kpmg-econtech-final

kpmg-econtech-final

kpmg-econtech-final

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

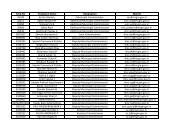

ABCDCPA AustraliaEconomic Analysis of the Impacts of Using GST to Reform TaxesSeptember 2011Appendix A: Definition of Taxes in MM900The following table summarises how each tax in this report is modelled in MM900.Table A.1Summary of MM900 Tax definitionsTaxMM900 modelling approachGSTPersonal Income TaxPayroll TaxCompany TaxInsurance DutyEach of the 889 products is distinguished to be taxable, input-taxed orzero-ratedThe tax includes personal income tax paid out of wages, the Medicarelevy, fringe benefits tax and tax on employer superannuationcontributions.This tax does not include personal income tax as it applies to incomefrom savings, because savings decisions of households are modelledas a constant proportion of household income.Tax on businesses for their total payments to employees (tax ratedepends on business size)Tax on net operating surplus of companiesTax on insurance service products (refer to Table 3.9 for more details)Fire Insurance LevyMotor Vehicle TaxesCommercial Transfer DutyResidential Transfer DutyTax on insurance service products (refer to Table 3.9 for more details)Tax on the gross fixed capital formation on the products Motor vehicleswith less than 10 person capacity and Motor scooters and motor cyclesTax on business and household ownership of vehicles (making it a taxon capital)Tax on investment in commercial structuresTax on investment in residential structures and on moving costs© 2011 KPMG, an Australian partnership and a member firm of the KPMG network of independentmember firms affiliated with KPMG International, a Swiss cooperative. All rights reserved.The KPMG logo and name are trademarks of KPMG.Liability limited by a scheme approved under Professional Standards Legislation.23