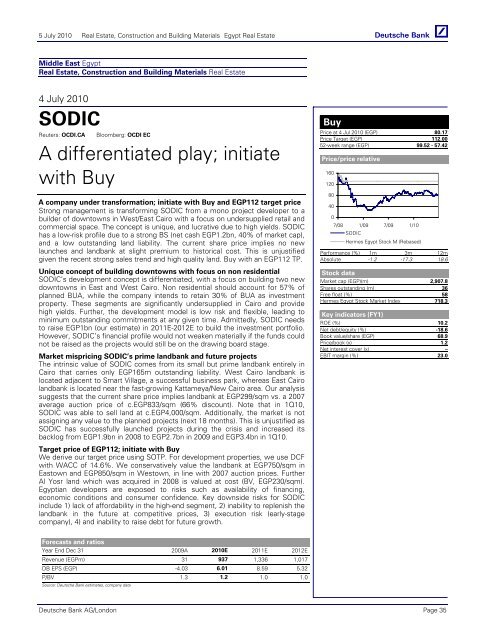

5 <strong>July</strong> <strong>2010</strong> <strong>Real</strong> <strong>Estate</strong>, Construction and Building Materials <strong>Egypt</strong> <strong>Real</strong> <strong>Estate</strong>Middle East <strong>Egypt</strong><strong>Real</strong> <strong>Estate</strong>, Construction and Building Materials <strong>Real</strong> <strong>Estate</strong>4 <strong>July</strong> <strong>2010</strong><strong>SODIC</strong>Reuters: OCDI.CABloomberg: OCDI ECA differentiated play; initiatewith BuyA company under transformation; initiate with Buy and EGP112 target priceStrong management is transforming <strong>SODIC</strong> from a mono project developer to abuilder <strong>of</strong> downtowns in West/East Cairo with a focus on undersupplied retail andcommercial space. The concept is unique, and lucrative due to high yields. <strong>SODIC</strong>has a low-risk pr<strong>of</strong>ile due to a strong BS (net cash EGP1.2bn, 40% <strong>of</strong> market cap),and a low outstanding land liability. The current share price implies no newlaunches and landbank at slight premium to historical cost. This is unjustifiedgiven the recent strong sales trend and high quality land. Buy with an EGP112 TP.Unique concept <strong>of</strong> building downtowns with focus on non residential<strong>SODIC</strong>’s development concept is differentiated, with a focus on building two newdowntowns in East and West Cairo. Non residential should account for 57% <strong>of</strong>planned BUA, while the company intends to retain 30% <strong>of</strong> BUA as investmentproperty. These segments are significantly undersupplied in Cairo and providehigh yields. Further, the development model is low risk and flexible, leading tominimum outstanding commitments at any given time. Admittedly, <strong>SODIC</strong> needsto raise EGP1bn (our estimate) in 2011E-2012E to build the investment portfolio.However, <strong>SODIC</strong>’s financial pr<strong>of</strong>ile would not weaken materially if the funds couldnot be raised as the projects would still be on the drawing board stage.Market mispricing <strong>SODIC</strong>’s prime landbank and future projectsThe intrinsic value <strong>of</strong> <strong>SODIC</strong> comes from its small but prime landbank entirely inCairo that carries only EGP165m outstanding liability. West Cairo landbank islocated adjacent to Smart Village, a successful business park, whereas East Cairolandbank is located near the fast-growing Kattameya/New Cairo area. Our analysissuggests that the current share price implies landbank at EGP299/sqm vs. a 2007average auction price <strong>of</strong> c.EGP833/sqm (66% discount). Note that in 1Q10,<strong>SODIC</strong> was able to sell land at c.EGP4,000/sqm. Additionally, the market is notassigning any value to the planned projects (next 18 months). This is unjustified as<strong>SODIC</strong> has successfully launched projects during the crisis and increased itsbacklog from EGP1.9bn in 2008 to EGP2.7bn in 2009 and EGP3.4bn in 1Q10.Target price <strong>of</strong> EGP112; initiate with BuyWe derive our target price using SOTP. For development properties, we use DCFwith WACC <strong>of</strong> 14.6%. We conservatively value the landbank at EGP750/sqm inEastown and EGP850/sqm in Westown, in line with 2007 auction prices. FurtherAl Yosr land which was acquired in 2008 is valued at cost (BV, EGP230/sqm).<strong>Egypt</strong>ian developers are exposed to risks such as availability <strong>of</strong> financing,economic conditions and consumer confidence. Key downside risks for <strong>SODIC</strong>include 1) lack <strong>of</strong> affordability in the high-end segment, 2) inability to replenish thelandbank in the future at competitive prices, 3) execution risk (early-stagecompany), 4) and inability to raise debt for future growth.BuyPrice at 4 Jul <strong>2010</strong> (EGP) 80.17Price Target (EGP) 112.0052-week range (EGP) 99.52 - 57.42Price/price relative160120804007/08 1/09 7/09 1/10<strong>SODIC</strong>Hermes <strong>Egypt</strong> Stock M (Rebased)Performance (%) 1m 3m 12mAbsolute -1.2 -17.3 18.6Stock dataMarket cap (EGP)(m) 2,907.8Shares outstanding (m) 36Free float (%) 58Hermes <strong>Egypt</strong> Stock Market Index 718.3Key indicators (FY1)ROE (%) 10.2Net debt/equity (%) -18.6Book value/share (EGP) 68.9Price/book (x) 1.2Net interest cover (x) –EBIT margin (%) 23.0Forecasts and ratiosYear End Dec 31 2009A <strong>2010</strong>E 2011E 2012ERevenue (EGPm) 31 937 1,336 1,017DB EPS (EGP) -4.03 6.01 8.59 5.32P/BV 1.3 1.2 1.0 1.0Source: <strong>Deutsche</strong> <strong>Bank</strong> estimates, company data<strong>Deutsche</strong> <strong>Bank</strong> AG/London Page 35

5 <strong>July</strong> <strong>2010</strong> <strong>Real</strong> <strong>Estate</strong>, Construction and Building Materials <strong>Egypt</strong> <strong>Real</strong> <strong>Estate</strong>Model updated:30 June <strong>2010</strong>Running the numbersMiddle East<strong>Egypt</strong><strong>Real</strong> <strong>Estate</strong><strong>SODIC</strong>Reuters: OCDI.CABuyBloomberg: OCDI ECPrice (5 Jul 10) EGP 79.92Target price EGP 112.0052-week Range EGP 57.42 - 99.52Market Cap (m) EGPm 2,899USDm 509Company Pr<strong>of</strong>ile<strong>SODIC</strong> was established in 1996 to undertake real estatedevelopment projects in Sixth <strong>of</strong> October City (West <strong>of</strong> Cairo).Currently, the company is in a transitional phase, movingfrom a mono project (Allegria) developer <strong>of</strong> residentialproperties for sale, to a developer building downtowns inEast/West Cairo with a diverse product portfolio (residential inhigh-end segment, commercial, retail and hospitality).Additionally, the strategy is to develop a portfolio <strong>of</strong> recurringincome generating rental assets.Price Performance16012080400Jul 08 Dec 08<strong>SODIC</strong>Jun 09 Dec 09 Jun 10Margin Trends1500-150-300-450-600Hermes <strong>Egypt</strong> St ock Market Index (Rebased)0 7 0 8 0 9 10 E 11E 12 EEBITDA Mar gin EBIT Mar ginGrowth & Pr<strong>of</strong>itability500-50-100Solvency30<strong>2010</strong>0-10-20-300 7 0 8 0 9 10 E 11E 12 ESales growth (LHS)ROE (RHS)0 7 0 8 0 9 10 E 11E 12 ENet debt /equit y (LHS)Athmane Benzerroug30<strong>2010</strong>0-10Net interest cover (RHS)+971 4 4283938 athmane.benzerroug@db.com6420Fiscal year end 31-Dec 2007 2008 2009 <strong>2010</strong>E 2011E 2012EFinancial SummaryDB EPS (EGP) 11.81 0.97 -4.03 6.01 8.59 5.32Reported EPS (EGP) 11.81 0.97 -4.03 6.01 8.59 5.32DPS (EGP) 0.00 0.00 0.00 0.00 0.00 0.00BVPS (EGP) 64.8 63.0 62.1 68.9 77.5 82.8Weighted average shares (m) 27 28 28 36 36 36Average market cap (EGPm) 4,514 4,216 1,777 2,899 2,899 2,899Enterprise value (EGPm) 3,981 3,995 1,268 2,307 2,751 3,338Valuation MetricsP/E (DB) (x) 14.2 156.5 nm 13.3 9.3 15.0P/E (Reported) (x) 14.2 156.5 nm 13.3 9.3 15.0P/BV (x) 3.53 0.68 1.29 1.16 1.03 0.97FCF Yield (%) nm 0.4 7.7 nm nm nmDividend Yield (%) 0.0 0.0 0.0 0.0 0.0 0.0EV/Sales (x) 8.1 17.2 41.3 2.5 2.1 3.3EV/EBITDA (x) 15.2 nm nm 10.4 7.6 14.6EV/EBIT (x) 15.2 nm nm 10.7 7.7 15.1Income Statement (EGPm)Sales revenue 493 232 31 937 1,336 1,017Gross pr<strong>of</strong>it 325 123 -2 382 531 405EBITDA 263 -8 -154 222 364 229Depreciation 1 3 6 6 7 7Amortisation 0 0 0 0 0 0EBIT 262 -12 -160 216 357 222Net interest income(expense) 34 12 -1 46 24 -40Associates/affiliates 5 0 0 0 0 40Exceptionals/extraordinaries 0 0 0 0 0 0Other pre-tax income/(expense) 22 38 23 11 11 12Pr<strong>of</strong>it before tax 323 38 -138 273 392 234Income tax expense -8 10 -25 55 78 39Minorities 0 0 2 2 2 2Other post-tax income/(expense) 0 0 0 0 0 0Net pr<strong>of</strong>it 331 27 -114 216 312 193DB adjustments (including dilution) 0 0 0 0 0 0DB Net pr<strong>of</strong>it 331 27 -114 216 312 193Cash Flow (EGPm)Cash flow from operations -12 29 160 -93 288 246Net Capex -8 -14 -24 -372 -729 -832Free cash flow -19 15 136 -465 -441 -586Equity raised/(bought back) 15 0 83 550 0 0Dividends paid 0 -18 -2 0 0 0Net inc/(dec) in borrowings 0 1 96 -97 500 500Other investing/financing cash flows -364 -214 -139 0 0 0Net cash flow -369 -216 174 -12 59 -86Change in working capital -416 -83 291 -318 -32 44Balance Sheet (EGPm)Cash and other liquid assets 467 238 482 470 528 443Tangible fixed assets 36 352 370 711 1,411 2,212Goodwill/intangible assets 0 0 0 0 0 0Associates/investments 85 4 149 149 149 149Other assets 1,674 3,647 4,015 4,782 5,684 6,407Total assets 2,262 4,242 5,016 6,112 7,772 9,211Interest bearing debt 0 1 97 0 500 1,000Other liabilities 498 2,463 3,161 3,586 4,432 5,176Total liabilities 498 2,465 3,258 3,586 4,932 6,176Shareholders' equity 1,745 1,757 1,733 2,499 2,811 3,004Minorities 19 20 26 28 29 31Total shareholders' equity 1,764 1,777 1,758 2,527 2,840 3,035Net debt -467 -237 -385 -470 -28 557Key Company MetricsSales growth (%) 35.8 -52.9 -86.8 nm 42.7 -23.9DB EPS growth (%) -2.0 -91.8 na na 43.0 -38.1EBITDA Margin (%) 53.3 -3.7 -503.0 23.7 27.2 22.5EBIT Margin (%) 53.1 -5.0 -522.8 23.0 26.7 21.8Payout ratio (%) 0.0 0.0 nm 0.0 0.0 0.0ROE (%) 21.1 1.6 -6.6 10.2 11.7 6.6Capex/sales (%) 1.6 6.1 78.8 39.7 54.6 81.8Capex/depreciation (x) 6.8 4.5 4.0 58.5 109.3 118.7Net debt/equity (%) -26.5 -13.3 -21.9 -18.6 -1.0 18.4Net interest cover (x) nm nm nm nm nm 5.5Source: Company data, <strong>Deutsche</strong> <strong>Bank</strong> estimatesPage 36<strong>Deutsche</strong> <strong>Bank</strong> AG/London

- Page 1: CompanyGlobal Markets ResearchMiddl

- Page 4 and 5: 5 July 2010 Real Estate, Constructi

- Page 6 and 7: 5 July 2010 Real Estate, Constructi

- Page 9 and 10: Page 8 Deutsche Bank AG/LondonFigur

- Page 11 and 12: 5 July 2010 Real Estate, Constructi

- Page 13 and 14: 5 July 2010 Real Estate, Constructi

- Page 15 and 16: 5 July 2010 Real Estate, Constructi

- Page 17 and 18: 5 July 2010 Real Estate, Constructi

- Page 19 and 20: 5 July 2010 Real Estate, Constructi

- Page 21 and 22: 5 July 2010 Real Estate, Constructi

- Page 23 and 24: 5 July 2010 Real Estate, Constructi

- Page 25 and 26: 5 July 2010 Real Estate, Constructi

- Page 27 and 28: 5 July 2010 Real Estate, Constructi

- Page 29 and 30: 5 July 2010 Real Estate, Constructi

- Page 31 and 32: 5 July 2010 Real Estate, Constructi

- Page 33 and 34: 5 July 2010 Real Estate, Constructi

- Page 35: 5 July 2010 Real Estate, Constructi

- Page 39 and 40: 5 July 2010 Real Estate, Constructi

- Page 41 and 42: 5 July 2010 Real Estate, Constructi

- Page 43 and 44: 5 July 2010 Real Estate, Constructi

- Page 45 and 46: 5 July 2010 Real Estate, Constructi

- Page 47 and 48: 5 July 2010 Real Estate, Constructi

- Page 49 and 50: 5 July 2010 Real Estate, Constructi

- Page 51 and 52: 5 July 2010 Real Estate, Constructi

- Page 53 and 54: 5 July 2010 Real Estate, Constructi

- Page 55 and 56: 5 July 2010 Real Estate, Constructi

- Page 57 and 58: 5 July 2010 Real Estate, Constructi

- Page 59 and 60: 5 July 2010 Real Estate, Constructi

- Page 61 and 62: 5 July 2010 Real Estate, Constructi

- Page 63 and 64: 5 July 2010 Real Estate, Constructi

- Page 65 and 66: 5 July 2010 Real Estate, Constructi

- Page 67 and 68: Page 66 Deutsche Bank AG/LondonFigu

- Page 69 and 70: 5 July 2010 Real Estate, Constructi

- Page 71 and 72: 5 July 2010 Real Estate, Constructi

- Page 73 and 74: 5 July 2010 Real Estate, Constructi

- Page 75 and 76: 5 July 2010 Real Estate, Constructi

- Page 77 and 78: 5 July 2010 Real Estate, Constructi

- Page 79 and 80: 5 July 2010 Real Estate, Constructi

- Page 81 and 82: 5 July 2010 Real Estate, Constructi

- Page 83 and 84: 5 July 2010 Real Estate, Constructi

- Page 85 and 86: 5 July 2010 Real Estate, Constructi

- Page 87 and 88:

5 July 2010 Real Estate, Constructi

- Page 89 and 90:

5 July 2010 Real Estate, Constructi

- Page 91 and 92:

5 July 2010 Real Estate, Constructi

- Page 93 and 94:

5 July 2010 Real Estate, Constructi

- Page 95 and 96:

5 July 2010 Real Estate, Constructi

- Page 97 and 98:

5 July 2010 Real Estate, Constructi

- Page 99 and 100:

5 July 2010 Real Estate, Constructi

- Page 101 and 102:

5 July 2010 Real Estate, Constructi

- Page 103 and 104:

5 July 2010 Real Estate, Constructi

- Page 105 and 106:

5 July 2010 Real Estate, Constructi

- Page 107 and 108:

5 July 2010 Real Estate, Constructi

- Page 109:

Deutsche Bank AG/LondonMiddle East