Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

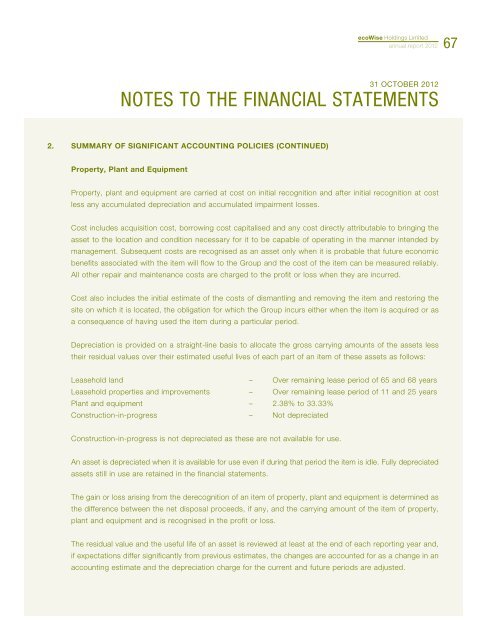

<strong>ecoWise</strong> <strong>Holdings</strong> <strong>Limited</strong>annual report <strong>2012</strong>6731 OCTOBER <strong>2012</strong>NOTES TO THE FINANCIAL STATEMENTS2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)Property, Plant and EquipmentProperty, plant and equipment are carried at cost on initial recognition and after initial recognition at costless any accumulated depreciation and accumulated impairment losses.Cost includes acquisition cost, borrowing cost capitalised and any cost directly attributable to bringing theasset to the location and condition necessary for it to be capable of operating in the manner intended bymanagement. Subsequent costs are recognised as an asset only when it is probable that future economicbenefits associated with the item will flow to the Group and the cost of the item can be measured reliably.All other repair and maintenance costs are charged to the profit or loss when they are incurred.Cost also includes the initial estimate of the costs of dismantling and removing the item and restoring thesite on which it is located, the obligation for which the Group incurs either when the item is acquired or asa consequence of having used the item during a particular period.Depreciation is provided on a straight-line basis to allocate the gross carrying amounts of the assets lesstheir residual values over their estimated useful lives of each part of an item of these assets as follows:Leasehold land – Over remaining lease period of 65 and 68 yearsLeasehold properties and improvements – Over remaining lease period of 11 and 25 yearsPlant and equipment – 2.38% to 33.33%Construction-in-progress – Not depreciatedConstruction-in-progress is not depreciated as these are not available for use.An asset is depreciated when it is available for use even if during that period the item is idle. Fully depreciatedassets still in use are retained in the financial statements.The gain or loss arising from the derecognition of an item of property, plant and equipment is determined asthe difference between the net disposal proceeds, if any, and the carrying amount of the item of property,plant and equipment and is recognised in the profit or loss.The residual value and the useful life of an asset is reviewed at least at the end of each reporting year and,if expectations differ significantly from previous estimates, the changes are accounted for as a change in anaccounting estimate and the depreciation charge for the current and future periods are adjusted.