Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

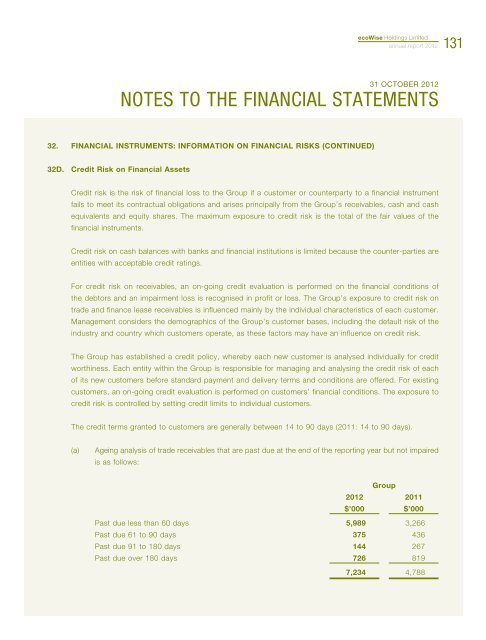

<strong>ecoWise</strong> <strong>Holdings</strong> <strong>Limited</strong>annual report <strong>2012</strong>13131 OCTOBER <strong>2012</strong>NOTES TO THE FINANCIAL STATEMENTS32. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONTINUED)32D. Credit Risk on Financial AssetsCredit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrumentfails to meet its contractual obligations and arises principally from the Group’s receivables, cash and cashequivalents and equity shares. The maximum exposure to credit risk is the total of the fair values of thefinancial instruments.Credit risk on cash balances with banks and financial institutions is limited because the counter-parties areentities with acceptable credit ratings.For credit risk on receivables, an on-going credit evaluation is performed on the financial conditions ofthe debtors and an impairment loss is recognised in profit or loss. The Group’s exposure to credit risk ontrade and finance lease receivables is influenced mainly by the individual characteristics of each customer.Management considers the demographics of the Group’s customer bases, including the default risk of theindustry and country which customers operate, as these factors may have an influence on credit risk.The Group has established a credit policy, whereby each new customer is analysed individually for creditworthiness. Each entity within the Group is responsible for managing and analysing the credit risk of eachof its new customers before standard payment and delivery terms and conditions are offered. For existingcustomers, an on-going credit evaluation is performed on customers’ financial conditions. The exposure tocredit risk is controlled by setting credit limits to individual customers.The credit terms granted to customers are generally between 14 to 90 days (2011: 14 to 90 days).(a)Ageing analysis of trade receivables that are past due at the end of the reporting year but not impairedis as follows:Group<strong>2012</strong> 2011$’000 $’000Past due less than 60 days 5,989 3,266Past due 61 to 90 days 375 436Past due 91 to 180 days 144 267Past due over 180 days 726 8197,234 4,788