- Page 1 and 2:

MarketingManagement,Millenium Editi

- Page 3 and 4:

SECTION ONE

- Page 5 and 6:

2 CHAPTER 1 MARKETING IN THE TWENTY

- Page 7 and 8:

4 CHAPTER 1 MARKETING IN THE TWENTY

- Page 9 and 10:

6 CHAPTER 1 MARKETING IN THE TWENTY

- Page 11 and 12:

8 CHAPTER 1 MARKETING IN THE TWENTY

- Page 13 and 14:

10 CHAPTER 1 MARKETING IN THE TWENT

- Page 15 and 16:

12 CHAPTER 1 MARKETING IN THE TWENT

- Page 17 and 18:

14 CHAPTER 1 MARKETING IN THE TWENT

- Page 19 and 20:

ConclusionThis vignette focused on

- Page 21 and 22:

18 CHAPTER 1 MARKETING IN THE TWENT

- Page 23 and 24:

40 CHAPTER 3 WINNING MARKETS THROUG

- Page 25 and 26:

42 CHAPTER 3 WINNING MARKETS THROUG

- Page 27 and 28:

44 CHAPTER 3 WINNING MARKETS THROUG

- Page 29 and 30:

46 CHAPTER 3 WINNING MARKETS THROUG

- Page 31 and 32:

48 CHAPTER 3 WINNING MARKETS THROUG

- Page 33 and 34:

50 CHAPTER 3 WINNING MARKETS THROUG

- Page 35 and 36:

52 CHAPTER 3 WINNING MARKETS THROUG

- Page 37 and 38:

54 CHAPTER 3 WINNING MARKETS THROUG

- Page 39 and 40:

56 CHAPTER 3 WINNING MARKETS THROUG

- Page 41 and 42:

58 CHAPTER 3 WINNING MARKETS THROUG

- Page 43 and 44:

60 CHAPTER 3 WINNING MARKETS THROUG

- Page 45:

62 CHAPTER 3 WINNING MARKETS THROUG

- Page 48 and 49:

formation is developed through inte

- Page 50:

pound employees treat citizens pick

- Page 53 and 54:

M A R K E T I N GmemoSecondary Sour

- Page 56:

■■■Survey research: Surveys a

- Page 63:

marketing researcher’s report may

- Page 67 and 68:

120AnalyzingMarketingOpportunitiesA

- Page 69 and 70:

■A sales budget is a conservative

- Page 74 and 75:

picking 400 of the most innovative

- Page 77 and 78:

and low company market budget are 0

- Page 79 and 80:

132AnalyzingMarketingOpportunities8

- Page 81:

SECTION TWO

- Page 84:

One major trend is the increasing p

- Page 88 and 89:

The explosive world population grow

- Page 90 and 91:

Yet marketers must be careful not t

- Page 92 and 93:

egional differences: People in Seat

- Page 94 and 95:

■ The Walt Disney Company The Wal

- Page 97 and 98:

Accelerating Pace of Technological

- Page 99 and 100:

and more business takes place in cy

- Page 101 and 102:

children and are reinforced by majo

- Page 103 and 104:

N O T E S1561. Gene Del Vecchio,

- Page 106 and 107:

Once a company has carefully segmen

- Page 109 and 110:

■was able to develop a new electr

- Page 113 and 114:

LayfutureplansYes Yes Yes Yes Yes Y

- Page 115:

that can be reviewed by a new-produ

- Page 119 and 120:

Package DesignBrand NameRetail Pric

- Page 122:

affecting profitability under an as

- Page 125 and 126:

■■■The rank-order method asks

- Page 127 and 128:

strategies, the greater the regiona

- Page 129 and 130:

In the movie business, it’s not u

- Page 131 and 132:

various prospect groups on these ch

- Page 133 and 134:

■■■Early adopters share some

- Page 135 and 136:

The first is relative advantage—t

- Page 138 and 139:

N O T E S1. New Products Management

- Page 140 and 141:

37. See Cooper and Kleinschmidt, Ne

- Page 142 and 143:

AnalyzingConsumer Marketsand BuyerB

- Page 144 and 145:

How and Why Consumers Buy 89➤Soci

- Page 146 and 147:

How and Why Consumers Buy 91Another

- Page 148 and 149:

How and Why Consumers Buy 93Althoug

- Page 150 and 151:

How and Why Consumers Buy 95➤pers

- Page 152 and 153:

The Consumer Buying Decision Proces

- Page 154 and 155:

The Consumer Buying Decision Proces

- Page 156 and 157:

The Consumer Buying Decision Proces

- Page 158 and 159:

Notes 103influences are operating.

- Page 160 and 161:

Notes 105Cohen, “An Examination o

- Page 162 and 163:

108 CHAPTER 6 ANALYZING BUSINESS MA

- Page 164 and 165:

Table 3.3Characteristics of Busines

- Page 166 and 167:

112 CHAPTER 6 ANALYZING BUSINESS MA

- Page 168 and 169:

114 CHAPTER 6 ANALYZING BUSINESS MA

- Page 170 and 171:

116 CHAPTER 6 ANALYZING BUSINESS MA

- Page 172 and 173:

118 CHAPTER 6 ANALYZING BUSINESS MA

- Page 174 and 175:

120 CHAPTER 6 ANALYZING BUSINESS MA

- Page 176 and 177:

122 CHAPTER 6 ANALYZING BUSINESS MA

- Page 178 and 179:

144 CHAPTER 8 IDENTIFYING MARKET SE

- Page 180 and 181:

146 CHAPTER 8 IDENTIFYING MARKET SE

- Page 182 and 183:

148 CHAPTER 8 IDENTIFYING MARKET SE

- Page 184 and 185:

150 CHAPTER 8 IDENTIFYING MARKET SE

- Page 186 and 187:

152 CHAPTER 8 IDENTIFYING MARKET SE

- Page 188 and 189:

154 CHAPTER 8 IDENTIFYING MARKET SE

- Page 190 and 191:

156 CHAPTER 8 IDENTIFYING MARKET SE

- Page 192 and 193:

158 CHAPTER 8 IDENTIFYING MARKET SE

- Page 194 and 195:

160 CHAPTER 8 IDENTIFYING MARKET SE

- Page 196 and 197:

162 CHAPTER 9 POSITIONING PRODUCTS

- Page 198 and 199:

164 CHAPTER 9 POSITIONING PRODUCTS

- Page 200 and 201:

166 CHAPTER 9 POSITIONING PRODUCTS

- Page 202 and 203:

168 CHAPTER 9 POSITIONING PRODUCTS

- Page 204 and 205:

170 CHAPTER 9 POSITIONING PRODUCTS

- Page 206 and 207:

172 CHAPTER 9 POSITIONING PRODUCTS

- Page 208 and 209:

174 CHAPTER 9 POSITIONING PRODUCTS

- Page 210 and 211:

176 CHAPTER 9 POSITIONING PRODUCTS

- Page 212 and 213:

178 CHAPTER 9 POSITIONING PRODUCTS

- Page 214 and 215:

180 CHAPTER 9 POSITIONING PRODUCTS

- Page 216 and 217:

182 CHAPTER 9 POSITIONING PRODUCTS

- Page 218 and 219:

Managing ProductLines and BrandsWe

- Page 220 and 221:

The Product and the Product Mix 185

- Page 222 and 223:

Brand Decisions 187After performing

- Page 224 and 225:

Brand Decisions 189Brand EquityBran

- Page 226 and 227:

Brand Decisions 191Why do middlemen

- Page 228 and 229:

Brand Decisions 193and shredded whe

- Page 230 and 231:

Packaging and Labeling 195ing itsel

- Page 232 and 233:

Notes 197stretching or line filling

- Page 234 and 235:

Designing andManaging ServicesWe wi

- Page 236 and 237:

The Nature of Services 201see the e

- Page 238 and 239:

Marketing Strategies for Service Fi

- Page 240 and 241:

Marketing Strategies for Service Fi

- Page 242 and 243:

Marketing Strategies for Service Fi

- Page 244 and 245:

Marketing Strategies for Service Fi

- Page 246 and 247:

Managing Product Support Services 2

- Page 248 and 249:

Notes 213(such as facilitating serv

- Page 250 and 251:

Designing PricingStrategies andProg

- Page 252 and 253:

Setting the Price 217➤➤ignoring

- Page 254 and 255:

Setting the Price 219Price elastici

- Page 256 and 257:

Setting the Price 221Next, the firm

- Page 258 and 259:

Setting the Price 223Figure 4-12Bre

- Page 260 and 261:

Setting the Price 225to achieve max

- Page 262 and 263:

Adapting the Price 227Table 4.4Pric

- Page 264 and 265:

➤Adapting the Price 229Location p

- Page 266 and 267:

Initiating and Responding to Price

- Page 268 and 269:

Notes 233➤ Launching a low-price

- Page 270 and 271:

SECTION FIVE

- Page 272 and 273:

236 CHAPTER 13 SELECTING AND MANAGI

- Page 274 and 275:

238 CHAPTER 13 SELECTING AND MANAGI

- Page 276 and 277:

240 CHAPTER 13 SELECTING AND MANAGI

- Page 278 and 279:

242 CHAPTER 13 SELECTING AND MANAGI

- Page 280 and 281:

244 CHAPTER 13 SELECTING AND MANAGI

- Page 282 and 283:

246 CHAPTER 13 SELECTING AND MANAGI

- Page 284 and 285:

248 CHAPTER 13 SELECTING AND MANAGI

- Page 286 and 287:

250 CHAPTER 13 SELECTING AND MANAGI

- Page 288 and 289:

Designing andManagingIntegratedMark

- Page 290 and 291:

Developing Effective Marketing Comm

- Page 292 and 293:

Developing Effective Marketing Comm

- Page 294 and 295:

Developing Effective Marketing Comm

- Page 296 and 297:

Developing Effective Marketing Comm

- Page 298 and 299:

Developing and Managing the Adverti

- Page 300 and 301:

Developing and Managing the Adverti

- Page 302 and 303:

Developing and Managing the Adverti

- Page 304 and 305:

Developing and Managing the Adverti

- Page 306 and 307:

Sales Promotion Strategies 289promo

- Page 308 and 309:

Sales Promotion Strategies 291Table

- Page 310 and 311:

Public Relations Strategies 293tion

- Page 312 and 313:

Notes 295that evaluates the strateg

- Page 314:

Notes 2971998, p. D3; “Ethical Fu

- Page 317 and 318:

MESSAGEMISSION• Sales goals• Ad

- Page 319 and 320:

■ Alka-Seltzer Alka-Seltzer antac

- Page 322 and 323:

ThemeCreative Copy7-Up is not a col

- Page 324 and 325:

meet its ethical standards while en

- Page 327 and 328:

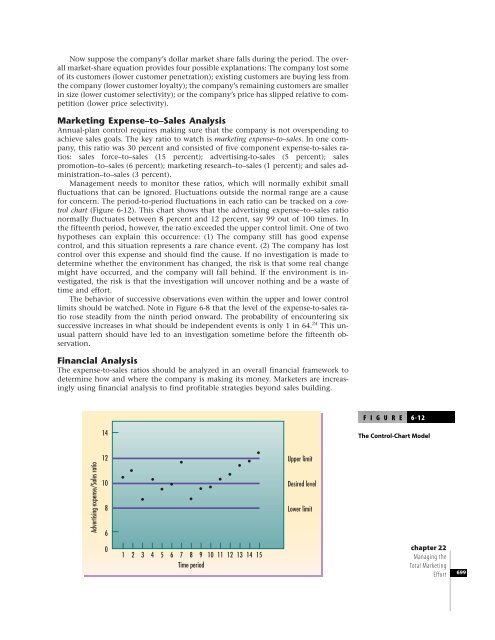

Another reason for review is the co

- Page 330 and 331:

592The timing pattern should consid

- Page 332:

■ Pizza Hut Pizza Hut levies a 4

- Page 336 and 337:

accepted by top management as an ef

- Page 338:

M A R K E T I N Gmemo600Sales Promo

- Page 343 and 344:

ventories in preparation for releas

- Page 345:

Clearly, creative public relations

- Page 349 and 350:

media by establishing the ad’s de

- Page 351 and 352:

N O T E Spart fiveManaging andDeliv

- Page 353 and 354:

part fiveManaging andDelivering Mar

- Page 355 and 356:

Managing theSales ForceWe will addr

- Page 357 and 358:

Designing the Sales Force 301reps l

- Page 359 and 360:

Managing the Sales Force 303money.

- Page 361 and 362:

Managing the Sales Force 305Supervi

- Page 363 and 364:

Managing the Sales Force 307away fr

- Page 365 and 366:

Principles of Personal Selling 309c

- Page 367 and 368:

Principles of Personal Selling 311

- Page 369 and 370:

Notes 313Choosing the sales force s

- Page 371 and 372:

Notes 31527. For an excellent summa

- Page 374:

The world is rapidly shrinking with

- Page 380 and 381:

372part threeDevelopingMarketingStr

- Page 382:

Although many countries in central

- Page 385 and 386: ever, it offers a chance to start f

- Page 387: this time, the company is operating

- Page 391 and 392: PROMOTIONCompanies can run the same

- Page 393 and 394: Very often a company finds some ent

- Page 395 and 396: may be international subsidiaries,

- Page 397 and 398: What are some questions concerning

- Page 399 and 400: 32. Elliott Masie, “Global Pricin

- Page 401 and 402: 318 CHAPTER 17 MANAGING DIRECT AND

- Page 403 and 404: 320 CHAPTER 17 MANAGING DIRECT AND

- Page 405 and 406: 322 CHAPTER 17 MANAGING DIRECT AND

- Page 407 and 408: 324 CHAPTER 17 MANAGING DIRECT AND

- Page 409 and 410: 326 CHAPTER 17 MANAGING DIRECT AND

- Page 411 and 412: 328 CHAPTER 17 MANAGING DIRECT AND

- Page 413 and 414: 330 CHAPTER 17 MANAGING DIRECT AND

- Page 415: 332 CHAPTER 17 MANAGING DIRECT AND

- Page 419 and 420: F I G U R E 6-5Stages in the Evolut

- Page 421 and 422: Other companies that have shifted t

- Page 423 and 424: PMAPMPA(a) Vertical product teamRPM

- Page 425 and 426: markets. They must analyze where th

- Page 427 and 428: 690part fiveManaging andDelivering

- Page 429 and 430: 692part fiveManaging andDelivering

- Page 431 and 432: 694part fiveManaging andDelivering

- Page 433 and 434: then. Two groups of experienced mar

- Page 441 and 442: 704part fiveManaging andDelivering

- Page 443 and 444: SalesfallManagementincreases salesi

- Page 445 and 446: MARKETINGmemoMarketing Effectivenes

- Page 451 and 452: 2. Modern marketing departments can

- Page 453 and 454: N O T E S716part fiveManaging andDe

- Page 455 and 456: 718part fiveManaging andDelivering