Downloading - Aditya Birla Nuvo, Ltd

Downloading - Aditya Birla Nuvo, Ltd

Downloading - Aditya Birla Nuvo, Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

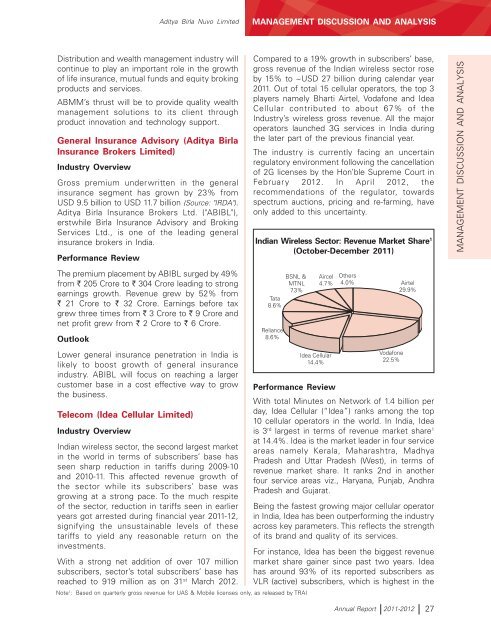

<strong>Aditya</strong> <strong>Birla</strong> <strong>Nuvo</strong> LimitedMANAGEMENT DISCUSSION AND ANALYSISDistribution and wealth management industry willcontinue to play an important role in the growthof life insurance, mutual funds and equity brokingproducts and services.ABMM’s thrust will be to provide quality wealthmanagement solutions to its client throughproduct innovation and technology support.General Insurance Advisory (<strong>Aditya</strong> <strong>Birla</strong>Insurance Brokers Limited)Industry OverviewGross premium underwritten in the generalinsurance segment has grown by 23% fromUSD 9.5 billion to USD 11.7 billion (Source: "IRDA").<strong>Aditya</strong> <strong>Birla</strong> Insurance Brokers <strong>Ltd</strong>. ("ABIBL"),erstwhile <strong>Birla</strong> Insurance Advisory and BrokingServices <strong>Ltd</strong>., is one of the leading generalinsurance brokers in India.Performance ReviewThe premium placement by ABIBL surged by 49%from ` 205 Crore to ` 304 Crore leading to strongearnings growth. Revenue grew by 52% from` 21 Crore to ` 32 Crore. Earnings before taxgrew three times from ` 3 Crore to ` 9 Crore andnet profit grew from ` 2 Crore to ` 6 Crore.OutlookLower general insurance penetration in India islikely to boost growth of general insuranceindustry. ABIBL will focus on reaching a largercustomer base in a cost effective way to growthe business.Telecom (Idea Cellular Limited)Industry OverviewIndian wireless sector, the second largest marketin the world in terms of subscribers’ base hasseen sharp reduction in tariffs during 2009-10and 2010-11. This affected revenue growth ofthe sector while its subscribers’ base wasgrowing at a strong pace. To the much respiteof the sector, reduction in tariffs seen in earlieryears got arrested during financial year 2011-12,signifying the unsustainable levels of thesetariffs to yield any reasonable return on theinvestments.With a strong net addition of over 107 millionsubscribers, sector’s total subscribers’ base hasreached to 919 million as on 31 st March 2012.Compared to a 19% growth in subscribers’ base,gross revenue of the Indian wireless sector roseby 15% to ~USD 27 billion during calendar year2011. Out of total 15 cellular operators, the top 3players namely Bharti Airtel, Vodafone and IdeaCellular contributed to about 67% of theIndustry’s wireless gross revenue. All the majoroperators launched 3G services in India duringthe later part of the previous financial year.The industry is currently facing an uncertainregulatory environment following the cancellationof 2G licenses by the Hon’ble Supreme Court inFebruary 2012. In April 2012, therecommendations of the regulator, towardsspectrum auctions, pricing and re-farming, haveonly added to this uncertainty.Tata8.6%Reliance8.6%BSNL &MTNL7.3%Note 1 : Based on quarterly gross revenue for UAS & Mobile licenses only, as released by TRAIIndian Wireless Sector: Revenue Market Share 1(October-December 2011)Aircel4.7%Idea Cellular14.4%Others4.0% Airtel29.9%Vodafone22.5%Performance ReviewWith total Minutes on Network of 1.4 billion perday, Idea Cellular (“Idea”) ranks among the top10 cellular operators in the world. In India, Ideais 3 rd largest in terms of revenue market share 1at 14.4%. Idea is the market leader in four serviceareas namely Kerala, Maharashtra, MadhyaPradesh and Uttar Pradesh (West), in terms ofrevenue market share. It ranks 2nd in anotherfour service areas viz., Haryana, Punjab, AndhraPradesh and Gujarat.Being the fastest growing major cellular operatorin India, Idea has been outperforming the industryacross key parameters. This reflects the strengthof its brand and quality of its services.For instance, Idea has been the biggest revenuemarket share gainer since past two years. Ideahas around 93% of its reported subscribers asVLR (active) subscribers, which is highest in theMANAGEMENT DISCUSSION AND ANALYSISAnnual Report 2011-2012 27