kpmg-econtech-final

kpmg-econtech-final

kpmg-econtech-final

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

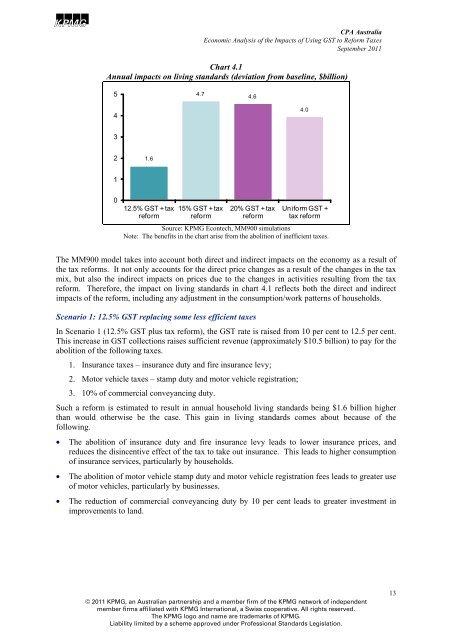

ABCDCPA AustraliaEconomic Analysis of the Impacts of Using GST to Reform TaxesSeptember 2011Chart 4.1Annual impacts on living standards (deviation from baseline, $billion)54.74.644.0321.61012.5% GST + taxreform15% GST + taxreform20% GST + taxreformUniform GST +tax reformSource: KPMG Econtech, MM900 simulationsNote: The benefits in the chart arise from the abolition of inefficient taxes.The MM900 model takes into account both direct and indirect impacts on the economy as a result ofthe tax reforms. It not only accounts for the direct price changes as a result of the changes in the taxmix, but also the indirect impacts on prices due to the changes in activities resulting from the taxreform. Therefore, the impact on living standards in chart 4.1 reflects both the direct and indirectimpacts of the reform, including any adjustment in the consumption/work patterns of households.Scenario 1: 12.5% GST replacing some less efficient taxesIn Scenario 1 (12.5% GST plus tax reform), the GST rate is raised from 10 per cent to 12.5 per cent.This increase in GST collections raises sufficient revenue (approximately $10.5 billion) to pay for theabolition of the following taxes.1. Insurance taxes – insurance duty and fire insurance levy;2. Motor vehicle taxes – stamp duty and motor vehicle registration;3. 10% of commercial conveyancing duty.Such a reform is estimated to result in annual household living standards being $1.6 billion higherthan would otherwise be the case. This gain in living standards comes about because of thefollowing.• The abolition of insurance duty and fire insurance levy leads to lower insurance prices, andreduces the disincentive effect of the tax to take out insurance. This leads to higher consumptionof insurance services, particularly by households.• The abolition of motor vehicle stamp duty and motor vehicle registration fees leads to greater useof motor vehicles, particularly by businesses.• The reduction of commercial conveyancing duty by 10 per cent leads to greater investment inimprovements to land.© 2011 KPMG, an Australian partnership and a member firm of the KPMG network of independentmember firms affiliated with KPMG International, a Swiss cooperative. All rights reserved.The KPMG logo and name are trademarks of KPMG.Liability limited by a scheme approved under Professional Standards Legislation.13