kpmg-econtech-final

kpmg-econtech-final

kpmg-econtech-final

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

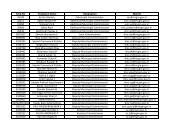

CPA AustraliaEconomic Analysis of the Impacts of Using GST to Reform TaxesSeptember 20111. IntroductionThe effectiveness of the Australian tax system is an issue that concerns all Australians. It affects theoperation of businesses, households and governments. Australia’s tax-transfer system forms anintegral part of our economic and societal structure through its influence on decisions of saving,consuming, investment, and working.In recognition of this, the Australian Government recently commissioned a panel of experts toundertake a review of Australia’s Future Tax System, headed by Ken Henry and termed ‘the HenryTax Review’. The review panel provided its report to the Australian Government in December 2009.In May 2010, the Australian Government released the <strong>final</strong> report of the Henry Tax Review, the mostcomprehensive review of Australia’s tax system to date. This report provides an excellentbackground to the consideration of tax reform options, because it discusses the general principles oftax reform and includes modelling of the economic costs of a number of state taxes. These economiccosts were modelled by KPMG Econtech, using the same framework used in this report.Following this, the Australian Government announced that it will convene a public Tax Forum inearly October 2011 to consider future tax reform options in the context of the Henry Tax Review.The discussion paper for this forum was released on 28 July 2011 2 , with the aim to “inform publicdebate on priorities and directions for continuing tax reform in the lead-up to the Tax Forum.” Thisdiscussion paper identifies economic growth as one of the important factors in the design of a taxsystem.Taxes are important sources of funding for government services, such as education, health andwelfare. However, taxes also affect the way that the economy operates, and can lead to lessproductive use of resources and lower living standards. The design of a tax can have an impact onhow distorting (or inefficient) a tax can be. As a consequence of differences in design, there issignificant variation in efficiency in the taxes currently faced by businesses and households inAustralia.For example, many of the state taxes are recognised as the more inefficient taxes. The moreinefficient or distorting a tax is, the more likely resources will be moved away from their highestvalueuse. This will lead to lower productivity across the economy.On the other hand, consumption taxes (such as Australia’s GST) are generally considered to be oneof the more efficient types of taxes. International organisations such as the International MonetaryFund (IMF) have recognised the implications of these efficiency differences, suggesting in 2010 thatthey would “welcome more reliance on consumption-based taxes [in Australia]. This would allow forthe elimination of inefficient taxes at the state level that impede labor mobility and allow forreductions in federal personal income taxes that would encourage increases in labor supply andsaving.” 3A 2009 survey of international tax rates 4 showed that Australia’s 10 per cent GST rate is at the lowerend of the world GST/VAT scale. The average GST/VAT rate across all 115 surveyed countries wasaround 15.25 per cent in that year. In addition, this survey showed that the 10 per cent AustralianGST rate is one of the lowest GST/VAT rates amongst all OECD countries, with many OECDcountries such as Denmark, France, Germany and the U.K. imposing GST/VAT rates around 20 percent. 5Despite these attributes, the GST was not included as one of the taxes examined in the Henry TaxReview. While the 2011 Tax Forum discussion paper contains some discussion questions around the2 Tax Reform Next Steps for Australia, Australian Government, Tax Forum Discussion Paper, July 2011.3 IMF 2010 Article IV Consultation Concluding Statement, September 15, 2010.http://www.imf.org/external/np/ms/2010/091510.htm4 KPMG Corporate and Indirect Tax Rate Survey, 20095 Table B.1 in Appendix B lists the GST rates in 2010 for OECD countries.© 2011 KPMG, an Australian partnership and a member firm of the KPMG network of independentmember firms affiliated with KPMG International, a Swiss cooperative. All rights reserved.The KPMG logo and name are trademarks of KPMG.Liability limited by a scheme approved under Professional Standards Legislation.1