Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

Annual Report & Accounts 2013 - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

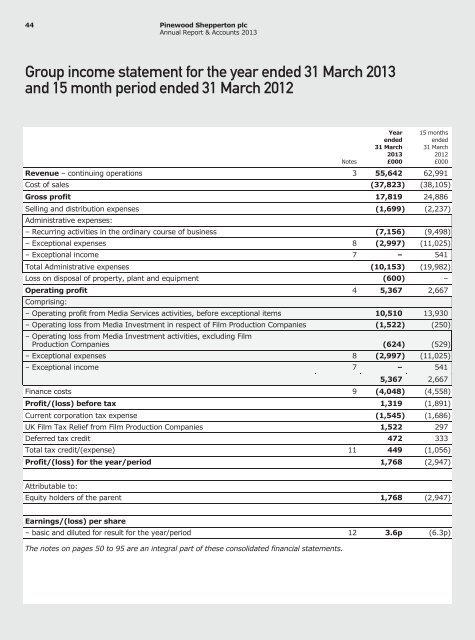

44 <strong>Pinewood</strong> Shepperton plc<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2013</strong>Group income statement for the year ended 31 March <strong>2013</strong>and 15 month period ended 31 March 2012NotesYearended31 March<strong>2013</strong>£00015 monthsended31 March2012£000Revenue – continuing operations 3 55,642 62,991Cost of sales (37,823) (38,105)Gross profit 17,819 24,886Selling and distribution expenses (1,699) (2,237)Administrative expenses:– Recurring activities in the ordinary course of business (7,156) (9,498)– Exceptional expenses 8 (2,997) (11,025)– Exceptional income 7 – 541Total Administrative expenses (10,153) (19,982)Loss on disposal of property, plant and equipment (600) –Operating profit 4 5,367 2,667Comprising:– Operating profit from Media Services activities, before exceptional items 10,510 13,930– Operating loss from Media Investment in respect of Film Production Companies (1,522) (250)– Operating loss from Media Investment activities, excluding FilmProduction Companies (624) (529)– Exceptional expenses 8 (2,997) (11,025)– Exceptional income 7 – 5415,367 2,667Finance costs 9 (4,048) (4,558)Profit/(loss) before tax 1,319 (1,891)Current corporation tax expense (1,545) (1,686)UK Film Tax Relief from Film Production Companies 1,522 297Deferred tax credit 472 333Total tax credit/(expense) 11 449 (1,056)Profit/(loss) for the year/period 1,768 (2,947)Attributable to:Equity holders of the parent 1,768 (2,947)Earnings/(loss) per share– basic and diluted for result for the year/period 12 3.6p (6.3p)The notes on pages 50 to 95 are an integral part of these consolidated financial statements.