Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

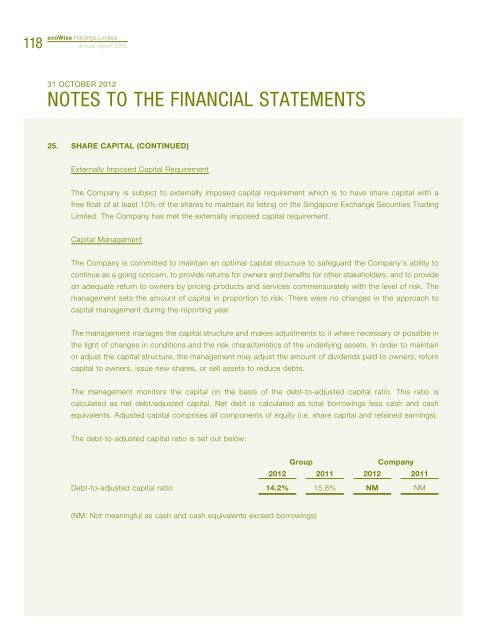

118<strong>ecoWise</strong> <strong>Holdings</strong> <strong>Limited</strong>annual report <strong>2012</strong>31 OCTOBER <strong>2012</strong>NOTES TO THE FINANCIAL STATEMENTS25. SHARE CAPITAL (CONTINUED)Externally Imposed Capital RequirementThe Company is subject to externally imposed capital requirement which is to have share capital with afree float of at least 10% of the shares to maintain its listing on the Singapore Exchange Securities Trading<strong>Limited</strong>. The Company has met the externally imposed capital requirement.Capital ManagementThe Company is committed to maintain an optimal capital structure to safeguard the Company’s ability tocontinue as a going concern, to provide returns for owners and benefits for other stakeholders, and to providean adequate return to owners by pricing products and services commensurately with the level of risk. Themanagement sets the amount of capital in proportion to risk. There were no changes in the approach tocapital management during the reporting year.The management manages the capital structure and makes adjustments to it where necessary or possible inthe light of changes in conditions and the risk characteristics of the underlying assets. In order to maintainor adjust the capital structure, the management may adjust the amount of dividends paid to owners, returncapital to owners, issue new shares, or sell assets to reduce debts.The management monitors the capital on the basis of the debt-to-adjusted capital ratio. This ratio iscalculated as net debt/adjusted capital. Net debt is calculated as total borrowings less cash and cashequivalents. Adjusted capital comprises all components of equity (i.e. share capital and retained earnings).The debt-to-adjusted capital ratio is set out below:GroupCompany<strong>2012</strong> 2011 <strong>2012</strong> 2011Debt-to-adjusted capital ratio 14.2% 15.8% NM NM(NM: Not meaningful as cash and cash equivalents exceed borrowings)