Panjawattana Plastic Public Company Limited

Panjawattana Plastic Public Company Limited

Panjawattana Plastic Public Company Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

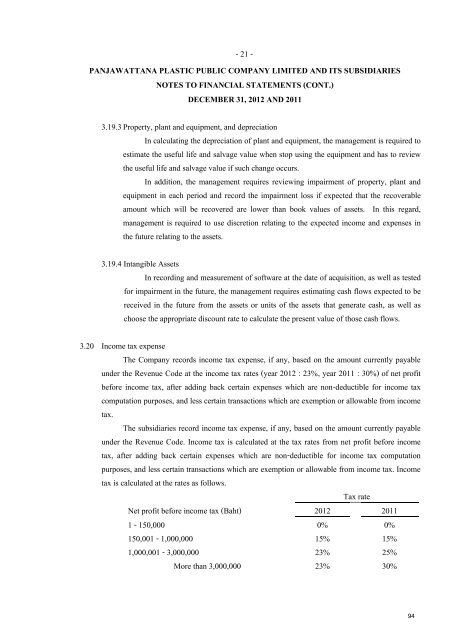

- 21 -PANJAWATTANA PLASTIC PUBLIC COMPANY LIMITED AND ITS SUBSIDIARIESNOTES TO FINANCIAL STATEMENTS (CONT.)DECEMBER 31, 2012 AND 20113.19.3 Property, plant and equipment, and depreciationIn calculating the depreciation of plant and equipment, the management is required toestimate the useful life and salvage value when stop using the equipment and has to reviewthe useful life and salvage value if such change occurs.In addition, the management requires reviewing impairment of property, plant andequipment in each period and record the impairment loss if expected that the recoverableamount which will be recovered are lower than book values of assets. In this regard,management is required to use discretion relating to the expected income and expenses inthe future relating to the assets.3.19.4 Intangible AssetsIn recording and measurement of software at the date of acquisition, as well as testedfor impairment in the future, the management requires estimating cash flows expected to bereceived in the future from the assets or units of the assets that generate cash, as well aschoose the appropriate discount rate to calculate the present value of those cash flows.3.20 Income tax expenseThe <strong>Company</strong> records income tax expense, if any, based on the amount currently payableunder the Revenue Code at the income tax rates (year 2012 : 23%, year 2011 : 30%) of net profitbefore income tax, after adding back certain expenses which are non-deductible for income taxcomputation purposes, and less certain transactions which are exemption or allowable from incometax.The subsidiaries record income tax expense, if any, based on the amount currently payableunder the Revenue Code. Income tax is calculated at the tax rates from net profit before incometax, after adding back certain expenses which are non-deductible for income tax computationpurposes, and less certain transactions which are exemption or allowable from income tax. Incometax is calculated at the rates as follows.Tax rateNet profit before income tax (Baht) 2012 20111 - 150,000 0% 0%150,001 - 1,000,000 15% 15%1,000,001 - 3,000,000 23% 25%More than 3,000,000 23% 30%94