Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

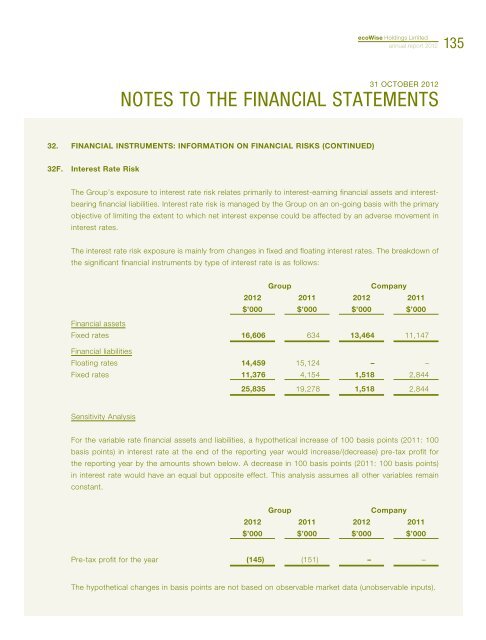

<strong>ecoWise</strong> <strong>Holdings</strong> <strong>Limited</strong>annual report <strong>2012</strong>13531 OCTOBER <strong>2012</strong>NOTES TO THE FINANCIAL STATEMENTS32. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONTINUED)32F. Interest Rate RiskThe Group’s exposure to interest rate risk relates primarily to interest-earning financial assets and interestbearingfinancial liabilities. Interest rate risk is managed by the Group on an on-going basis with the primaryobjective of limiting the extent to which net interest expense could be affected by an adverse movement ininterest rates.The interest rate risk exposure is mainly from changes in fixed and floating interest rates. The breakdown ofthe significant financial instruments by type of interest rate is as follows:GroupCompany<strong>2012</strong> 2011 <strong>2012</strong> 2011$’000 $’000 $’000 $’000Financial assetsFixed rates 16,606 634 13,464 11,147Financial liabilitiesFloating rates 14,459 15,124 – –Fixed rates 11,376 4,154 1,518 2,84425,835 19,278 1,518 2,844Sensitivity AnalysisFor the variable rate financial assets and liabilities, a hypothetical increase of 100 basis points (2011: 100basis points) in interest rate at the end of the reporting year would increase/(decrease) pre-tax profit forthe reporting year by the amounts shown below. A decrease in 100 basis points (2011: 100 basis points)in interest rate would have an equal but opposite effect. This analysis assumes all other variables remainconstant.GroupCompany<strong>2012</strong> 2011 <strong>2012</strong> 2011$’000 $’000 $’000 $’000Pre-tax profit for the year (145) (151) – –The hypothetical changes in basis points are not based on observable market data (unobservable inputs).