Women at the Helm - Planters Development Bank

Women at the Helm - Planters Development Bank

Women at the Helm - Planters Development Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

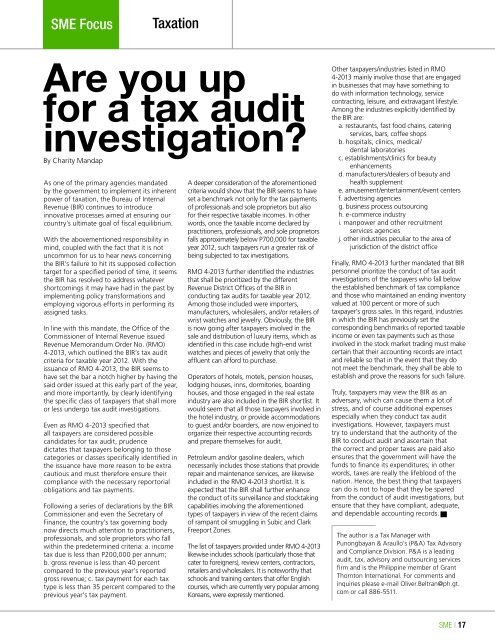

SME FocusTax<strong>at</strong>ionAre you upfor a tax auditinvestig<strong>at</strong>ion?By Charity MandapAs one of <strong>the</strong> primary agencies mand<strong>at</strong>edby <strong>the</strong> government to implement its inherentpower of tax<strong>at</strong>ion, <strong>the</strong> Bureau of InternalRevenue (BIR) continues to introduceinnov<strong>at</strong>ive processes aimed <strong>at</strong> ensuring ourcountry’s ultim<strong>at</strong>e goal of fiscal equilibrium.With <strong>the</strong> abovementioned responsibility inmind, coupled with <strong>the</strong> fact th<strong>at</strong> it is notuncommon for us to hear news concerning<strong>the</strong> BIR’s failure to hit its supposed collectiontarget for a specified period of time, it seems<strong>the</strong> BIR has resolved to address wh<strong>at</strong>evershortcomings it may have had in <strong>the</strong> past byimplementing policy transform<strong>at</strong>ions andemploying vigorous efforts in performing itsassigned tasks.In line with this mand<strong>at</strong>e, <strong>the</strong> Office of <strong>the</strong>Commissioner of Internal Revenue issuedRevenue Memorandum Order No. (RMO)4-2013, which outlined <strong>the</strong> BIR’s tax auditcriteria for taxable year 2012. With <strong>the</strong>issuance of RMO 4-2013, <strong>the</strong> BIR seems tohave set <strong>the</strong> bar a notch higher by having <strong>the</strong>said order issued <strong>at</strong> this early part of <strong>the</strong> year,and more importantly, by clearly identifying<strong>the</strong> specific class of taxpayers th<strong>at</strong> shall moreor less undergo tax audit investig<strong>at</strong>ions.Even as RMO 4-2013 specified th<strong>at</strong>all taxpayers are considered possiblecandid<strong>at</strong>es for tax audit, prudencedict<strong>at</strong>es th<strong>at</strong> taxpayers belonging to thosec<strong>at</strong>egories or classes specifically identified in<strong>the</strong> issuance have more reason to be extracautious and must <strong>the</strong>refore ensure <strong>the</strong>ircompliance with <strong>the</strong> necessary reportorialoblig<strong>at</strong>ions and tax payments.Following a series of declar<strong>at</strong>ions by <strong>the</strong> BIRCommissioner and even <strong>the</strong> Secretary ofFinance, <strong>the</strong> country’s tax governing bodynow directs much <strong>at</strong>tention to practitioners,professionals, and sole proprietors who fallwithin <strong>the</strong> predetermined criteria: a. incometax due is less than P200,000 per annum;b. gross revenue is less than 40 percentcompared to <strong>the</strong> previous year’s reportedgross revenue; c. tax payment for each taxtype is less than 35 percent compared to <strong>the</strong>previous year’s tax payment.A deeper consider<strong>at</strong>ion of <strong>the</strong> aforementionedcriteria would show th<strong>at</strong> <strong>the</strong> BIR seems to haveset a benchmark not only for <strong>the</strong> tax paymentsof professionals and sole proprietors but alsofor <strong>the</strong>ir respective taxable incomes. In o<strong>the</strong>rwords, once <strong>the</strong> taxable income declared bypractitioners, professionals, and sole proprietorsfalls approxim<strong>at</strong>ely below P700,000 for taxableyear 2012, such taxpayers run a gre<strong>at</strong>er risk ofbeing subjected to tax investig<strong>at</strong>ions.RMO 4-2013 fur<strong>the</strong>r identified <strong>the</strong> industriesth<strong>at</strong> shall be prioritized by <strong>the</strong> differentRevenue District Offices of <strong>the</strong> BIR inconducting tax audits for taxable year 2012.Among those included were importers,manufacturers, wholesalers, and/or retailers ofwrist w<strong>at</strong>ches and jewelry. Obviously, <strong>the</strong> BIRis now going after taxpayers involved in <strong>the</strong>sale and distribution of luxury items, which asidentified in this case include high-end wristw<strong>at</strong>ches and pieces of jewelry th<strong>at</strong> only <strong>the</strong>affluent can afford to purchase.Oper<strong>at</strong>ors of hotels, motels, pension houses,lodging houses, inns, dormitories, boardinghouses, and those engaged in <strong>the</strong> real est<strong>at</strong>eindustry are also included in <strong>the</strong> BIR shortlist. Itwould seem th<strong>at</strong> all those taxpayers involved in<strong>the</strong> hotel industry, or provide accommod<strong>at</strong>ionsto guest and/or boarders, are now enjoined toorganize <strong>the</strong>ir respective accounting recordsand prepare <strong>the</strong>mselves for audit.Petroleum and/or gasoline dealers, whichnecessarily includes those st<strong>at</strong>ions th<strong>at</strong> providerepair and maintenance services, are likewiseincluded in <strong>the</strong> RMO 4-2013 shortlist. It isexpected th<strong>at</strong> <strong>the</strong> BIR shall fur<strong>the</strong>r enhance<strong>the</strong> conduct of its surveillance and stocktakingcapabilities involving <strong>the</strong> aforementionedtypes of taxpayers in view of <strong>the</strong> recent claimsof rampant oil smuggling in Subic and ClarkFreeport Zones.The list of taxpayers provided under RMO 4-2013likewise includes schools (particularly those th<strong>at</strong>c<strong>at</strong>er to foreigners), review centers, contractors,retailers and wholesalers. It is noteworthy th<strong>at</strong>schools and training centers th<strong>at</strong> offer Englishcourses, which are currently very popular amongKoreans, were expressly mentioned.O<strong>the</strong>r taxpayers/industries listed in RMO4-2013 mainly involve those th<strong>at</strong> are engagedin businesses th<strong>at</strong> may have something todo with inform<strong>at</strong>ion technology, servicecontracting, leisure, and extravagant lifestyle.Among <strong>the</strong> industries explicitly identified by<strong>the</strong> BIR are:a. restaurants, fast food chains, c<strong>at</strong>eringservices, bars, coffee shopsb. hospitals, clinics, medical/dental labor<strong>at</strong>oriesc. establishments/clinics for beautyenhancementsd. manufacturers/dealers of beauty andhealth supplemente. amusement/entertainment/event centersf. advertising agenciesg. business process outsourcingh. e-commerce industryi. manpower and o<strong>the</strong>r recruitmentservices agenciesj. o<strong>the</strong>r industries peculiar to <strong>the</strong> area ofjurisdiction of <strong>the</strong> district officeFinally, RMO 4-2013 fur<strong>the</strong>r mand<strong>at</strong>ed th<strong>at</strong> BIRpersonnel prioritize <strong>the</strong> conduct of tax auditinvestig<strong>at</strong>ions of <strong>the</strong> taxpayers who fall below<strong>the</strong> established benchmark of tax complianceand those who maintained an ending inventoryvalued <strong>at</strong> 100 percent or more of suchtaxpayer’s gross sales. In this regard, industriesin which <strong>the</strong> BIR has previously set <strong>the</strong>corresponding benchmarks of reported taxableincome or even tax payments such as thoseinvolved in <strong>the</strong> stock market trading must makecertain th<strong>at</strong> <strong>the</strong>ir accounting records are intactand reliable so th<strong>at</strong> in <strong>the</strong> event th<strong>at</strong> <strong>the</strong>y donot meet <strong>the</strong> benchmark, <strong>the</strong>y shall be able toestablish and prove <strong>the</strong> reasons for such failure.Truly, taxpayers may view <strong>the</strong> BIR as anadversary, which can cause <strong>the</strong>m a lot ofstress, and of course additional expensesespecially when <strong>the</strong>y conduct tax auditinvestig<strong>at</strong>ions. However, taxpayers musttry to understand th<strong>at</strong> <strong>the</strong> authority of <strong>the</strong>BIR to conduct audit and ascertain th<strong>at</strong><strong>the</strong> correct and proper taxes are paid alsoensures th<strong>at</strong> <strong>the</strong> government will have <strong>the</strong>funds to finance its expenditures; in o<strong>the</strong>rwords, taxes are really <strong>the</strong> lifeblood of <strong>the</strong>n<strong>at</strong>ion. Hence, <strong>the</strong> best thing th<strong>at</strong> taxpayerscan do is not to hope th<strong>at</strong> <strong>the</strong>y be sparedfrom <strong>the</strong> conduct of audit investig<strong>at</strong>ions, butensure th<strong>at</strong> <strong>the</strong>y have compliant, adequ<strong>at</strong>e,and dependable accounting records.The author is a Tax Manager withPunongbayan & Araullo’s (P&A) Tax Advisoryand Compliance Division. P&A is a leadingaudit, tax, advisory and outsourcing servicesfirm and is <strong>the</strong> Philippine member of GrantThornton Intern<strong>at</strong>ional. For comments andinquiries please e-mail Oliver.Beltran@ph.gt.com or call 886-5511.SME | 17