kpmg-econtech-final

kpmg-econtech-final

kpmg-econtech-final

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

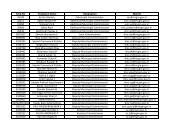

ABCDCPA AustraliaEconomic Analysis of the Impacts of Using GST to Reform TaxesSeptember 2011Different states and territories tend to have different payroll tax rates and thresholds. States andterritories with higher thresholds tend to have high payroll tax rates so as to maintain revenue-raisingability. Table C.1 shows the current rates and thresholds for each state and territory.Table C.1Payroll taxes (tax rates and thresholds effective from 1 July 2010 to 30 June 2011)State/Territory Rate (%) Annual wages threshold ($’000)New South Wales 5.45 (1 Jan 2011) 658Victoria 4.9 550Queensland 4.75 1,000South Australia 4.95 600Western Australia 5.5 750Tasmania 6.1 1,010Australian CapitalTerritory6.85 1,500Northern Territory 5.9 1,250Source: Websites of the Office of State Revenue for all jurisdictionsImplications of current designThe excess burden associated with payroll taxes is caused by two distortions, along with thenarrowing of the tax base due to its small business exemption.Firstly, payroll tax causes distortions to households’ labour supply decisions. This is because payrolltax drives a wedge between the wage received by households and the wage paid by employers.Similar to personal income tax, this wedge creates an excess burden by distorting the labour market.Although the statutory burden of the tax does not fall on workers, employers generally pass some ofthe burden of the tax on through lower real wages, either by offering a lower nominal wage or byraising output prices. Consequently, payroll tax can discourage labour supply by lowering the realpurchasing power of wages.The mobility of labour plays a role in determining the size of the excess burden due to labour supplydistortions. Since the mobility of labour is only moderate, payroll tax is expected to have a relativelylow excess burden if it is applied uniformly across all labour.Secondly, the application of a small business exemption creates further distortions as it is appliedunevenly to businesses of different sizes. Despite applying to all businesses, this exemption providesa relatively larger cost saving to small business (when calculated on a per unit of output basis).Treating small businesses more favourably compared to large businesses distorts businesses’ optimaldecisions regarding its operation size. Specifically, it creates a disincentive for these businesses toexpand to reach the optimal size.Also, around one-half of the payroll tax base in Australia is lost in practice because of the smallbusiness exemption. However, as discussed in Chapter The economic cost of taxation, labour supplydecisions are affected by the marginal rate of tax, which is independent of the threshold forexemption. This means that while the small business exemption undermines the revenue-raisingability of payroll tax, it does little to encourage labour supply. This further contributes to the excessburden of the tax.Finally, the differential treatments of payroll tax across states and territories create yet an additionaldistortion. Specifically, businesses have incentives to locate in states which offer lower payroll taxliabilities. This may imply that the excess burden of payroll tax is slightly higher than that estimatedin this study.Taking all of the above into consideration, payroll taxes can be expected to have a high excessburden.© 2011 KPMG, an Australian partnership and a member firm of the KPMG network of independentmember firms affiliated with KPMG International, a Swiss cooperative. All rights reserved.The KPMG logo and name are trademarks of KPMG.Liability limited by a scheme approved under Professional Standards Legislation.29