introducing the new sfdcp target date funds and sfdcp website

introducing the new sfdcp target date funds and sfdcp website

introducing the new sfdcp target date funds and sfdcp website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

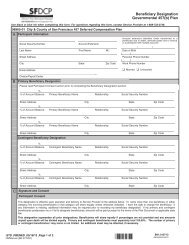

Introducing New TARGET DATE FUNDS to <strong>the</strong>San Francisco 457(b) Deferred Compensation Plan.SNAPSHOT OF THEINVESTMENT CHANGESEffective April 27, 2012, all participant assets invested in<strong>the</strong> SFDCP Long Term, Mid Term, <strong>and</strong> Near Term Portfolioswill transfer to <strong>the</strong> <strong>new</strong> Target Date Funds based upon eachparticipant’s current age <strong>and</strong> projected retirement year(assuming a normal retirement age of 62).These changes will take place automatically after <strong>the</strong> NewYork Stock Exchange closes on April 27, 2012 (generally1:00 p.m. Pacific Time).In order for this change to occur, <strong>the</strong>re will be a ”blackoutperiod” from 1:00 p.m. Pacific Time on Friday, April 27,2012 to approximately 9:00 a.m. on Monday, April30, 2012. During this time, participants may not entertransactions. A blackout period is a st<strong>and</strong>ard practice thatoccurs when a plan adds or eliminates <strong>funds</strong>. Please note:Account balances will remain fully invested while this changeis taking place.SPOTLIGHT ON THE NEWSFDCP TARGET DATE FUNDSEstablishing <strong>the</strong> appropriate allocation of stocks <strong>and</strong> bondsin a retirement account is an important component to helpingparticipants reach <strong>the</strong>ir savings goals. However, monitoring <strong>and</strong>adjusting allocations over time can be challenging. Target DateFunds simplify <strong>the</strong> process <strong>and</strong> leave <strong>the</strong> continuing work ofmonitoring <strong>and</strong> adjusting allocations to investment professionals.PICTURE ONE SIMPLE CHOICEThe <strong>new</strong> Target Date Funds—developed specifically for SFDCPparticipants—offer a simple, diversified investment strategy. Eachfund is a portfolio comprised of underlying stock <strong>and</strong> bond <strong>funds</strong>strategically mixed for participants with approximate retirement<strong>date</strong>s of 2015, 2020, 2025, 2030, 2035, 2040, 2045,2050 or 2055. The mix of stocks <strong>and</strong> bonds in each TargetDate Fund is diversified across asset classes, multiple managers<strong>and</strong> investment styles.Your lens to <strong>the</strong> future 1

MANAGING INVESTMENT RISKRisk management is ano<strong>the</strong>r important factor when saving forretirement. Generally, stocks tend to earn higher returns thanbonds over <strong>the</strong> long term. However, stock values tend to bemore volatile over <strong>the</strong> short term <strong>and</strong>, thus, stocks are riskier.Younger participants can typically assume more risk—becausemarket downturns can potentially be offset with years of futuresavings <strong>and</strong> potential growth. 2But as participants get closer to retirement, <strong>the</strong> more it makessense to focus on preserving savings by shifting out of riskierstocks to less risky investments, such as bonds.The SFDCP Target Date Funds automatically manage this processfor participants. The <strong>funds</strong> gradually reduce stock holdings <strong>and</strong>increase bond holdings over time. When <strong>the</strong> <strong>target</strong> year in <strong>the</strong>fund name arrives, <strong>the</strong> investment mix is fixed at 35% stocks <strong>and</strong>65% bonds.A SNAPSHOT OF HOW IT WORKSHere is an example of how an SFDCPTarget Date Fund will change over time.For a participant who is 32 years old <strong>and</strong> hopes to retire in <strong>the</strong> year 2040at age 62, <strong>the</strong> Target Date Fund closest to that estimated retirement <strong>date</strong> is<strong>the</strong> SFDCP Target Date 2040 Fund.The illustration below shows that early on, <strong>the</strong> fund allocation is moreaggressive <strong>and</strong> intended to grow participant assets. However, as <strong>the</strong>participant gets closer to retirement, <strong>the</strong> 2040 Fund will gradually shift to amore conservative allocation, intended to preserve participant assets. In <strong>the</strong>year 2040 <strong>the</strong> account balance will shift into <strong>the</strong> SFDCP Retirement Fund,which has a 35% stock <strong>and</strong> 65% bond allocation.32 years old AGGRESSIVE TO CONSERVATIVE62 years old10%90%bonds 10%stocks 90%39.5%60.5%bonds 36.5%stocks 63.5%52.5% 47.5%bondsstocks65%bonds 60%stocks 40%SFDCP TARGET35% bonDATE 2040 FUNDbondsstoBONDS stocksSTOCKS30 yearsto retirement15 yearsto retirement10 yearsto retirementYear of retirement <strong>and</strong>ongoing <strong>the</strong>reafterPercentages are subject to change based on <strong>the</strong> determinations of <strong>the</strong> SFDCP´s investment adviser. Great-West Retirement Services ® isnot responsible for <strong>the</strong> composition of <strong>the</strong> SFDCP Target Date Funds.The SFDCP Target Date Funds automatically reallocate <strong>the</strong> investment mix. Still, participants should monitor <strong>the</strong> growth of <strong>the</strong>irretirement savings to make sure <strong>the</strong>y are on track to meeting <strong>the</strong>ir retirement savings goals. Investments are subject to <strong>the</strong> volatility of<strong>the</strong> financial markets, including equity <strong>and</strong> fixed income investments in <strong>the</strong> United States <strong>and</strong> abroad. The principal value of a TargetDate Fund is not guaranteed at any time, including at <strong>the</strong> <strong>target</strong> <strong>date</strong>. Many o<strong>the</strong>r factors, including <strong>the</strong> rate of contributions fromparticipants’ paychecks, can impact successful retirement savings outcomes. It is important to plan wisely.2 Past performance is not a guarantee or prediction of future results.2 Your lens to <strong>the</strong> future

A VIEW OF THE NEWSFDCP TARGET DATE FUNDSWith <strong>the</strong> <strong>new</strong> SFDCP Target Date Funds,participants make one choice: <strong>the</strong> Target DateFund closest to <strong>the</strong>ir projected retirement year.For example, a participant who expects to retire in <strong>the</strong> year 2021would probably choose to invest in <strong>the</strong> Target Date 2020 Fund.SFDCPRETIREMENT FUNDSFDCP TARGETDATE 2015 FUNDbonds 60%stocks 40%35% 38.5%65% 61.5%SFDCP TARGETDATE 2020 FUNDbonds 60%stocks 40%52.5% 47.5%SFDCP TARGETDATE 2025 FUNDbondsstocks39.5%60.5%SFDCP TARGETDATE 2030 FUNDbonds 36.5%stocks 63.5%23%77%bondsstocksbonds 10% bonds 10% bonds 10% bonds 10%10% stocks 10% 90% stocks 10% 90% stocks 10% 90% stocks 10% 90%bonds 1stocks90% 90% 90% 90% 90%SFDCP TARGETDATE 2035 FUNDSFDCP TARGETDATE 2040 FUNDSFDCP TARGETDATE 2045 FUNDSFDCP TARGETDATE 2050 FUNDSFDCP TARGETDATE 2055 FUNDSFDCP TARGET DATE FUNDSBONDSSTOCKSbonds bondsstocks stocksIf a participant’s estimated retirement year falls betweentwo Target Date Funds—e.g., a participant plans to retire in2018—a choice may not be clear. If <strong>the</strong> participant chooses<strong>the</strong> Target Date 2020 Fund, that fund will generally havea more aggressive investment allocation at that time than aTarget Date Fund with an earlier <strong>date</strong>, such as <strong>the</strong> TargetDate 2015 Fund.Target Date Funds are designed for <strong>the</strong> “typical investor” witha moderate risk level who is on track to saving enough to retirewithin a year or two of a specific <strong>target</strong> year. Each participant’sneeds <strong>and</strong> circumstances should be considered before selectingan SFDCP Target Date Fund or any o<strong>the</strong>r investment strategy.Please consider <strong>the</strong> investment objectives, risks, fees <strong>and</strong> expenses carefully before investing. For this <strong>and</strong> o<strong>the</strong>r important information,you may obtain disclosure documents, mutual fund prospectuses for <strong>the</strong> underlying <strong>funds</strong>, <strong>the</strong> annuity contract <strong>and</strong> <strong>the</strong> annuity’s underlying<strong>funds</strong> <strong>and</strong>/or disclosure documents from your registered representative or <strong>the</strong> Plan <strong>website</strong>. For prospectuses related to investments inyour Self-Directed Brokerage (SDB) account, contact TD Ameritrade, Inc. at (866) 766-4015. Read <strong>the</strong>m carefully before investing.www.<strong>sfdcp</strong>.org (888) SFDCP4U (888-733-2748)3

MOVING FROM LIFESTYLE PORTFOLIOSTO SFDCP TARGET DATE FUNDSAfter <strong>the</strong> financial markets close on April 27, 2012, all of <strong>the</strong>participants’ investments in <strong>the</strong> three SFDCP Lifestyle Portfolios willautomatically transfer to an SFDCP Target Date Fund based on eachparticipant’s current age <strong>and</strong> projected retirement year (assumingretirement at age 62).Note: Contributions made on or after April 30, 2012, will also be investedin <strong>the</strong> same Target Date Fund.The chart below details how <strong>the</strong> appropriate Target Date Fund will beselected for participants currently invested in <strong>the</strong> Lifestyle Portfolios.PARTICIPANT ISBORN BETWEEN…PARTICIPANT’SAGE IS BETWEEN…PARTICIPANT’S PROJECTEDRETIREMENT YEAR IS BETWEEN…THE SFDCP TARGET DATE FUND IS…1991 or later 21 or younger 2053 <strong>and</strong> beyond SFDCP 2055 Fund1986 - 1990 22 to 26 2048 - 2052 SFDCP 2050 Fund1981 - 1985 27 to 31 2043 - 2047 SFDCP 2045 Fund1976 - 1980 32 to 36 2038 - 2042 SFDCP 2040 Fund1971 - 1975 37 to 41 2033 - 2037 SFDCP 2035 Fund1966 - 1970 42 to 46 2028 - 2032 SFDCP 2030 Fund1961 - 1965 47 to 51 2023 - 2027 SFDCP 2025 Fund1956 - 1960 52 to 56 2018 - 2022 SFDCP 2020 Fund1951 - 1955 57 to 61 2013 - 2017 SFDCP 2015 Fund1950 or earlier 62 or older 2012 <strong>and</strong> earlier SFDCP Retirement Fund4 Your lens to <strong>the</strong> future

A NEW FOCUS ON INVESTMENT OPTIONSFOR RETIREMENT SAVINGSParticipants may currently be invested in one or more of <strong>the</strong> threeLifestyle Portfolios. As detailed on <strong>the</strong> previous page, any assetsinvested in <strong>the</strong> Lifestyle Portfolios on April 27, 2012 will transferto a Target Date Fund based on <strong>the</strong> participant’s current age <strong>and</strong>projected retirement year (assuming retirement at age 62).If a participant invests in more than one Lifestyle Portfolio, <strong>the</strong>assets in all of his or her Lifestyle Portfolios will be transferred toone Target Date Fund.Along with <strong>the</strong> investments in <strong>the</strong> Lifestyle Portfolios, someparticipants may have allocations to o<strong>the</strong>r Plan investmentoptions. If a participant has an asset allocation that includesboth <strong>the</strong> Lifestyle Portfolios <strong>and</strong> o<strong>the</strong>r Plan investment options,only <strong>the</strong> assets allocated to <strong>the</strong> Lifestyle Portfolios will betransferred to <strong>the</strong> Target Date Funds. Allocations to o<strong>the</strong>r Planinvestment options will not be modified in any way <strong>and</strong> willremain invested in <strong>the</strong> original options.Here are two examples that illustrate how this transfer will work.Example 1: Single Lifestyle Portfolio InvestmentParticipant is 27 years oldExpects to retire in 2047Currently 100% invested in <strong>the</strong> Long Term Portfolio100% of assets will transfer to SFDCP Target Date 2045 Fund100% 100%Example 2: Multiple Fund InvestmentsParticipant is 45 years oldExpects to retire in 2029Currently invested in <strong>the</strong> Lifestyle Mid Term <strong>and</strong> Near TermPortfolios <strong>and</strong> Stable Value PortfolioLifestyle Mid Term <strong>and</strong> Near Term Portfolios will transfer to <strong>the</strong>SFDCP Target Date 2030 FundAll assets in <strong>the</strong> Stable Value Portfolio will remain invested in<strong>the</strong> Stable Value PortfoliobondsbondsstocksstocksLIFESTYLE LONG TERM PORTFOLIOSFDCP TARGET DATE 2045 FUND 70%10% 10%20%90%bs70% LIFESTYLE MID TERM PORTFOLIO20% LIFESTYLE NEAR TERM PORTFOLIO10% STABLE VALUE PORTFOLIO90% SFDCP TARGETDATE 2030 FUND10% STABLE VALUEPORTFOLIOwww.<strong>sfdcp</strong>.org (888) SFDCP4U (888-733-2748)5

FREQUENTLY ASKED QUESTIONSWhat do <strong>the</strong> SFDCP Target Date Funds invest in?The SFDCP Target Date Fund fact sheet includes information about<strong>the</strong> stock <strong>and</strong> bond <strong>funds</strong> held by each Target Date Fund. Visit <strong>the</strong><strong>website</strong> at www.<strong>sfdcp</strong>.org to download a copy of <strong>the</strong> fact sheet.If participants currently invest in <strong>the</strong> SFDCPLifestyle Portfolios, what will happen to <strong>the</strong>irmoney on April 27, 2012?Assets in <strong>the</strong> Lifestyle Portfolios will migrate to <strong>the</strong> SFDCPTarget Date Funds after financial markets close on April 27,2012. If participants are currently invested in one or more of<strong>the</strong> Lifestyle Portfolios, <strong>the</strong>ir investment will be transferred to anage-appropriate Target Date Fund based on <strong>the</strong>ir projectedretirement year at age 62. See page 4 for more information.What if a participant wants to invest in a differentTarget Date Fund?After <strong>the</strong> Target Date Funds are added to <strong>the</strong> SFDCP, participantsmay transfer money from one fund to ano<strong>the</strong>r <strong>and</strong>/or change <strong>the</strong>way future contributions are invested by visiting www.<strong>sfdcp</strong>.orgor by calling KeyTalk ® at (888) SFDCP4U (888-733-2748). 3Can participants transfer money from a LifestylePortfolio to a core fund before April 27, 2012?Yes. Participants may transfer money from one fund toano<strong>the</strong>r <strong>and</strong>/or change <strong>the</strong> way future contributions areinvested by visiting www.<strong>sfdcp</strong>.org or by calling KeyTalk. 3What if a participant’s estimated retirement <strong>date</strong>falls between two Target Date Fund years?If a participant’s estimated retirement <strong>date</strong> falls between twoTarget Date Fund years—for example, 2023—a choice maynot be clear. In general, a Target Date Fund with a later <strong>date</strong> in<strong>the</strong> fund name, such as <strong>the</strong> Target Date 2025 Fund, will havea higher allocation to stocks than a Target Date Fund with anearlier year, such as <strong>the</strong> Target Date 2020 Fund.If participants are currently invested in core <strong>funds</strong>,will <strong>the</strong>ir investments automatically transfer toa Target Date Fund?No, investments will not transfer automatically from core <strong>funds</strong> (i.e.,all fund options o<strong>the</strong>r than Lifestyle Portfolios) to a Target Date Fund.Participants who decide to invest in a Target Date Fund may transfersome or all of <strong>the</strong>ir current balance <strong>and</strong>/or change <strong>the</strong> way futurecontributions are invested by visiting www.<strong>sfdcp</strong>.org or by callingKeyTalk anytime after 9:00 a.m. Pacific Time on April 30, 2012. 33 Access to KeyTalk <strong>and</strong> <strong>the</strong> <strong>website</strong> may be limited or unavailable during periods ofpeak dem<strong>and</strong>, market volatility, systems upgrades/maintenance or o<strong>the</strong>r reasons.Transfer requests made via <strong>the</strong> <strong>website</strong> or KeyTalk received on business daysprior to close of <strong>the</strong> New York Stock Exchange (1:00 p.m. Pacific Time or earlieron some holidays or o<strong>the</strong>r special circumstances) will be initiated at <strong>the</strong> close ofbusiness <strong>the</strong> same day <strong>the</strong> request was received. The actual effective <strong>date</strong> of yourtransaction may vary depending on <strong>the</strong> investment option selected.The Target Date 2035 Fund <strong>and</strong> those with later<strong>target</strong> <strong>date</strong>s all invest 90% in stock <strong>funds</strong> <strong>and</strong> 10%in bond <strong>funds</strong>. What’s <strong>the</strong> difference between <strong>the</strong>m?Although <strong>the</strong>se <strong>funds</strong> all start with <strong>the</strong> same 90% allocationto underlying stock <strong>funds</strong>, <strong>the</strong> <strong>date</strong> at which each fund startsshifting toward a higher allocation to bond <strong>funds</strong> (<strong>the</strong>rebyreducing <strong>the</strong> allocation of stock <strong>funds</strong>) will vary. The TargetDate 2035 Fund will begin increasing <strong>the</strong> allocationof bonds sooner than <strong>the</strong> Target Date 2055 Fund.What happens when a Target Date Fund reachesits <strong>target</strong> retirement year?By <strong>the</strong> end of <strong>the</strong> fund’s <strong>target</strong> retirement year (for example,2020), <strong>the</strong> Target Date Fund will be “retired” <strong>and</strong> participants’assets will be transferred to <strong>the</strong> Retirement Fund. This RetirementFund maintains a 35% investment in stock <strong>funds</strong> to provide anopportunity for continued growth, <strong>and</strong> a 65% allocation to bondsto manage risk <strong>and</strong> provide for interest income. Generally,this approach will better support retirement income needs.What happens if participants keep workingpast <strong>the</strong>ir <strong>target</strong> retirement <strong>date</strong>?When a Target Date Fund reaches its <strong>target</strong> year, <strong>the</strong> assets willtransfer to <strong>the</strong> Retirement Fund even if <strong>the</strong> participant continuesto work beyond that year. Assets will remain in <strong>the</strong> RetirementFund until <strong>the</strong> participant decides to transfer to ano<strong>the</strong>r optionor begins taking money out to meet retirement income needs.Where can participants find information on<strong>the</strong> annual fees for <strong>the</strong> Target Date Funds?Participants can review <strong>the</strong> fees for <strong>the</strong> <strong>funds</strong> on <strong>the</strong>investment overview page <strong>and</strong> in <strong>the</strong> SFDCP Target DateFund Portfolio Summary available at www.<strong>sfdcp</strong>.org.Who administers <strong>the</strong> Target Date Funds?The Target Date Funds are administered by <strong>the</strong> Retirement Board,SFDCP staff <strong>and</strong> its investment consultants. The Retirement Board,SFDCP staff <strong>and</strong> investment consultants designed <strong>the</strong> initialallocations <strong>and</strong> will oversee <strong>the</strong> ongoing allocation of TargetDate Funds as <strong>the</strong> allocations gradually shift to become moreconservative over time. The underlying portfolios are managedby <strong>the</strong> same professionals who manage <strong>the</strong> core <strong>funds</strong>.Why don’t <strong>the</strong> <strong>new</strong> SFDCP Target Date Fundshave a performance track record?The Target Date Funds are <strong>new</strong> investment options built specificallyfor <strong>the</strong> SFDCP. Because <strong>the</strong>y are <strong>new</strong>, <strong>the</strong>y do not have ahistorical performance track record. As <strong>the</strong>y build a performancetrack record, performance will be available for review on <strong>the</strong>investment performance document at www.<strong>sfdcp</strong>.org.6 Your lens to <strong>the</strong> future

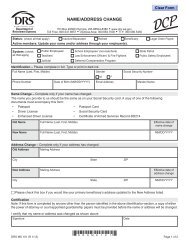

THE NEW SFDCP WEBSITE: WHERE YOUR RETIREMENT PICTURE GOES DIGITALThe <strong>new</strong>ly redesigned SFDCP <strong>website</strong> (www.<strong>sfdcp</strong>.org) includes arange of upgrades <strong>and</strong> enhancements designed to make <strong>the</strong> siteeasier to use. The <strong>new</strong> site makes it:Easier to find information – The site‘s tile-based designstreamlines access to <strong>the</strong> most popular tools <strong>and</strong> information.Easier to learn – The <strong>new</strong> site makes it easier to bean informed investor. It provides a calculator to show howretirement contributions affect a paycheck, as well as quickonline courses on investment fundamentals.Easier to take action – When a participant decides totake action, such as changing an investment mix, <strong>the</strong> <strong>new</strong> sitemakes it easy to turn those decisions into actions.PRE-LOGIN HOME PAGEPOST-LOGIN HOME PAGEBecause each participant’s retirement picture isunique, <strong>the</strong> <strong>new</strong> site provides a personalizedaccount view <strong>and</strong> suggests steps that can betaken to reach retirement income goals.At a Glance – Each time participants log on, <strong>the</strong>yimmediately see <strong>the</strong> current progress toward <strong>the</strong>ir savingsgoal—how much has been saved, <strong>the</strong> rate of return, <strong>and</strong><strong>the</strong> amount of <strong>the</strong> last contribution.Suggested Links – Each visited page featuressuggested links for next steps that <strong>the</strong> participant mightconsider, based on <strong>the</strong> content of <strong>the</strong> page.The <strong>new</strong> <strong>website</strong> debuts on April 27, 2012.www.<strong>sfdcp</strong>.org (888) SFDCP4U (888-733-2748)7

IMPORTANT DATES TO REMEMBERAPRIL 27, 2012 – APRIL 30, 2012Blackout PeriodSFDCP accounts will close at 1:00 p.m. Pacific Time until approximately 9:00 a.m.Pacific Time on April 30, 2012. No transactions will be allowed until <strong>the</strong> end of <strong>the</strong>blackout period.10 <strong>new</strong> Target Date Funds will be added.The <strong>new</strong> <strong>and</strong> improved SFDCP <strong>website</strong> at www.<strong>sfdcp</strong>.org will open.APRIL 27, 2012Fund MappingThrough a process called “mapping,” current balances <strong>and</strong> future contributions in <strong>the</strong>SFDCP Lifestyle Portfolios will be mapped to <strong>the</strong> age-appropriate SFDCP Target Date Fundbased on an estimated retirement age of 62.APRIL 30, 2012All Account Activities Open(After 9:00 a.m. Pacific Time)SFDCP accounts will be available for all account activities. All existing accountbalances will be verified <strong>and</strong> reconciled.The www.<strong>sfdcp</strong>.org <strong>website</strong> <strong>and</strong> KeyTalk, <strong>the</strong> automated voice response system,will be fully operational for all transactions.New SFDCP Target Date Funds will open for investment.JULY 2012First Statement with NewTarget Date FundsIn July 2012, participants will receive <strong>the</strong>ir June 30, 2012 quarterly statements showing<strong>the</strong> <strong>new</strong> Target Date Funds <strong>and</strong> account balance allocation. This statement will include<strong>the</strong> fund transfers to <strong>the</strong> <strong>new</strong> Target Date Funds on April 27, 2012, as well as any o<strong>the</strong>raccount activity that may have been initiated.WHAT ARE THE NEXT STEPS?We encourage participants to stay informed by:Calling <strong>the</strong> SFDCP local San Francisco Regional Office at (415) 671-7800 or toll-free at(877) 457-9321 for answers to specific questions or to schedule an individual meeting.Reviewing <strong>the</strong> additional information available on <strong>the</strong> <strong>website</strong>:Fund fact sheet for <strong>the</strong> SFDCP Target Date Funds.Scheduling or attending a group educational meeting.8 Your lens to <strong>the</strong> future

GROUP MEETINGSLearn more about <strong>the</strong> Target Date Funds <strong>and</strong> <strong>the</strong> <strong>new</strong> <strong>website</strong> by attending any of <strong>the</strong> scheduled meetings listed below.Registration is not required.Meeting times may change, so check <strong>the</strong> <strong>website</strong> at www.<strong>sfdcp</strong>.org or call Great-West Retirement Services ® at(877) 457-9321 for <strong>the</strong> latest schedule.Interested in scheduling a group meeting for your department? Call Great-West at (877) 457-9321.DATE TIME LOCATIONMONDAY, APRIL 2, 2012WEDNESDAY, APRIL 4, 2012THURSDAY, APRIL 5, 2012TUESDAY, APRIL 10, 2012WEDNESDAY, APRIL 11, 2012THURSDAY, APRIL 12, 2012MONDAY, APRIL 16, 2012TUESDAY, APRIL 17, 2012WEDNESDAY, APRIL 18, 2012THURSDAY, APRIL 19, 2012FRIDAY, APRIL 20, 2012TUESDAY, APRIL 24, 2012WEDNESDAY, APRIL 25, 2012THURSDAY, APRIL 26, 2012THURSDAY, APRIL 26, 20129:30 A.M., 11:00 A.M.AND 2:00 P.M.9:30 A.M., 11:00 A.M.AND 2:00 P.M.9:30 A.M., 11:00 A.M.,2:00 P.M. AND 4:00 P.M.9:30 A.M., 11:00 A.M.,5:00 P.M. AND 6:30 P.M.9:00 A.M., 11:00 A.M.AND 2:00 P.M.9:30 A.M., 11:00 A.M.AND 2:00 P.M.10:30 A.M., 1:00 P.M.AND 2:30 P.M.9:00 A.M., 11:00 A.M.AND 2:00 P.M.9:00 A.M., 11:00 A.M.,2:00 P.M. AND 4:00 P.M.2:00 P.M. AND 4:00 P.M.9:30 A.M., 11:00 A.M.AND 2:00 P.M.11:00 A.M., 1:30 P.M.AND 3:30 P.M.9:00 A.M., 11:00 A.M.,2:00 P.M. AND 4:00 P.M.9:00 A.M., 11:00 A.M.,2:00 P.M. AND 4:00 P.M.9:30 A.M., 11:00 A.M.,2:00 P.M. AND 4:00 P.M.HALL OF JUSTICE850 BRYANT, 6TH FLOOR CONFERENCE ROOMMAIN LIBRARY100 LARKIN STREET, KORET AUDITORIUMSAN FRANCISCO EMPLOYEES’ RETIREMENT SYSTEM30 VAN NESS, SUITE 3000, BOARD ROOMMAIN LIBRARY100 LARKIN STREET, KORET AUDITORIUMFIRE COMMISSION ROOM698 2ND STREETHALL OF JUSTICE850 BRYANT, 6TH FLOOR CONFERENCE ROOMMAIN LIBRARY100 LARKIN STREET, KORET AUDITORIUMFIRE COMMISSION ROOM698 2ND STREETPUBLIC HEALTH BUILDING101 GROVE, ROOM 300PUBLIC HEALTH BUILDING101 GROVE, ROOM 300HALL OF JUSTICE850 BRYANT, 6TH FLOOR CONFERENCE ROOMFIRE COMMISSION ROOM698 2ND STREETPUBLIC HEALTH BUILDING101 GROVE, ROOM 300PUBLIC HEALTH BUILDING101 GROVE, ROOM 300SAN FRANCISCO EMPLOYEES’ RETIREMENT SYSTEM30 VAN NESS, SUITE 3000, SFERS PRESENTATION ROOMwww.<strong>sfdcp</strong>.org (888) SFDCP4U (888-733-2748)9

Core securities, when offered, are offered through GWFS Equities, Inc. <strong>and</strong>/or o<strong>the</strong>r broker dealers. GWFS Equities, Inc. is a whollyowned subsidiary of Great-West Life & Annuity Insurance Company.Great-West Retirement Services ® refers to products <strong>and</strong> services provided by Great-West Life & Annuity Insurance Company, FASCore, LLC (FASCore Administrators,LLC in California) <strong>and</strong> <strong>the</strong>ir subsidiaries <strong>and</strong> affiliates. Great-West Retirement Services ® <strong>and</strong> KeyTalk ® are registered trademarks of Great-West Life & Annuity InsuranceCompany. ©2012 Great-West Life & Annuity Insurance Company. All rights reserved. Not intended for Plans whose situs is in New York.Form# CB1108TDF_DM (3/12) PT141441Your lens to <strong>the</strong> future