Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Annual Report 2012 - ecoWise Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

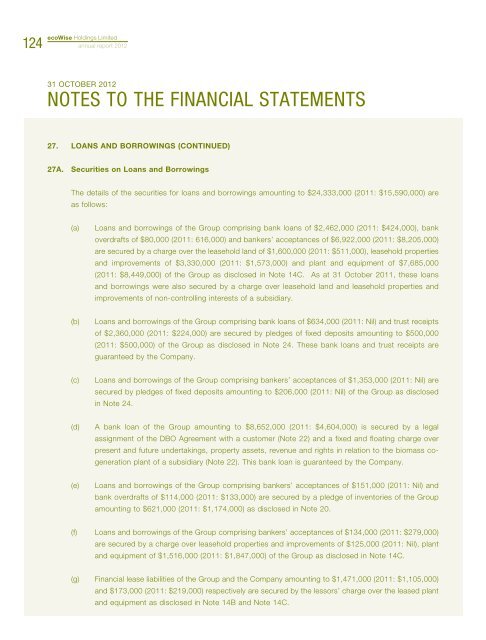

124<strong>ecoWise</strong> <strong>Holdings</strong> <strong>Limited</strong>annual report <strong>2012</strong>31 OCTOBER <strong>2012</strong>NOTES TO THE FINANCIAL STATEMENTS27. LOANS AND BORROWINGS (CONTINUED)27A. Securities on Loans and BorrowingsThe details of the securities for loans and borrowings amounting to $24,333,000 (2011: $15,590,000) areas follows:(a)Loans and borrowings of the Group comprising bank loans of $2,462,000 (2011: $424,000), bankoverdrafts of $80,000 (2011: 616,000) and bankers’ acceptances of $6,922,000 (2011: $8,205,000)are secured by a charge over the leasehold land of $1,600,000 (2011: $511,000), leasehold propertiesand improvements of $3,330,000 (2011: $1,573,000) and plant and equipment of $7,685,000(2011: $8,449,000) of the Group as disclosed in Note 14C. As at 31 October 2011, these loansand borrowings were also secured by a charge over leasehold land and leasehold properties andimprovements of non-controlling interests of a subsidiary.(b)Loans and borrowings of the Group comprising bank loans of $634,000 (2011: Nil) and trust receiptsof $2,360,000 (2011: $224,000) are secured by pledges of fixed deposits amounting to $500,000(2011: $500,000) of the Group as disclosed in Note 24. These bank loans and trust receipts areguaranteed by the Company.(c)Loans and borrowings of the Group comprising bankers’ acceptances of $1,353,000 (2011: Nil) aresecured by pledges of fixed deposits amounting to $206,000 (2011: Nil) of the Group as disclosedin Note 24.(d)A bank loan of the Group amounting to $8,652,000 (2011: $4,604,000) is secured by a legalassignment of the DBO Agreement with a customer (Note 22) and a fixed and floating charge overpresent and future undertakings, property assets, revenue and rights in relation to the biomass cogenerationplant of a subsidiary (Note 22). This bank loan is guaranteed by the Company.(e)Loans and borrowings of the Group comprising bankers’ acceptances of $151,000 (2011: Nil) andbank overdrafts of $114,000 (2011: $133,000) are secured by a pledge of inventories of the Groupamounting to $621,000 (2011: $1,174,000) as disclosed in Note 20.(f) Loans and borrowings of the Group comprising bankers’ acceptances of $134,000 (2011: $279,000)are secured by a charge over leasehold properties and improvements of $125,000 (2011: Nil), plantand equipment of $1,516,000 (2011: $1,847,000) of the Group as disclosed in Note 14C.(g) Financial lease liabilities of the Group and the Company amounting to $1,471,000 (2011: $1,105,000)and $173,000 (2011: $219,000) respectively are secured by the lessors’ charge over the leased plantand equipment as disclosed in Note 14B and Note 14C.