'07 4Q - Boston

'07 4Q - Boston

'07 4Q - Boston

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

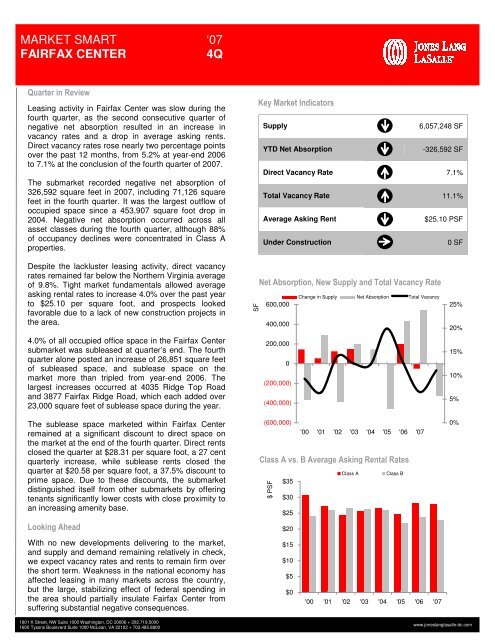

MARKET SMARTFAIRFAX CENTER‘07<strong>4Q</strong>Quarter in ReviewLeasing activity in Fairfax Center was slow during thefourth quarter, as the second consecutive quarter ofnegative net absorption resulted in an increase invacancy rates and a drop in average asking rents.Direct vacancy rates rose nearly two percentage pointsover the past 12 months, from 5.2% at year-end 2006to 7.1% at the conclusion of the fourth quarter of 2007.The submarket recorded negative net absorption of326,592 square feet in 2007, including 71,126 squarefeet in the fourth quarter. It was the largest outflow ofoccupied space since a 453,907 square foot drop in2004. Negative net absorption occurred across allasset classes during the fourth quarter, although 88%of occupancy declines were concentrated in Class Aproperties.Key Market IndicatorsSupply6,057,248 SFYTD Net Absorption-326,592 SFDirect Vacancy Rate 7.1%Total Vacancy Rate 11.1%Average Asking Rent$25.10 PSFUnder Construction0 SFDespite the lackluster leasing activity, direct vacancyrates remained far below the Northern Virginia averageof 9.8%. Tight market fundamentals allowed averageasking rental rates to increase 4.0% over the past yearto $25.10 per square foot, and prospects lookedfavorable due to a lack of new construction projects inthe area.4.0% of all occupied office space in the Fairfax Centersubmarket was subleased at quarter’s end. The fourthquarter alone posted an increase of 26,851 square feetof subleased space, and sublease space on themarket more than tripled from year-end 2006. Thelargest increases occurred at 4035 Ridge Top Roadand 3877 Fairfax Ridge Road, which each added over23,000 square feet of sublease space during the year.The sublease space marketed within Fairfax Centerremained at a significant discount to direct space onthe market at the end of the fourth quarter. Direct rentsclosed the quarter at $28.31 per square foot, a 27 centquarterly increase, while sublease rents closed thequarter at $20.58 per square foot, a 37.5% discount toprime space. Due to these discounts, the submarketdistinguished itself from other submarkets by offeringtenants significantly lower costs with close proximity toan increasing amenity base.Looking AheadWith no new developments delivering to the market,and supply and demand remaining relatively in check,we expect vacancy rates and rents to remain firm overthe short term. Weakness in the national economy hasaffected leasing in many markets across the country,but the large, stabilizing effect of federal spending inthe area should partially insulate Fairfax Center fromsuffering substantial negative consequences.SFNet Absorption, New Supply and Total Vacancy RateChange in Supply Net Absorption Total Vacancy600,000400,000200,0000(200,000)(400,000)(600,000)'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>Class A vs. B Average Asking Rental Rates$ PSFClass AClass B$35$30$25$20$15$10$5$0'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>25%20%15%10%5%0%1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800www.joneslanglasalle-dc.com