Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

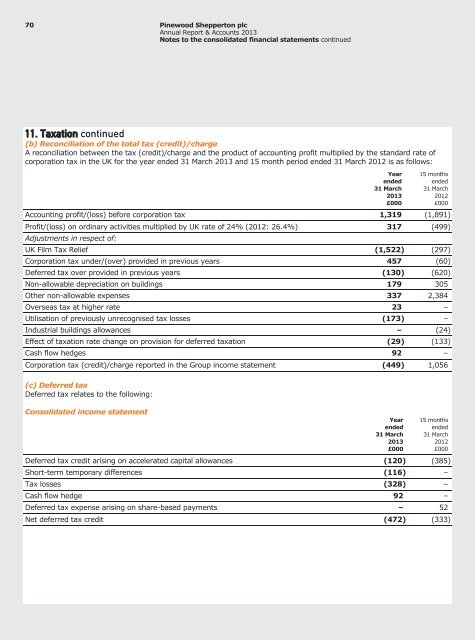

70 <strong>Pinewood</strong> Shepperton plc<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2013</strong>Notes to the consolidated financial statements continued11. Taxation continued(b) Reconciliation of the total tax (credit)/chargeA reconciliation between the tax (credit)/charge and the product of accounting profit multiplied by the standard rate ofcorporation tax in the UK for the year ended 31 March <strong>2013</strong> and 15 month period ended 31 March 2012 is as follows:Yearended31 March<strong>2013</strong>£00015 monthsended31 March2012£000Accounting profit/(loss) before corporation tax 1,319 (1,891)Profit/(loss) on ordinary activities multiplied by UK rate of 24% (2012: 26.4%) 317 (499)Adjustments in respect of:UK Film Tax Relief (1,522) (297)Corporation tax under/(over) provided in previous years 457 (60)Deferred tax over provided in previous years (130) (620)Non-allowable depreciation on buildings 179 305Other non-allowable expenses 337 2,384Overseas tax at higher rate 23 –Utilisation of previously unrecognised tax losses (173) –Industrial buildings allowances – (24)Effect of taxation rate change on provision for deferred taxation (29) (133)Cash flow hedges 92 –Corporation tax (credit)/charge reported in the Group income statement (449) 1,056(c) Deferred taxDeferred tax relates to the following:Consolidated income statementYearended31 March<strong>2013</strong>£00015 monthsended31 March2012£000Deferred tax credit arising on accelerated capital allowances (120) (385)Short-term temporary differences (116) –Tax losses (328) –Cash flow hedge 92 –Deferred tax expense arising on share-based payments – 52Net deferred tax credit (472) (333)