Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

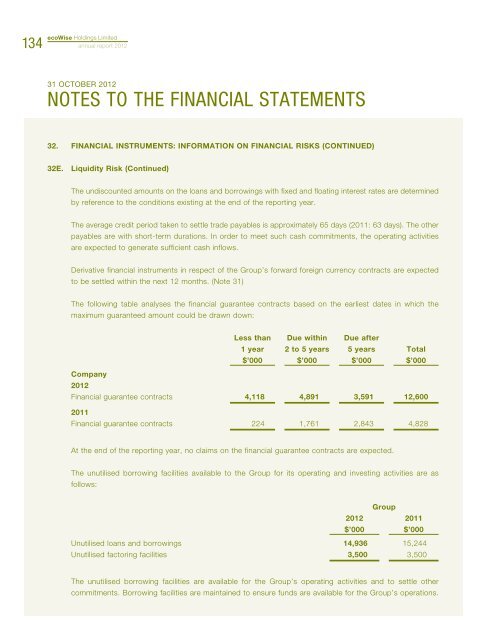

134<strong>ecoWise</strong> <strong>Holdings</strong> <strong>Limited</strong>annual report <strong>2012</strong>31 OCTOBER <strong>2012</strong>NOTES TO THE FINANCIAL STATEMENTS32. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONTINUED)32E. Liquidity Risk (Continued)The undiscounted amounts on the loans and borrowings with fixed and floating interest rates are determinedby reference to the conditions existing at the end of the reporting year.The average credit period taken to settle trade payables is approximately 65 days (2011: 63 days). The otherpayables are with short-term durations. In order to meet such cash commitments, the operating activitiesare expected to generate sufficient cash inflows.Derivative financial instruments in respect of the Group’s forward foreign currency contracts are expectedto be settled within the next 12 months. (Note 31)The following table analyses the financial guarantee contracts based on the earliest dates in which themaximum guaranteed amount could be drawn down:Less than1 yearDue within2 to 5 yearsDue after5 years Total$’000 $’000 $’000 $’000Company<strong>2012</strong>Financial guarantee contracts 4,118 4,891 3,591 12,6002011Financial guarantee contracts 224 1,761 2,843 4,828At the end of the reporting year, no claims on the financial guarantee contracts are expected.The unutilised borrowing facilities available to the Group for its operating and investing activities are asfollows:Group<strong>2012</strong> 2011$’000 $’000Unutilised loans and borrowings 14,936 15,244Unutilised factoring facilities 3,500 3,500The unutilised borrowing facilities are available for the Group’s operating activities and to settle othercommitments. Borrowing facilities are maintained to ensure funds are available for the Group’s operations.