kpmg-econtech-final

kpmg-econtech-final

kpmg-econtech-final

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

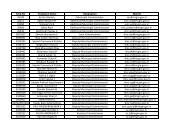

ABCDCPA AustraliaEconomic Analysis of the Impacts of Using GST to Reform TaxesSeptember 2011abolished inefficient taxes tend to experience price decreases. For example, the transportation sectorexperiences price decreases in all scenarios as it is currently subject to motor vehicle taxes which areabolished in the tax reform scenarios. Price levels in the health sector are also lower because thissector is not subject to GST, thus does not experience higher prices under an increases GST rate. Theclothing and footwear sector on the other hand has a relatively large exposure to the GST, henceprice levels in the sector are higher under scenarios involving an increase in the GST rate. Table E.1in Appendix E has more details on CPI impacts in different sectors.It is worth noting that the size of the price rise will be smaller than the increase in the GST rate inany given sector. This is because the positive price impact of the GST is always offset to an extentby the price impact from abolishing the inefficient taxes.Changes in the price level flow through to the purchasing power of wages, and lower prices lead to ahigher after tax real wage in each of the scenarios. In addition, in Scenario 3(20% GST plus tax reform) the reduction of personal income tax also directly raises the real after taxwage. Overall higher wages would tend to raise the incentive to supply labour and lead to higheremployment levels.However, there is another factor affecting the supply of labour, and this is the level of income thathouseholds earn from non-labour sources. In all scenarios, the tax reforms lead to the economyoperating in a more efficient manner. This is particularly true for the 15% GST and the 20% GSTscenarios because they involve the reduction of payroll tax. As discussed above, this reduces theincentive for businesses to be small, and increases their productivity. While higher productivityreduces the need for foreign investment in capital, it increases the return to locally owned capital.This raises non-labour income, and reduces the incentive to work. However, despite a lowerincentive to work, the average living standards of Australian households would still be higherbecause they have higher incomes as well as more leisure.Overall, these impacts lead to the effects on total employment shown in Table 4.1. The higher aftertax real wages in the 12.5% GST scenario and the Uniform GST scenario lead to higher employmentlevels. However, in the 15% GST and the 20% GST scenarios, the impact of higher non-labourincomes outweighs this effect. In the long run, employment levels are the same as would otherwisebe the case in the 15% GST scenario and slightly lower than would otherwise be the case in the20% GST scenario.© 2011 KPMG, an Australian partnership and a member firm of the KPMG network of independentmember firms affiliated with KPMG International, a Swiss cooperative. All rights reserved.The KPMG logo and name are trademarks of KPMG.Liability limited by a scheme approved under Professional Standards Legislation.21