Panjawattana Plastic Public Company Limited

Panjawattana Plastic Public Company Limited

Panjawattana Plastic Public Company Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

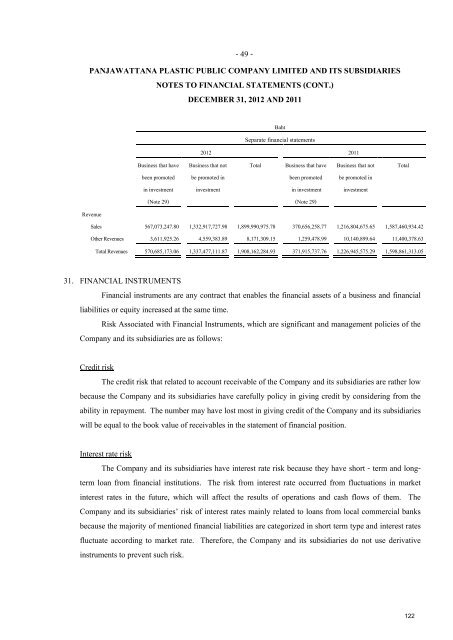

- 49 -PANJAWATTANA PLASTIC PUBLIC COMPANY LIMITED AND ITS SUBSIDIARIESNOTES TO FINANCIAL STATEMENTS (CONT.)DECEMBER 31, 2012 AND 2011RevenueBusiness that havebeen promotedin investment(Note 29)BahtSeparate financial statements2012 2011Business that notbe promoted ininvestmentTotalBusiness that havebeen promotedin investment(Note 29)Business that notbe promoted ininvestmentSales 567,073,247.80 1,332,917,727.98 1,899,990,975.78 370,656,258.77 1,216,804,675.65 1,587,460,934.42Other Revenues 3,611,925.26 4,559,383.89 8,171,309.15 1,259,478.99 10,140,899.64 11,400,378.63Total Revenues 570,685,173.06 1,337,477,111.87 1,908,162,284.93 371,915,737.76 1,226,945,575.29 1,598,861,313.05Total31. FINANCIAL INSTRUMENTSFinancial instruments are any contract that enables the financial assets of a business and financialliabilities or equity increased at the same time.Risk Associated with Financial Instruments, which are significant and management policies of the<strong>Company</strong> and its subsidiaries are as follows:Credit riskThe credit risk that related to account receivable of the <strong>Company</strong> and its subsidiaries are rather lowbecause the <strong>Company</strong> and its subsidiaries have carefully policy in giving credit by considering from theability in repayment. The number may have lost most in giving credit of the <strong>Company</strong> and its subsidiarieswill be equal to the book value of receivables in the statement of financial position.Interest rate riskThe <strong>Company</strong> and its subsidiaries have interest rate risk because they have short - term and longtermloan from financial institutions. The risk from interest rate occurred from fluctuations in marketinterest rates in the future, which will affect the results of operations and cash flows of them. The<strong>Company</strong> and its subsidiaries’ risk of interest rates mainly related to loans from local commercial banksbecause the majority of mentioned financial liabilities are categorized in short term type and interest ratesfluctuate according to market rate. Therefore, the <strong>Company</strong> and its subsidiaries do not use derivativeinstruments to prevent such risk.122