Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

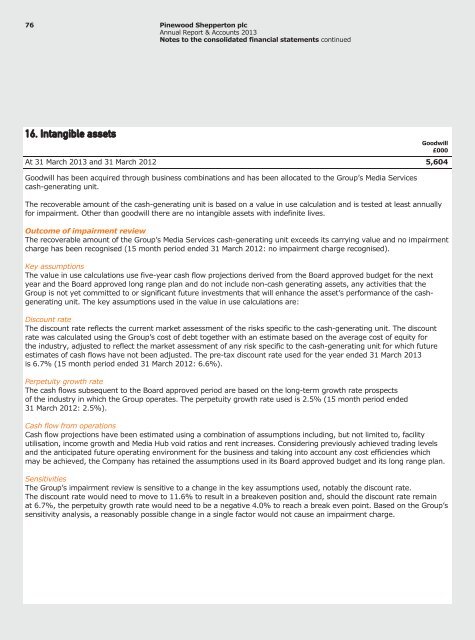

76 <strong>Pinewood</strong> Shepperton plc<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2013</strong>Notes to the consolidated financial statements continued16. Intangible assetsGoodwill£000At 31 March <strong>2013</strong> and 31 March 2012 5,604Goodwill has been acquired through business combinations and has been allocated to the Group’s Media Servicescash-generating unit.The recoverable amount of the cash-generating unit is based on a value in use calculation and is tested at least annuallyfor impairment. Other than goodwill there are no intangible assets with indefinite lives.Outcome of impairment reviewThe recoverable amount of the Group’s Media Services cash-generating unit exceeds its carrying value and no impairmentcharge has been recognised (15 month period ended 31 March 2012: no impairment charge recognised).Key assumptionsThe value in use calculations use five-year cash flow projections derived from the Board approved budget for the nextyear and the Board approved long range plan and do not include non-cash generating assets, any activities that theGroup is not yet committed to or significant future investments that will enhance the asset’s performance of the cashgeneratingunit. The key assumptions used in the value in use calculations are:Discount rateThe discount rate reflects the current market assessment of the risks specific to the cash-generating unit. The discountrate was calculated using the Group’s cost of debt together with an estimate based on the average cost of equity forthe industry, adjusted to reflect the market assessment of any risk specific to the cash-generating unit for which futureestimates of cash flows have not been adjusted. The pre-tax discount rate used for the year ended 31 March <strong>2013</strong>is 6.7% (15 month period ended 31 March 2012: 6.6%).Perpetuity growth rateThe cash flows subsequent to the Board approved period are based on the long-term growth rate prospectsof the industry in which the Group operates. The perpetuity growth rate used is 2.5% (15 month period ended31 March 2012: 2.5%).Cash flow from operationsCash flow projections have been estimated using a combination of assumptions including, but not limited to, facilityutilisation, income growth and Media Hub void ratios and rent increases. Considering previously achieved trading levelsand the anticipated future operating environment for the business and taking into account any cost efficiencies whichmay be achieved, the Company has retained the assumptions used in its Board approved budget and its long range plan.SensitivitiesThe Group’s impairment review is sensitive to a change in the key assumptions used, notably the discount rate.The discount rate would need to move to 11.6% to result in a breakeven position and, should the discount rate remainat 6.7%, the perpetuity growth rate would need to be a negative 4.0% to reach a break even point. Based on the Group’ssensitivity analysis, a reasonably possible change in a single factor would not cause an impairment charge.