Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

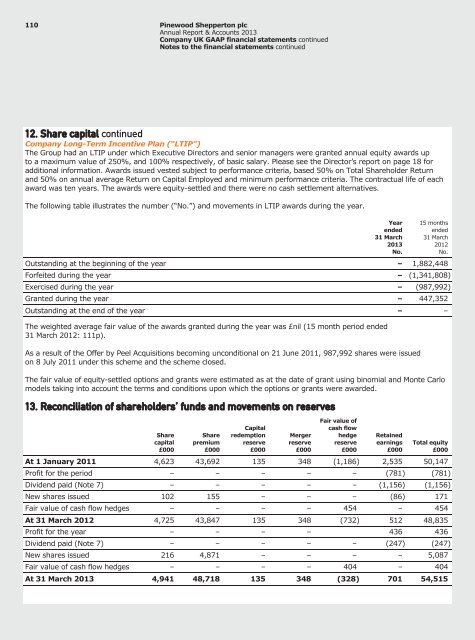

110 <strong>Pinewood</strong> Shepperton plc<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2013</strong>Company UK GAAP financial statements continuedNotes to the financial statements continued12. Share capital continuedCompany Long-Term Incentive Plan (“LTIP”)The Group had an LTIP under which Executive Directors and senior managers were granted annual equity awards upto a maximum value of 250%, and 100% respectively, of basic salary. Please see the Director’s report on page 18 foradditional information. Awards issued vested subject to performance criteria, based 50% on Total Shareholder Returnand 50% on annual average Return on Capital Employed and minimum performance criteria. The contractual life of eachaward was ten years. The awards were equity-settled and there were no cash settlement alternatives.The following table illustrates the number (“No.”) and movements in LTIP awards during the year.Yearended31 March<strong>2013</strong>No.15 monthsended31 March2012No.Outstanding at the beginning of the year – 1,882,448Forfeited during the year – (1,341,808)Exercised during the year – (987,992)Granted during the year – 447,352Outstanding at the end of the year – –The weighted average fair value of the awards granted during the year was £nil (15 month period ended31 March 2012: 111p).As a result of the Offer by Peel Acquisitions becoming unconditional on 21 June 2011, 987,992 shares were issuedon 8 July 2011 under this scheme and the scheme closed.The fair value of equity-settled options and grants were estimated as at the date of grant using binomial and Monte Carlomodels taking into account the terms and conditions upon which the options or grants were awarded.13. Reconciliation of shareholders’ funds and movements on reservesSharecapital£000Sharepremium£000Capitalredemptionreserve£000Mergerreserve£000Fair value ofcash flowhedgereserve£000Retainedearnings£000Total equity£000At 1 January 2011 4,623 43,692 135 348 (1,186) 2,535 50,147Profit for the period – – – – – (781) (781)Dividend paid (Note 7) – – – – – (1,156) (1,156)New shares issued 102 155 – – – (86) 171Fair value of cash flow hedges – – – – 454 – 454At 31 March 2012 4,725 43,847 135 348 (732) 512 48,835Profit for the year – – – – 436 436Dividend paid (Note 7) – – – – – (247) (247)New shares issued 216 4,871 – – – – 5,087Fair value of cash flow hedges – – – – 404 – 404At 31 March <strong>2013</strong> 4,941 48,718 135 348 (328) 701 54,515