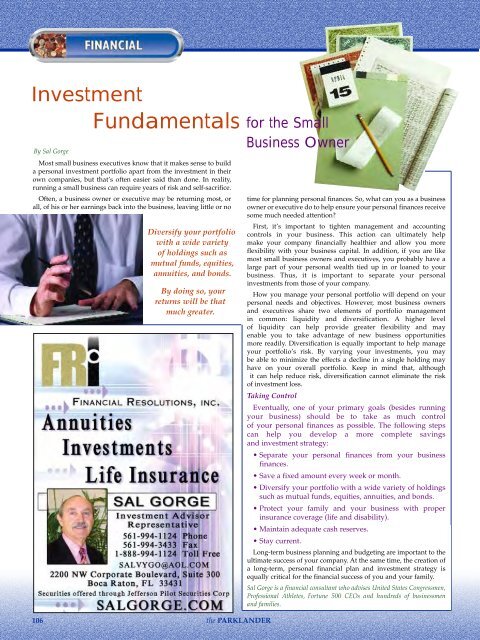

InvestmentFundamentalsBy Sal GorgeMost small business executives know that it makes sense to builda personal investment portfolio apart from the investment in theirown companies, but that’s often easier said than done. In reality,running a small business can require years of risk and self-sacrifice.Often, a business owner or executive may be returning most, orall, of his or her earnings back into the business, leaving little or noDiversify your portfoliowith a wide varietyof holdings such asmutual funds, equities,annuities, and bonds.By doing so, yourreturns will be thatmuch greater.for the SmallBusiness Ownertime for planning personal finances. So, what can you as a businessowner or executive do to help ensure your personal finances receivesome much needed attention?First, it’s important to tighten management and accountingcontrols in your business. This action can ultimately helpmake your company financially healthier and allow you moreflexibility with your business capital. In addition, if you are likemost small business owners and executives, you probably have alarge part of your personal wealth tied up in or loaned to yourbusiness. Thus, it is important to separate your personalinvestments from those of your company.How you manage your personal portfolio will depend on yourpersonal needs and objectives. However, most business ownersand executives share two elements of portfolio managementin common: liquidity and diversification. A higher levelof liquidity can help provide greater flexibility and mayenable you to take advantage of new business opportunitiesmore readily. Diversification is equally important to help manageyour portfolio’s risk. By varying your investments, you maybe able to minimize the effects a decline in a single holding mayhave on your overall portfolio. Keep in mind that, althoughit can help reduce risk, diversification cannot eliminate the riskof investment loss.Taking ControlEventually, one of your primary goals (besides runningyour business) should be to take as much controlof your personal finances as possible. <strong>The</strong> following stepscan help you develop a more complete savingsand investment strategy:• Separate your personal finances from your businessfinances.• Save a fixed amount every week or month.• Diversify your portfolio with a wide variety of holdingssuch as mutual funds, equities, annuities, and bonds.• Protect your family and your business with properinsurance coverage (life and disability).• Maintain adequate cash reserves.• Stay current.Long-term business planning and budgeting are important to theultimate success of your company. At the same time, the creation ofa long-term, personal financial plan and investment strategy isequally critical for the financial success of you and your family.Sal Gorge is a financial consultant who advises United States Congressmen,Professional Athletes, Fortune 500 CEOs and hundreds of businessmenand families.106the PARKLANDER

Marci groomingPuppy PlanetMission Bay Plaza20449 State Road 7, Suite A-2 — Boca Raton, FL 33498Between LA Fitness and Office Max in the CourtyardPhone: (561) 477-DOGS (3647)Grooming: 561-852-0201www.puppyplanetonline.comPuppy Planet is a full-service pet boutiquethat offers professional grooming, a full line ofupscale accessories for dogs, a dog-walkingservice and professional training. <strong>The</strong>y specialize inadorable tea cup, small and large breed puppies. It’s afamily owned and operated business and owner RichKlein personally selects each and every puppy.When a puppy leaves their care, Rich and Marci aren’t so quickto say goodbye. <strong>The</strong>y follow up with phone calls to check on thepuppies, and they’re always glad to hear from customers. Everybreeder they use is licensed and registered by the U.S. Departmentof Agriculture, which means each breeder is inspected constantly.“<strong>The</strong> cleanliness of the store is important. We make sure there’s nosmell and that everything is clean,” says Rich. “We give a two–yearhealth guarantee. We’re affiliated with Boca Greens AnimalHospital and we offer a free initial checkup there. And we arecompetitively priced in all areas.”All Puppy Planet puppies are micro-chippedat the age of six weeks, so if a lost dog isfound, it can be quickly reunited withits owner. Comfort is key and noneof the puppies are caged. <strong>The</strong>y’rekept in expensive, custom-builthabitats with special pet bedding.<strong>The</strong> ventilation system pumps infresh air every 20 minutes, to preventairborne bacteria and keep thetemperature consistent.“We’ll have 15 to 20 dogs at any given time,” Rich says. “If apuppy doesn’t sell, we work with rescue foundations so it can beadopted by a deserving family. We encourage customers who wanta second dog to bring their first dog into the shop to meet thepuppy. We only use organic food.”It’s easy to see that the Kleins got into thisbusiness as a labor of love. Rich was agolden retriever and maltese breeder manyyears ago and Marci is a certified mastergroomer. “Our entire family has a love ofanimals,” says Marci. “Many on our staff arein school to become veterinarians orveterinary technicians.”“Coming to work is an absolute joy,” adds Rich. “We lovemaking a perfect fit between clients and puppies and all ourclients tell us how happy they are with their new family member,Richard, Marciand Calvin Kleinand how much they appreciate our professionalismand personal touch.”<strong>The</strong> Kleins have also had some famous clients,including DJ Valentine from 95.5, some Miami Heatand Orlando Magic players, Hillary Duff and one ofthe NY Knicks.When customers take their dogs in forgrooming, there’s no waiting. With anappointment, the dog is taken immediately.Dog walking service is available. Matt, an aspiringveterinarian, goes to the client’s home and takes the dog outfor 15 to 20 minutes, as many times a day as required.Calvin, the Klein’s three-year old golden retriever, is theofficial Puppy Planet mascot and according to Rich, he’s the hitof West Boca. Calvin, and the rest of the puppy planet teamlook foward to your visit!Bondedwww.a1apetsitters.comInsuredPet Sitters Inc.Mary Jane PattersonSecure, affordable, in homepet care and absenteehomeowner service.“Going away … Call A1A”954-422-8PETOBEDIENCE TRAININGBEHAVIOR PROBLEMSPUPPY TRAININGCHILD & DOGSAFETYSteve GinsbergCertified Pet Dog TrainerMember of APDTPh: 954-722-8836Cell: 954-304-2590sgins@bellsouth.netthe PARKLANDER 107