Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

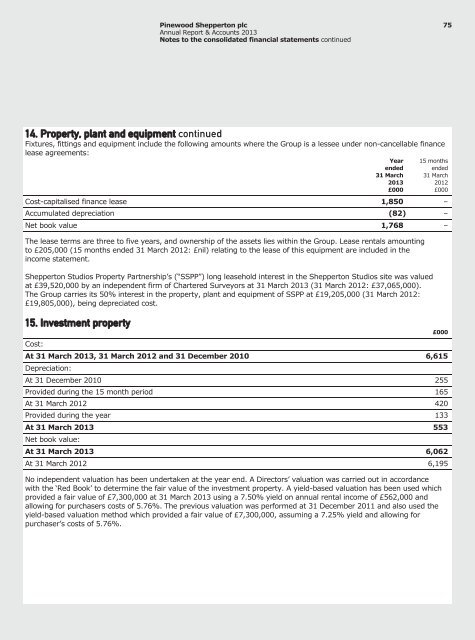

<strong>Pinewood</strong> Shepperton plc 75<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2013</strong>Notes to the consolidated financial statements continued14. Property, plant and equipment continuedFixtures, fittings and equipment include the following amounts where the Group is a lessee under non-cancellable financelease agreements:Yearended31 March<strong>2013</strong>£00015 monthsended31 March2012£000Cost-capitalised finance lease 1,850 –Accumulated depreciation (82) –Net book value 1,768 –The lease terms are three to five years, and ownership of the assets lies within the Group. Lease rentals amountingto £205,000 (15 months ended 31 March 2012: £nil) relating to the lease of this equipment are included in theincome statement.Shepperton <strong>Studios</strong> Property Partnership’s (“SSPP”) long leasehold interest in the Shepperton <strong>Studios</strong> site was valuedat £39,520,000 by an independent firm of Chartered Surveyors at 31 March <strong>2013</strong> (31 March 2012: £37,065,000).The Group carries its 50% interest in the property, plant and equipment of SSPP at £19,205,000 (31 March 2012:£19,805,000), being depreciated cost.15. Investment propertyCost:At 31 March <strong>2013</strong>, 31 March 2012 and 31 December 2010 6,615Depreciation:At 31 December 2010 255Provided during the 15 month period 165At 31 March 2012 420Provided during the year 133At 31 March <strong>2013</strong> 553Net book value:At 31 March <strong>2013</strong> 6,062At 31 March 2012 6,195No independent valuation has been undertaken at the year end. A Directors’ valuation was carried out in accordancewith the ‘Red Book’ to determine the fair value of the investment property. A yield-based valuation has been used whichprovided a fair value of £7,300,000 at 31 March <strong>2013</strong> using a 7.50% yield on annual rental income of £562,000 andallowing for purchasers costs of 5.76%. The previous valuation was performed at 31 December 2011 and also used theyield-based valuation method which provided a fair value of £7,300,000, assuming a 7.25% yield and allowing forpurchaser’s costs of 5.76%.£000