Outerwear. - Business Location Switzerland

Outerwear. - Business Location Switzerland

Outerwear. - Business Location Switzerland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

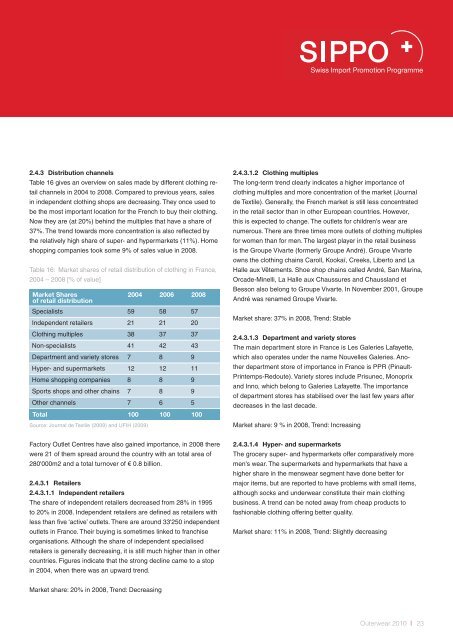

2.4.3 Distribution channels<br />

Table 16 gives an overview on sales made by different clothing retail<br />

channels in 2004 to 2008. Compared to previous years, sales<br />

in independent clothing shops are decreasing. They once used to<br />

be the most important location for the French to buy their clothing.<br />

Now they are (at 20%) behind the multiples that have a share of<br />

37%. The trend towards more concentration is also reflected by<br />

the relatively high share of super- and hypermarkets (11%). Home<br />

shopping companies took some 9% of sales value in 2008.<br />

Table 16: Market shares of retail distribution of clothing in France,<br />

2004 – 2008 [% of value]<br />

Market Shares<br />

of retail distribution<br />

2004 2006 2008<br />

Specialists 59 58 57<br />

Independent retailers 21 21 20<br />

Clothing multiples 38 37 37<br />

Non-specialists 41 42 43<br />

Department and variety stores 7 8 9<br />

Hyper- and supermarkets 12 12 11<br />

Home shopping companies 8 8 9<br />

Sports shops and other chains 7 8 9<br />

Other channels 7 6 5<br />

Total 100 100 100<br />

Source: Journal de Textile (2009) and UFIH (2009)<br />

Factory Outlet Centres have also gained importance, in 2008 there<br />

were 21 of them spread around the country with an total area of<br />

280'000m2 and a total turnover of € 0.8 billion.<br />

2.4.3.1 Retailers<br />

2.4.3.1.1 Independent retailers<br />

The share of independent retailers decreased from 28% in 1995<br />

to 20% in 2008. Independent retailers are defined as retailers with<br />

less than five ‘active’ outlets. There are around 33'250 independent<br />

outlets in France. Their buying is sometimes linked to franchise<br />

organisations. Although the share of independent specialised<br />

retailers is generally decreasing, it is still much higher than in other<br />

countries. Figures indicate that the strong decline came to a stop<br />

in 2004, when there was an upward trend.<br />

Market share: 20% in 2008, Trend: Decreasing<br />

2.4.3.1.2 Clothing multiples<br />

The long-term trend clearly indicates a higher importance of<br />

clothing multiples and more concentration of the market (Journal<br />

de Textile). Generally, the French market is still less concentrated<br />

in the retail sector than in other European countries. However,<br />

this is expected to change. The outlets for children's wear are<br />

numerous. There are three times more outlets of clothing multiples<br />

for women than for men. The largest player in the retail business<br />

is the Groupe Vivarte (formerly Groupe André). Groupe Vivarte<br />

owns the clothing chains Caroll, Kookaï, Creeks, Liberto and La<br />

Halle aux Vêtements. Shoe shop chains called André, San Marina,<br />

Orcade-Minelli, La Halle aux Chaussures and Chaussland et<br />

Besson also belong to Groupe Vivarte. In November 2001, Groupe<br />

André was renamed Groupe Vivarte.<br />

Market share: 37% in 2008, Trend: Stable<br />

2.4.3.1.3 Department and variety stores<br />

The main department store in France is Les Galeries Lafayette,<br />

which also operates under the name Nouvelles Galeries. Another<br />

department store of importance in France is PPR (Pinault-<br />

Printemps-Redoute). Variety stores include Prisunec, Monoprix<br />

and Inno, which belong to Galeries Lafayette. The importance<br />

of department stores has stabilised over the last few years after<br />

decreases in the last decade.<br />

Market share: 9 % in 2008, Trend: Increasing<br />

2.4.3.1.4 Hyper- and supermarkets<br />

The grocery super- and hypermarkets offer comparatively more<br />

men's wear. The supermarkets and hypermarkets that have a<br />

higher share in the menswear segment have done better for<br />

major items, but are reported to have problems with small items,<br />

although socks and underwear constitute their main clothing<br />

business. A trend can be noted away from cheap products to<br />

fashionable clothing offering better quality.<br />

Market share: 11% in 2008, Trend: Slightly decreasing<br />

<strong>Outerwear</strong> 2010 l 23