City of Mesa 457 Deferred Compensation Plan

City of Mesa 457 Deferred Compensation Plan

City of Mesa 457 Deferred Compensation Plan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

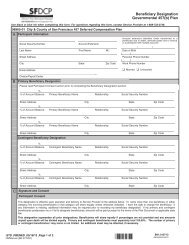

<strong>City</strong> <strong>of</strong> <strong>Mesa</strong> <strong>457</strong> <strong>Deferred</strong><strong>Compensation</strong> <strong>Plan</strong>Winter 2008Questions?Please call the Great-WestRetirement Services ® <strong>Mesa</strong><strong>of</strong>fice at (480) 921-2885or visit the Web site atwww.mesadcp.com. 1Your local representative,Scott Taylor, is also availableto answer your questions.E-mail:scott.taylor@gwrs.comToll free:(800) 933-9808(voice mail only)<strong>Mesa</strong> <strong>457</strong> <strong>Plan</strong> Adds PCRASelf-Directed Brokerage OptionWhat is the PCRA?The Schwab Personal Choice Retirement Account® (PCRA) is an optional, self-directedbrokerage account <strong>of</strong>fered through Charles Schwab & Co., Inc. (Member SIPC)that allows you to select from numerous mutual funds and other securities, such asstocks and bonds, for an additional fee or fees. These securities are not part <strong>of</strong> the coreinvestment options in your <strong>City</strong> <strong>of</strong> <strong>Mesa</strong> <strong>Deferred</strong> <strong>Compensation</strong> <strong>Plan</strong>, and are not<strong>of</strong>fered through GWFS Equities, Inc. 2For whom is this investment option appropriate?The Schwab PCRA is for knowledgeable investors who acknowledge and understandthe risks associated with many <strong>of</strong> the investment choices available through the PCRA.By utilizing the PCRA, you acknowledge that none <strong>of</strong> the available options in thePCRA have been reviewed for suitability by the <strong>City</strong> <strong>of</strong> <strong>Mesa</strong> or Great-West RetirementServices®, your service provider. You are solely responsible for determining suitability <strong>of</strong>the options that are available through the PCRA. You agree to fully indemnify and holdharmless your employer, the <strong>Plan</strong> and Great-West Retirement Services, and any and allservice providers to the <strong>Plan</strong>, against any claims, damages, or other possible causes <strong>of</strong>actions resulting from your use <strong>of</strong> PCRAHow do I get started?This is a Web-based feature only. You can open an account or just find out more aboutthis optional feature by logging on to www.mesadcp.com 1 and clicking on the “ChangeAccount” tab at the top <strong>of</strong> the page. You will then need to select the “Manage Your Self-Directed Brokerage Account” link.2009 Contribution LimitsIn 2009, the maximum amount you may defer from your salary is 100% <strong>of</strong> yourincludible compensation as defined by the Internal Revenue Code or $16,500,whichever is less.The additional age 50+ catch-up contribution has increased to $5,500 in 2009, whichmeans you can contribute a maximum <strong>of</strong> $22,000 to the <strong>Plan</strong> if you are 50 or olderduring the 2009 calendar year.The standard catch-up contribution amount will also increase to $16,500 in 2009,which means you can contribute a maximum <strong>of</strong> $33,000 to the <strong>Plan</strong> if you are withinthree years <strong>of</strong> normal retirement age and under contributed in prior years.Even if you are eligible for both catch-up options, you may not contribute to both in thesame year.1

Get Ready for That Rainy DaySavings you can turn to when unexpected costs ariseWhether you make $30,000 a year or $300,000, you should have an emergency fund—a stash <strong>of</strong> cashearmarked for unexpected expenses, like a new ro<strong>of</strong> or an income shortfall due to illness or job loss.Without this, you could be forced to take extreme financial steps to make ends meet. Fortunately, you canavoid doing so with a little forethought.Do the MathTo be safe, an emergency fund shouldcover three to six months’ worth <strong>of</strong>expenses without income. If you andyour spouse both work and you haveno dependents, aim for three months.Make six months your goal if your familyis dependent on your income alone,you have dependents, and/or you havetuition, mortgage payments or otherlarge fixed monthly costs.HANDS OFF!Borrowing $10,000 from a retirement savings accountwith a $50,000 balance at age 40 could mean you’dhave nearly $86,000 less at age 65 than if you’d left themoney invested, earning an 8% annual return on monthlycontributions <strong>of</strong> $250.$50,000 retirementaccount with no loanAge 40 Age 45 Age 65$50,000 $91,820 $571,134$40,000 retirementCreate a Listaccount, after takingAdd up your monthly expenses. Theout a $10,000 loanobvious ones are food, rent or mortgagepayments, utilities, telephone and carpayments. But don’t forget the not-soobviousones, such as all your credit cardbills, gas for the car, cable TV and othercosts that may not necessarily leap tomind. Multiply that sum by the number <strong>of</strong> months you think you’ll likely go without income.$40,000 $73,456 $485,541FOR ILLUSTRATIVE PURPOSES ONLY. This hypothetical illustration does not representthe performance <strong>of</strong> any investment options. It assumes an 8% annual rate <strong>of</strong> return, monthlycontributions <strong>of</strong> $250, which cease during the loan repayment period, and a five-year loanrepayment <strong>of</strong> $200 per month with 8% interest. The illustration does not reflect any charges,expenses or fees that may be associated with your <strong>Plan</strong>. The tax-deferred accumulations shownabove would be reduced if these fees had been deducted.Make It HappenYour emergency fund should be held in a conservative, fluid investment, such as a savings account at yourlocal bank or a short-term fund. The interest you’ll earn in either account won’t be much, but you’re lookingfor stability and accessibility, not high returns. Keep in mind that a certificate <strong>of</strong> deposit (CD) is not an idealemergency-fund vehicle. Tap it before it matures and you’ll pay a significant penalty. 3To build your emergency fund, make regular payments into the account you choose, just as you do with yourretirement savings plan account. No amount is too small. Be sure that you don’t substitute emergency fundpayments for investments in your <strong>City</strong> <strong>of</strong> <strong>Mesa</strong> <strong>457</strong> <strong>Deferred</strong> <strong>Compensation</strong> account. It would be in your bestinterest to do both.Don’t Touch Your Nest EggIn a pinch, borrowing money from your retirement savings plan may seem logical (it is your money), butdoing so may do more harm than good. For starters, you will lose the benefit <strong>of</strong> compounding, or the ability<strong>of</strong> your principal and interest to grow exponentially. When you pay the loan back, you replace pre-tax moneywith after-tax income. Generally, you have to repay the loan within five years. If you don’t, you may incur a10% early withdrawal penalty.Should the day come when the pipes burst and your basement floods—or you get sick or laid <strong>of</strong>f—anemergency fund could be your saving grace. So plan wisely. In a time <strong>of</strong> need, you’ll be glad you did.2