Distribution/Direct Rollover Request form

Distribution/Direct Rollover Request form

Distribution/Direct Rollover Request form

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

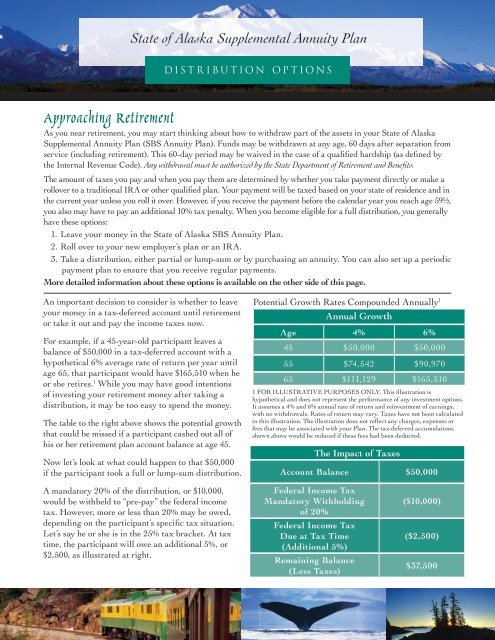

State of Alaska Supplemental Annuity Plan<strong>Distribution</strong> OptionsApproaching RetirementAs you near retirement, you may start thinking about how to withdraw part of the assets in your State of AlaskaSupplemental Annuity Plan (SBS Annuity Plan). Funds may be withdrawn at any age, 60 days after separation fromservice (including retirement). This 60-day period may be waived in the case of a qualified hardship (as defined bythe Internal Revenue Code). Any withdrawal must be authorized by the State Department of Retirement and Benefits.The amount of taxes you pay and when you pay them are determined by whether you take payment directly or make arollover to a traditional IRA or other qualified plan. Your payment will be taxed based on your state of residence and inthe current year unless you roll it over. However, if you receive the payment before the calendar year you reach age 59½,you also may have to pay an additional 10% tax penalty. When you become eligible for a full distribution, you generallyhave these options:1. Leave your money in the State of Alaska SBS Annuity Plan.2. Roll over to your new employer’s plan or an IRA.3. Take a distribution, either partial or lump-sum or by purchasing an annuity. You can also set up a periodicpayment plan to ensure that you receive regular payments.More detailed in<strong>form</strong>ation about these options is available on the other side of this page.An important decision to consider is whether to leaveyour money in a tax-deferred account until retirementor take it out and pay the income taxes now.For example, if a 45-year-old participant leaves abalance of $50,000 in a tax-deferred account with ahypothetical 6% average rate of return per year untilage 65, that participant would have $165,510 when heor she retires. 1 While you may have good intentionsof investing your retirement money after taking adistribution, it may be too easy to spend the money.The table to the right above shows the potential growththat could be missed if a participant cashed out all ofhis or her retirement plan account balance at age 45.Now let’s look at what could happen to that $50,000if the participant took a full or lump-sum distribution.Potential Growth Rates Compounded Annually 1Annual GrowthAge 4% 6%45 $50,000 $50,00055 $74,542 $90,97065 $111,129 $165,5101 FOR ILLUSTRATIVE PURPOSES ONLY. This illustration ishypothetical and does not represent the per<strong>form</strong>ance of any investment options.It assumes a 4% and 6% annual rate of return and reinvestment of earnings,with no withdrawals. Rates of return may vary. Taxes have not been calculatedin this illustration. The illustration does not reflect any charges, expenses orfees that may be associated with your Plan. The tax-deferred accumulationsshown above would be reduced if these fees had been deducted.The Impact of TaxesAccount Balance $50,000A mandatory 20% of the distribution, or $10,000,would be withheld to “pre-pay” the federal incometax. However, more or less than 20% may be owed,depending on the participant’s specific tax situation.Let’s say he or she is in the 25% tax bracket. At taxtime, the participant will owe an additional 5%, or$2,500, as illustrated at right.Federal Income TaxMandatory Withholdingof 20%Federal Income TaxDue at Tax Time(Additional 5%)Remaining Balance(Less Taxes)($10,000)($2,500)$37,500

Understand the Impact of Your DecisionOption Pros ConsLeave your moneyin the State ofAlaska SBSAnnuity Plan.<strong>Direct</strong> rollover toyour new employer’splan or an IRA.• Money is tax-deferred.• You have access to your account at any time aftera distribution event.• Plan offers a diverse selection of investment options.• There are no tax consequences until distribution.• Competitive monthly administrative fee is 0.009% and there’sa $35 fixed annual fee ($25 for non-contributing participants).• You can access the full suite of Reality Investing ®Advisory Services provided by Advised Assets Group,LLC (AAG), a federally registered investment adviser, tohelp with account management.• Money remains tax-deferred.• Your new employer’s plan or IRA may offer a diverseselection of investment options.• In an IRA and most plans, you control access to yoursavings.• Investment options are limitedto those offered by the Plan.• Investment options are limited tothose offered by the IRA provideror new employer.• You may be subject to various additionalfees on your account (recordkeeping,administrative, distribution, etc.).• A 10% early withdrawal federal taxpenalty may apply if rolled into anemployer’s 401(k), 403(b) or 401(a) planor an IRA and a distribution is takenbefore age 59½.Take a distribution.• Money, less tax withholding, will be availableimmediately.• You can still elect to roll over into a new employer’s planor an IRA within 60 days. 2• Savings are no longer tax‐deferred.• A mandatory 20% federal income taxwithholding applies to distributionstaken that are eligible for rollover. 3• <strong>Distribution</strong>s are taxed as ordinaryincome in the year received unless rolledinto a new employer’s plan or an IRAwithin 60 days of the distribution.• A 10% federal tax penalty may apply ifpayment is received before age 59½.There is no guarantee that participation in Reality Investing Advisory Services will result in a profit or that your accountwill outper<strong>form</strong> a self-managed portfolio.Questions? For more in<strong>form</strong>ation, visit the Website at www.akdrb.com orcall KeyTalk ® at 1-800-232-0859 toll free, seven days a week, 24 hours a day(except between 10:00 p.m. Saturday and 10:00 a.m. Sunday, Alaska Time). 42 If you elect to roll over within 60 days, you will be responsible for replacing the 20% withholding.3 Withdrawals are subject to ordinary income tax.4 Access to KeyTalk and/or any Website may be limited or unavailable during periods of peak demand, market volatility, systems upgrades/maintenance or other reasons.Core securities, when offered, are offered through GWFS Equities, Inc. and/or other broker dealers.GWFS Equities, Inc., Member FINRA/SIPC, is a wholly owned subsidiary of Great-West Life & Annuity Insurance Company. Managed Accounts, Guidance andAdvice services are offered by Advised Assets Group, LLC (AAG), a federally registered investment adviser. More in<strong>form</strong>ation can be found at www.adviserinfo.sec.gov. The trademarks, logos, service marks, and design elements used are owned by Great-West Life & Annuity Insurance Company. ©2014 Great-West Life & AnnuityInsurance Company. Form# CB1027DO-SBS (03/2014) PT194059

98214-03Last Name First Name M.I. Social Security Number NumberG Signatures and Consent(After receiving ALL required signatures, continue to the next section.)My ConsentMy withdrawal may be subject to withdrawal fees and/or loss of interest based upon my investment options, my length of time in thePlan and other possible considerations. If I have not been advised of the fees and risks associated with my withdrawal, I may contactService Provider for a withdrawal quote at 1-800-232-0859.In completing this <strong>form</strong>, I acknowledge that a person who knowingly makes a false statement or falsifies, or permits to be falsified, a record ofthe retirement system in an attempt to defraud the system, is guilty of a class A misdemeanor, which, upon conviction, is punishable by a fineof not more than $500.00 or by imprisonment for not more than twelve months or both. AS 39.35.670; AS 11.56.210. I also acknowledge that aperson who obtains funds and/or benefits by deception may be subject to prosecution for other crimes, including theft, which may be charged asmisdemeanors or felonies with potential fines and penalties including imprisonment. I also acknowledge that a person who obtains funds and/orbenefits from the system unlawfully may also be required to make restitution.Any person who presents a false or fraudulent claim is subject to criminal and civil penalties.Before signing this <strong>form</strong>: I must sign this <strong>form</strong> in the presence of a Notary Public or my authorized Plan Administrator if my withdrawalrequest will include a change of address or check delivery to an alternate mailing address. The date that I sign this <strong>form</strong> must matchthe date of the Notary Public or Plan Administrator signature.My SignatureDate (Required)My Change of Address/Alternate Address NotarizationMay also be witnessed by my authorized Plan Administrator in the below section.q Permanent Address Change - I would like the address on my account to be updated with this address. If I am requesting a check, I understandthat it will be mailed to this address.Mailing AddressCity/State/Zip Codeq Alternate Mailing Address - I would like my withdrawal check to be sent to the following alternate mailing address. I understand that thisaddress will be used for this withdrawal only.Alternate Mailing AddressCity/State/Zip CodeIf I live in California and my notary is required to use the state notary <strong>form</strong>, the following items must be completed by the notary on the state notary<strong>form</strong>: the title of the <strong>form</strong> I am completing, the plan name, the plan number, the document date, and the participant’s name. The notary <strong>form</strong>s notcontaining this in<strong>form</strong>ation will be rejected and it will delay this request.The date I sign this <strong>form</strong> must match the date on which my signature in 'My Consent' section was notarized or witnessed.Statement of NotaryState of ))ss.County of )NOTE: Notary seal must be visible.This request was subscribed and sworn (or affirmed) to before meon this day of , year , by(name of participant)proved to me on the basis of satisfactory evidence to be the person whoappeared before me.SEALNotary Public My commission expires / /STD FSPSRV ][10/15/14)( 98214-03 WITHDRAWAL[/GU22)(/][/LDOM)(/][374584607)(Page 5 of 15

98214-03Last Name First Name M.I. Social Security Number NumberG Signatures and Consent(After receiving ALL required signatures, continue to the next section.)My Spouse's ConsentNot Applicable if I am unmarried or my vested account balance is less than $5,000.00If I am legally married, I must obtain my spouse’s consent to request this withdrawal.I (name of spouse), ___________________________________________ , the Participant’s spouse, have read and understand the withdrawalrequest. I understand that I can refuse to consent to the withdrawal request and that my consent cannot be revoked or withdrawn once given. Ifurther understand and voluntarily consent that the withdrawal to be made will reduce any future benefit I may be entitled to. Being fully apprisedof these facts, I hereby voluntarily consent to this withdrawal request.Spouse’s SignatureDate (Required)If I live in California and my notary is required to use the state notary <strong>form</strong>, the following items must be completed by the notary on the state notary<strong>form</strong>: the title of the <strong>form</strong> I am completing, the plan name, the plan number, the document date, the participant’s name and participant spouse’sname. The notary <strong>form</strong>s not containing this in<strong>form</strong>ation will be rejected and it will delay this request.My signature must be notarized by a Notary Public or witnessed by my spouse's authorized Plan Administrator. The date I sign this <strong>form</strong> mustmatch the date on which my signature is notarized or witnessed. My consent must be obtained no more than 180 days prior to the effectivedate of the original request in order to be effective.Statement of NotaryState of ))ss.County of )NOTE: Notary seal must be visible.The consent to this request was subscribed and sworn (or affirmed)to before me on this day of , year , by(name of spouse)proved to me on the basis of satisfactory evidence to be the personwho appeared before me, who affirmed that such consent representshis/her free and voluntary act.SEALNotary Public My commission expires / /My Authorized Plan Administrator SignatureThis request is in compliance with the terms of the Plan and a written explanation of the tax rules and any Internal Revenue Service, Departmentof Labor or other notice requirements applicable to this request have been provided to the participant as required by law. The appropriate consentand waivers have been obtained by the Plan Administrator and Service Provider is authorized to rely on the in<strong>form</strong>ation provided on this request.I approve this withdrawal as it is presented on this <strong>form</strong>.If the participant request includes either a permanent address change or an alternate mailing address and the participant’s signatureis not notarized, I certify that this request was signed by the participant in my presence. The date that I sign this <strong>form</strong> must match thedate the participant has signed.If Spousal Consent notarization is not obtained, I certify that the consent was signed by the spouse of the participant in my presence.The date that I sign this <strong>form</strong> must match the date the participant's spouse has signed.I represent that I am an authorized signer on behalf of the above-named Plan and have an authority to instruct Service Provider to process this <strong>form</strong>.AuthorizedPlan Administrator SignatureH Where should I send this <strong>form</strong>?Date (Required)After all signatures have been obtained, this <strong>form</strong> can be sent byFax to:Great-West Financial ®1-303-801-5800OR Regular Mail to:Great-West Financial ®PO Box 173764Denver, CO 80217-3764ORExpress Mail to:Great-West Financial ®8515 E. Orchard RoadGreenwood Village, CO 80111Great-West Financial ® refers to products and services provided by Great-West Life & Annuity Insurance Company (GWL&A), Corporate Headquarters:Greenwood Village, CO; Great-West Life & Annuity Insurance Company of New York (GWL&A of NY), Home Office: White Plains, NY; and their subsidiariesand affiliates, including Great-West Funds, Inc. and Great-West Trust Company, LLC. All trademarks, logos, service marks, and design elements used areowned by their respective owners and are used by permission.STD FSPSRV ][10/15/14)( 98214-03 WITHDRAWAL[/GU22)(/][/LDOM)(/][374584607)(Page 6 of 15

402(f) NOTICE OF SPECIAL TAX RULES ON DISTRIBUTIONSYOUR ROLLOVER OPTIONSYou are receiving this notice because all or a portion of a payment you arereceiving from the State of Alaska Supplemental Annuity Plan (the “Plan”)is eligible to be rolled over to an IRA or an employer plan. This notice isintended to help you decide whether to do such a rollover.This notice describes the rollover rules that apply to payments from the Planthat are not from a designated Roth account (a type of account with specialtax rules in some employer plans). If you also receive a payment from adesignated Roth account in the Plan, you will be provided a different noticefor that payment, and the Plan administrator or the payor will tell you theamount that is being paid from each account.Rules that apply to most payments from a plan are described in the “GeneralIn<strong>form</strong>ation About <strong>Rollover</strong>s” section. Special rules that only apply in certaincircumstances are described in the “Special Rules and Options” section.GENERAL INFORMATION ABOUT ROLLOVERSHow can a rollover affect my taxes?You will be taxed on a payment from the Plan if you do not roll it over. If youare under age 59½ and do not do a rollover, you will also have to pay a 10%additional income tax on early distributions (unless an exception applies).However, if you do a rollover, you will not have to pay tax until you receivepayments later and the 10% additional income tax will not apply if thosepayments are made after you are age 59½ (or if an exception applies).Where may I roll over the payment?You may roll over the payment to either an IRA (an individual retirementaccount or individual retirement annuity) or an employer plan (a tax-qualifiedplan, section 403(b) plan, or governmental section 457(b) plan) that willaccept the rollover. The rules of the IRA or employer plan that holds therollover will determine your investment options, fees, and rights to paymentfrom the IRA or employer plan (for example, no spousal consent rules applyto IRAs and IRAs may not provide loans). Further, the amount rolled overwill become subject to the tax rules that apply to the IRA or employer plan.How do I do a rollover?There are two ways to do a rollover. You can do either a direct rollover ora 60-day rollover.If you do a direct rollover, the Plan will make the payment directly toyour IRA or an employer plan. You should contact the IRA sponsor or theadministrator of the employer plan for in<strong>form</strong>ation on how to do a directrollover.If you do not do a direct rollover, you may still do a rollover by making adeposit into an IRA or eligible employer plan that will accept it. You will have60 days after you receive the payment to make the deposit. If you do not do adirect rollover, the Plan is required to withhold 20% of the payment for federalincome taxes (up to the amount of cash and property received other thanemployer stock). This means that, in order to roll over the entire payment ina 60-day rollover, you must use other funds to make up for the 20% withheld.If you do not roll over the entire amount of the payment, the portion not rolledover will be taxed and will be subject to the 10% additional income tax onearly distributions if you are under age 59½ (unless an exception applies).How much may I roll over?If you wish to do a rollover, you may roll over all or part of the amount eligiblefor rollover. Any payment from the Plan is eligible for rollover, except:• Certain payments spread over a period of at least 10 years or overyour life or life expectancy (or the lives or joint life expectancy of youand your beneficiary)• Required minimum distributions after age 70½ (or after death)• Hardship distributions• ESOP dividends• Corrective distributions of contributions that exceed tax law limitations• Loans treated as deemed distributions (for example, loans in defaultdue to missed payments before your employment ends)• Cost of life insurance paid by the Plan• Contributions made under special automatic enrollment rules that arewithdrawn pursuant to your request within 90 days of enrollment• Amounts treated as distributed because of a prohibited allocation of Scorporation stock under an ESOP (also, there will generally be adversetax consequences if you roll over a distribution of S corporation stockto an IRA).The Plan administrator or the payor can tell you what portion of a paymentis eligible for rollover.If I don’t do a rollover, will I have to pay the 10% additional income taxon early distributions?If you are under age 59½, you will have to pay the 10% additional incometax on early distributions for any payment from the Plan (including amountswithheld for income tax) that you do not roll over, unless one of theexceptions listed below applies. This tax is in addition to the regular incometax on the payment not rolled over.The 10% additional income tax does not apply to the following paymentsfrom the Plan:• Payments made after you separate from service if you will be at leastage 55 in the year of the separation• Payments that start after you separate from service if paid at leastannually in equal or close to equal amounts over your life or lifeexpectancy (or the lives or joint life expectancy of you and yourbeneficiary)• Payments from a governmental defined benefit pension plan madeafter you separate from service if you are a public safety employeeand you are at least age 50 in the year of the separation• Payments made due to disability• Payments after your death• Payments of ESOP dividends• Corrective distributions of contributions that exceed tax law limitations• Cost of life insurance paid by the Plan• Contributions made under special automatic enrollment rules that arewithdrawn pursuant to your request within 90 days of enrollment• Payments made directly to the government to satisfy a federal tax levy• Payments made under a qualified domestic relations order (QDRO)• Payments up to the amount of your deductible medical expenses• Certain payments made while you are on active duty if you were amember of a reserve component called to duty after September 11,2001 for more than 179 days• Payments of certain automatic enrollment contributions requested tobe withdrawn within 90 days of the first contribution.If I do a rollover to an IRA, will the 10% additional income tax apply toearly distributions from the IRA?If you receive a payment from an IRA when you are under age 59½, youwill have to pay the 10% additional income tax on early distributions fromthe IRA, unless an exception applies. In general, the exceptions to the 10%additional income tax for early distributions from an IRA are the same as theexceptions listed above for early distributions from a plan. However, thereare a few differences for payments from an IRA, including:• There is no exception for payments after separation from service thatare made after age 55.• The exception for qualified domestic relations orders (QDROs) doesnot apply (although a special rule applies under which, as part of adivorce or separation agreement, a tax-free transfer may be madedirectly to an IRA of a spouse or <strong>form</strong>er spouse).• The exception for payments made at least annually in equal or closeto equal amounts over a specified period applies without regard towhether you have had a separation from service.• There are additional exceptions for (1) payments for qualified highereducation expenses, (2) payments up to $10,000 used in a qualifiedfirst-time home purchase, and (3) payments after you have receivedunemployment compensation for 12 consecutive weeks (or wouldhave been eligible to receive unemployment compensation but for selfemployedstatus).Will I owe State income taxes?This notice does not describe any State or local income tax rules (includingwithholding rules).SPECIAL RULES AND OPTIONSIf your payment includes after-tax contributionsAfter-tax contributions included in a payment are not taxed. If a payment isonly part of your benefit, an allocable portion of your after-tax contributionsis generally included in the payment. If you have pre-1987 after-taxcontributions maintained in a separate account, a special rule may apply todetermine whether the after-tax contributions are included in a payment.You may roll over to an IRA a payment that includes after-tax contributionsthrough either a direct rollover or a 60-day rollover. You must keep track ofthe aggregate amount of the after-tax contributions in all of your IRAs (inorder to determine your taxable income for later payments from the IRAs).If you do a direct rollover of only a portion of the amount paid from the Planand a portion is paid to you, each of the payments will include an allocableportion of the after-tax contributions. If you do a 60-day rollover to an IRAof only a portion of the payment made to you, the after-tax contributionsSTD FSPSRV ][10/15/14)( 98214-03 WITHDRAWAL[/GU22)(/][/LDOM)(/][374584607)(Page 13 of 15

are treated as rolled over last. For example, assume you are receiving acomplete distribution of your benefit which totals $12,000, of which $2,000is after-tax contributions. In this case, if you roll over $10,000 to an IRA in a60-day rollover, no amount is taxable because the $2,000 amount not rolledover is treated as being after-tax contributions.You may roll over to an employer plan all of a payment that includes after-taxcontributions, but only through a direct rollover (and only if the receiving planseparately accounts for after-tax contributions and is not a governmentalsection 457(b) plan). You can do a 60-day rollover to an employer plan ofpart of a payment that includes after-tax contributions, but only up to theamount of the payment that would be taxable if not rolled over.If you miss the 60-day rollover deadlineGenerally, the 60-day rollover deadline cannot be extended. However,the IRS has the limited authority to waive the deadline under certainextraordinary circumstances, such as when external events prevented youfrom completing the rollover by the 60-day rollover deadline. To apply for awaiver, you must file a private letter ruling request with the IRS. Private letterruling requests require the payment of a nonrefundable user fee. For morein<strong>form</strong>ation, see IRS Publication 590, Individual Retirement Arrangements(IRAs).If your payment includes employer stock that you do not roll overIf you do not do a rollover, you can apply a special rule to payments ofemployer stock (or other employer securities) that are either attributable toafter-tax contributions or paid in a lump sum after separation from service(or after age 59½, disability, or the participant’s death). Under the specialrule, the net unrealized appreciation on the stock will not be taxed whendistributed from the Plan and will be taxed at capital gain rates when you sellthe stock. Net unrealized appreciation is generally the increase in the valueof employer stock after it was acquired by the Plan. If you do a rollover for apayment that includes employer stock (for example, by selling the stock androlling over the proceeds within 60 days of the payment), the special rulerelating to the distributed employer stock will not apply to any subsequentpayments from the IRA or employer plan. The Plan administrator can tellyou the amount of any net unrealized appreciation.If you have an outstanding loan that is being offsetIf you have an outstanding loan from the Plan, your Plan benefit may beoffset by the amount of the loan, typically when your employment ends.The loan offset amount is treated as a distribution to you at the time of theoffset and will be taxed (including the 10% additional income tax on earlydistributions, unless an exception applies) unless you do a 60-day rolloverin the amount of the loan offset to an IRA or employer plan.If you were born on or before January 1, 1936If you were born on or before January 1, 1936 and receive a lump sumdistribution that you do not roll over, special rules for calculating the amountof the tax on the payment might apply to you. For more in<strong>form</strong>ation, see IRSPublication 575, Pension and Annuity Income.If your payment is from a governmental section 457(b) planIf the Plan is a governmental section 457(b) plan, the same rules describedelsewhere in this notice generally apply, allowing you to roll over thepayment to an IRA or an employer plan that accepts rollovers. Onedifference is that, if you do not do a rollover, you will not have to paythe 10% additional income tax on early distributions from the Plan even ifyou are under age 59½ (unless the payment is from a separate accountholding rollover contributions that were made to the Plan from a tax-qualifiedplan, a section 403(b) plan, or an IRA). However, if you do a rollover toan IRA or to an employer plan that is not a governmental section 457(b)plan, a later distribution made before age 59½ will be subject to the 10%additional income tax on early distributions (unless an exception applies).Other differences are that you cannot do a rollover if the payment is due toan “unforeseeable emergency” and the special rules under “If your paymentincludes employer stock that you do not roll over” and “If you were born onor before January 1, 1936” do not apply.If you are an eligible retired public safety officer and your pensionpayment is used to pay for health coverage or qualified long-term careinsuranceIf the Plan is a governmental plan, you retired as a public safety officer, andyour retirement was by reason of disability or was after normal retirementage, you can exclude from your taxable income plan payments paid directlyas premiums to an accident or health plan (or a qualified long-term careinsurance contract) that your employer maintains for you, your spouse, oryour dependents, up to a maximum of $3,000 annually. For this purpose,a public safety officer is a law enforcement officer, firefighter, chaplain, ormember of a rescue squad or ambulance crew.If you roll over your payment to a Roth IRAYou can roll over a payment from the Plan made before January 1, 2010to a Roth IRA only if your modified adjusted gross income is not more than$100,000 for the year the payment is made to you and, if married, you filea joint return. These limitations do not apply to payments made to you fromthe Plan after 2009. If you wish to roll over the payment to a Roth IRA,but you are not eligible to do a rollover to a Roth IRA until after 2009, youcan do a rollover to a traditional IRA and then, after 2009, elect to convertthe traditional IRA into a Roth IRA. If you roll over the payment to a RothIRA, a special rule applies under which the amount of the payment rolledover (reduced by any after-tax amounts) will be taxed. However, the 10%additional income tax on early distributions will not apply (unless you takethe amount rolled over out of the Roth IRA within 5 years, counting fromJanuary 1 of the year of the rollover). For payments from the Plan during2010 that are rolled over to a Roth IRA, the taxable amount can be spreadover a 2-year period starting in 2011.If you roll over the payment to a Roth IRA, later payments from the RothIRA that are qualified distributions will not be taxed (including earnings afterthe rollover). A qualified distribution from a Roth IRA is a payment madeafter you are age 59½ (or after your death or disability, or as a qualifiedfirst-time homebuyer distribution of up to $10,000) and after you have hada Roth IRA for at least 5 years. In applying this 5-year rule, you count fromJanuary 1 of the year for which your first contribution was made to a RothIRA. Payments from the Roth IRA that are not qualified distributions will betaxed to the extent of earnings after the rollover, including the 10% additionalincome tax on early distributions (unless an exception applies). You donot have to take required minimum distributions from a Roth IRA duringyour lifetime. For more in<strong>form</strong>ation, see IRS Publication 590, IndividualRetirement Arrangements (IRAs). Payments from the Plan cannot be rolledover to a designated Roth account in an employer plan.If you are not a plan participantPayments after death of the participant. If you receive a distribution after theparticipant’s death that you do not roll over, the distribution will generally betaxed in the same manner described elsewhere in this notice. However, the10% additional income tax on early distributions and the special rules forpublic safety officers do not apply, and the special rule described under thesection “If you were born on or before January 1, 1936” applies only if theparticipant was born on or before January 1, 1936.If you are a surviving spouse. If you receive a payment from thePlan as the surviving spouse of a deceased participant, you have thesame rollover options that the participant would have had, as describedelsewhere in this notice. In addition, if you choose to do a rolloverto an IRA, you may treat the IRA as your own or as an inheritedIRA. An IRA you treat as your own is treated like any other IRA ofyours, so that payments made to you before you are age 59½ will besubject to the 10% additional income tax on early distributions (unlessan exception applies) and required minimum distributions from yourIRA do not have to start until after you are age 70½. If you treat theIRA as an inherited IRA, payments from the IRA will not be subject tothe 10% additional income tax on early distributions. However, if theparticipant had started taking required minimum distributions, you willhave to receive required minimum distributions from the inherited IRA.If the participant had not started taking required minimum distributionsfrom the Plan, you will not have to start receiving required minimumdistributions from the inherited IRA until the year the participant wouldhave been age 70½.If you are a surviving beneficiary other than a spouse. If youreceive a payment from the Plan because of the participant’s deathand you are a designated beneficiary other than a surviving spouse,the only rollover option you have is to do a direct rollover to an inheritedIRA. Payments from the inherited IRA will not be subject to the 10%additional income tax on early distributions. You will have to receiverequired minimum distributions from the inherited IRA.Payments under a qualified domestic relations order. If you are the spouseor <strong>form</strong>er spouse of the participant who receives a payment from the Planunder a qualified domestic relations order (QDRO), you generally have thesame options the participant would have (for example, you may roll over thepayment to your own IRA or an eligible employer plan that will accept it).Payments under the QDRO will not be subject to the 10% additional incometax on early distributions.If you are a nonresident alienIf you are a nonresident alien and you do not do a direct rollover to a U.S.IRA or U.S. employer plan, instead of withholding 20%, the Plan is generallyrequired to withhold 30% of the payment for federal income taxes. If theSTD FSPSRV ][10/15/14)( 98214-03 WITHDRAWAL[/GU22)(/][/LDOM)(/][374584607)(Page 14 of 15

amount withheld exceeds the amount of tax you owe (as may happen if youdo a 60-day rollover), you may request an income tax refund by filing Form1040NR and attaching your Form 1042-S. See Form W-8BEN for claimingthat you are entitled to a reduced rate of withholding under an income taxtreaty. For more in<strong>form</strong>ation, see also IRS Publication 519, U.S. Tax Guidefor Aliens, and IRS Publication 515, Withholding of Tax on NonresidentAliens and Foreign Entities.Other special rulesIf a payment is one in a series of payments for less than 10 years, yourchoice whether to make a direct rollover will apply to all later payments inthe series (unless you make a different choice for later payments). If yourpayments for the year are less than $200 (not including payments from adesignated Roth account in the Plan), the Plan is not required to allow youto do a direct rollover and is not required to withhold for federal incometaxes. However, you may do a 60-day rollover. Unless you elect otherwise,a mandatory cash-out of more than $1,000 (not including payments froma designated Roth account in the Plan) will be directly rolled over to anIRA chosen by the Plan administrator or the payor. A mandatory cash-outis a payment from a plan to a participant made before age 62 (or normalretirement age, if later) and without consent, where the participant’s benefitdoes not exceed $5,000 (not including any amounts held under the plan asa result of a prior rollover made to the plan).You may have special rollover rights if you recently served in the U.S. ArmedForces. For more in<strong>form</strong>ation, see IRS Publication 3, Armed Forces’ TaxGuide.Postponement of <strong>Distribution</strong> NoticeIf you elect to defer your distribution, the Plan will not make a distributionto you without your consent until required by the terms of the Plan or bylaw. If you elect to defer your distribution, your vested account balance willcontinue to experience investment gains, losses and Plan expenses. As aresult, the value of your vested account balance ultimately distributed toyou could be more or less than the value of your current vested accountbalance. In determining the economic consequences of postponing yourdistribution, you should compare the administration cost and investmentoptions (including fees) applicable to your vested account balance in thePlan if you postpone your distribution to the costs and options you mayobtain with investment options outside the plan.Upon distribution of your vested account balance from the Plan, you will betaxed (except to the extent your vested account balance consists of after-taxcontributions or qualified amounts held in a ROTH money source) on yourvested account balance at the time of the distribution if you do not rolloveryour balance. As explained in greater detail in the 402(f) Notice of SpecialTax Rules on <strong>Distribution</strong>s, you can roll over your distribution directly or youmay receive your distribution and roll it over within 60 days to avoid currenttaxation and to continue to have the opportunity to accumulate tax-deferredearnings. There are many complex rules relating to rollovers, and youshould read the 402(f) Notice of Special Tax Rules on <strong>Distribution</strong>s carefullybefore deciding whether a rollover is desirable in your circumstances. Youshould also note that a 10% penalty tax may apply to distributions madebefore you reach age 59½.If you defer your distribution of your vested account balance, you mayinvest in the investment options available to active employees. If you donot defer distribution of your vested account balance, the currently availableinvestment options in the Plan may not be generally available on similarterms outside the Plan. Fees and expenses (including administrative orinvestment related fees) outside the Plan may be different from fees andexpenses that apply to your vested account balance in the Plan. For morein<strong>form</strong>ation about fees, expenses, and currently available Plan investmentoptions, including investment related fees, refer to the Summary PlanDescription available from your Plan Administrator and prospectuses and/ordisclosure documents regarding Plan investments available from your Planrepresentative.When considering whether to defer your distribution, carefully review thePlan’s Summary Plan Description, including the sections on timing ofdistributions and available distributions.FOR MORE INFORMATIONYou may wish to consult with the Plan administrator or payor, or aprofessional tax advisor, before taking a payment from the Plan. Also,you can find more detailed in<strong>form</strong>ation on the federal tax treatment ofpayments from employer plans in: IRS Publication 575, Pension and AnnuityIncome; IRS Publication 590, Individual Retirement Arrangements (IRAs);and IRS Publication 571, Tax-Sheltered Annuity Plans (403(b) Plans).These publications are available from a local IRS office, on the web atwww.irs.gov, or by calling 1-800-TAX-FORM.STD FSPSRV ][10/15/14)( 98214-03 WITHDRAWAL[/GU22)(/][/LDOM)(/][374584607)(Page 15 of 15