seedevelopment happen elsewhere in the region, the cityrezoned its corridors over the last few years to allow fordense mixed-use development. The first commercialprojects to take advantage of this are Akridge’s Office /Residential / Retail “Falls Church Gateway with 72,500square feet of condo office space on N. WashingtonStreet, and Atlantic Realty’s just-approved “CityCenter” plan that will include over 100,000 square feetof new office space alongside a mix of developmenttypes.(100,000)'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>Class A vs. B Average Asking Rental Rates$ PSF$35$30$25$20$15Class AClass B0%At present, ninety percent of the existing supply withinFalls Church is between 20 and 40 years old. Such aninflux of new development in this submarket willcontinue to redefine Falls Church, giving it more of acompetitive edge within the larger market.$10$5$0'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800www.joneslanglasalle-dc.com