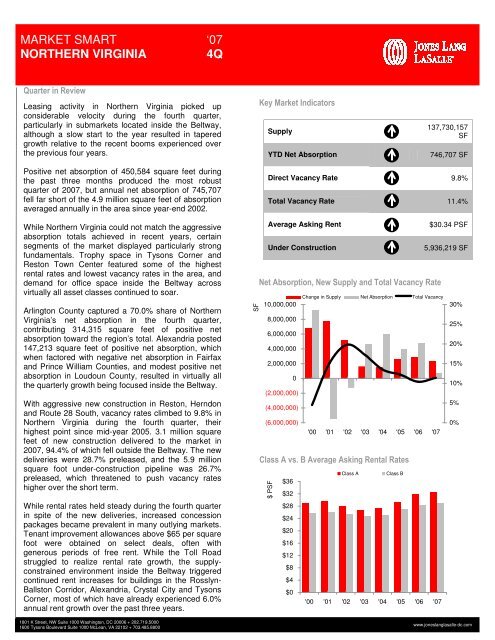

MARKET SMARTNORTHERN VIRGINIA‘073Q‘07<strong>4Q</strong>Quarter in ReviewLeasing activity in Northern Virginia picked upconsiderable velocity during the fourth quarter,particularly in submarkets located inside the Beltway,although a slow start to the year resulted in taperedgrowth relative to the recent booms experienced overthe previous four years.Key Market IndicatorsSupplyYTD Net Absorption137,730,157SF746,707 SFPositive net absorption of 450,584 square feet duringthe past three months produced the most robustquarter of 2007, but annual net absorption of 745,707fell far short of the 4.9 million square feet of absorptionaveraged annually in the area since year-end 2002.While Northern Virginia could not match the aggressiveabsorption totals achieved in recent years, certainsegments of the market displayed particularly strongfundamentals. Trophy space in Tysons Corner andReston Town Center featured some of the highestrental rates and lowest vacancy rates in the area, anddemand for office space inside the Beltway acrossvirtually all asset classes continued to soar.Arlington County captured a 70.0% share of NorthernVirginia’s net absorption in the fourth quarter,contributing 314,315 square feet of positive netabsorption toward the region’s total. Alexandria posted147,213 square feet of positive net absorption, whichwhen factored with negative net absorption in Fairfaxand Prince William Counties, and modest positive netabsorption in Loudoun County, resulted in virtually allthe quarterly growth being focused inside the Beltway.With aggressive new construction in Reston, Herndonand Route 28 South, vacancy rates climbed to 9.8% inNorthern Virginia during the fourth quarter, theirhighest point since mid-year 2005. 3.1 million squarefeet of new construction delivered to the market in2007, 94.4% of which fell outside the Beltway. The newdeliveries were 28.7% preleased, and the 5.9 millionsquare foot under-construction pipeline was 26.7%preleased, which threatened to push vacancy rateshigher over the short term.While rental rates held steady during the fourth quarterin spite of the new deliveries, increased concessionpackages became prevalent in many outlying markets.Tenant improvement allowances above $65 per squarefoot were obtained on select deals, often withgenerous periods of free rent. While the Toll Roadstruggled to realize rental rate growth, the supplyconstrainedenvironment inside the Beltway triggeredcontinued rent increases for buildings in the Rosslyn-Ballston Corridor, Alexandria, Crystal City and TysonsCorner, most of which have already experienced 6.0%annual rent growth over the past three years.1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800SFDirect Vacancy Rate 9.8%Total Vacancy Rate 11.4%Average Asking Rent$30.34 PSFUnder Construction5,936,219 SFNet Absorption, New Supply and Total Vacancy RateChange in Supply Net Absorption Total Vacancy10,000,0008,000,00030%25%6,000,0004,000,00020%2,000,00015%010%(2,000,000)(4,000,000)5%(6,000,000)0%'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>Class A vs. B Average Asking Rental Rates$ PSFClass AClass B$36$32$28$24$20$16$12$8$4$0'00 '01 '02 '03 '04 '05 '06 <strong>'07</strong>www.joneslanglasalle-dc.com

MARKET SMARTNORTHERN VIRGINIA‘073Q‘07<strong>4Q</strong>Development ActivityNorthern Virginia averaged 2.6 million square feet ofnew construction over the past four years. In 2007, 3.1million square feet delivered and in 2008, 5.3 millionsquare feet will come online.The development and new delivery pipelines, whichhave historically seen preleasing levels surpass 60%,both remain below 30% preleased. Properties insidethe Beltway and situated around established amenitybases, such as Reston Town Center and TysonsCorner Center have fared comparatively well, while theremaining pipeline excluding those properties endedthe fourth quarter just 18.8% preleased.While new development is substantially higher thannormal, the current pipeline will result in a moderate3.8% increase to Northern Virginia’s massive 137.7million square foot existing inventory. The regions’strong economy, demographics and population trendshave enticed quality tenants to expand or relocate inthe area, such as Volkswagen, Apple and the CollegeBoard, and the vast presence of the federalgovernment continues to make Northern Virginia thepreferred location for defense contractors andinformation technology firms.The fourth quarter delivery of the 177,046 square footTwo Liberty Center in Ballston and next quarter’splanned delivery of the 633,000 square foot Waterviewbuilding in Rosslyn also showcases Northern Virginiaas an alternative to properties in Downtown D.C. DFIInternational and the Corporate Executive Board, twoestablished D.C. tenants, opted to relocate to newbuildings in the Rosslyn-Ballston Corridor, whichprovided cost savings and space planning benefits overoptions Downtown.Development Pipeline6,000,0005,000,0004,000,0003,000,0002,000,0001,000,0000Preleased (SF)Available (SF)'03 '04 '05 '06 <strong>'07</strong> '08 '09DemandWith over 10 active requirements over 70,000 squarefeet, the Northern Virginia market is poised to capturesignificant leasing activity over the quarters ahead.Proximity to federal agencies and key governmentinstallations, such as Fort Belvoir, the Pentagon, NROand CIA, typically drives over half of all demand in theregion, although international corporations areincreasingly embracing Northern Virginia’s favorablebusiness climate, solid regional amenities and welleducatedlocal work force.Next quarter Volkswagen will open its new NorthAmerican headquarters in Herndon, which the companyreportedly selected due to a combination of state andcounty incentives, local demographics and proximity to amajor international airport. Markets closer to the Districtare projected to capture the most attention from privatesector professional service tenants in the market, and atrend among non-profits and associations that havebeen migrating from the District across the Potomac intoCrystal City and Alexandria is expected to continue.Rental RatesAverage asking rental rates in Northern Virginia climbedto a new historical high of $30.34 per square foot duringthe fourth quarter, with Trophy-quality space in TysonsCorner, Reston Town Center and the Rosslyn-BallstonCorridor cracking $50.00 per square foot. Five of eightsubmarkets in Alexandria and Arlington Countyaveraged rents above $33.00 per square foot, whilenone of the 21 submarkets in Fairfax, Prince William andLoudoun Counties surpassed that figure. Ballston led allregional submarkets with average asking rents of $37.10per square foot.Looking AheadWith local employment growth expected to generateapproximately 40,000 jobs in the area in 2008, it couldtake two years of economic expansion for the largequantities of new office space delivering to the marketalong the Dulles Toll Road to strike a balance withcurrent demand in the market. Although no major rentcorrection is expected, rent growth in outlying areasshould more closely mirror the rate of inflation at 2% to3%, and concessions packages are likely to remain highto attract occupiers.Downtown tenants will continue to look for opportunitiesacross the river in Rosslyn-Ballston and Crystal City.However, quality new construction projects in ArlingtonCounty will usher in asking rents previously unseen inNorthern Virginia, and begin to erode the marginbetween D.C. and Arlington County rental rates.1801 K Street, NW Suite 1000 Washington, DC 20006 + 202.719.50001600 Tysons Boulevard Suite 1000 McLean, VA 22102 + 703.485.8800www.joneslanglasalle-dc.com