You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

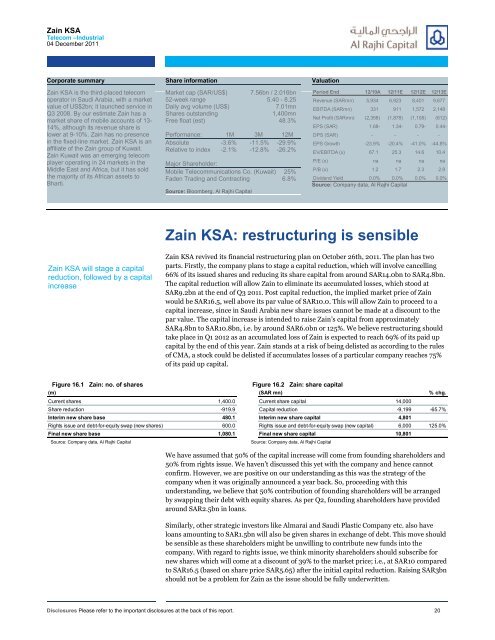

Zain KSATelecom –Industrial04 December 2011Corporate summary Share information ValuationZain KSA is the third-placed telecomoperator in <strong>Saudi</strong> Arabia, with a marketvalue of US$2bn; it launched service inQ3 2008. By our estimate Zain has amarket share of mobile accounts of 13-14%, although its revenue share islower at 9-10%. Zain has no presencein the fixed-line market. Zain KSA is anaffiliate of the Zain group of Kuwait.Zain Kuwait was an emerging telecomplayer operating in 24 markets in theMiddle East and Africa, but it has soldthe majority of its African assets toBharti.Market cap (SAR/US$) 7.56bn / 2.016bn52-week range 5.40 - 8.25Daily avg volume (US$)7.01mnShares outstanding1,400mnFree float (est) 48.3%Performance: 1M 3M 12MAbsolute -3.6% -11.5% -29.9%Relative to index -2.1% -12.8% -26.2%Major Shareholder:Mobile Telecommunications Co. (Kuwait) 25%Faden Trading and Contracting 6.8%Source: Bloomberg, Al Rajhi CapitalPeriod End 12/10A 12/11E 12/12E 12/13ERevenue (SARmn) 5,934 6,923 8,401 9,677EBITDA (SARmn) 331 911 1,572 2,148Net Profit (SARmn) (2,358) (1,878) (1,108) (612)EPS (SAR) 1.68- 1.34- 0.79- 0.44-DPS (SAR) - - - -EPS Growth -23.9% -20.4% -41.0% -44.8%EV/EBITDA (x) 67.1 25.3 14.6 10.4P/E (x) na na na naP/B (x) 1.2 1.7 2.3 2.9Dividend Yield 0.0% 0.0% 0.0% 0.0%Source: Company data, Al Rajhi CapitalZain KSA: restructuring is sensibleZain KSA will stage a capitalreduction, followed by a capitalincreaseZain KSA revived its financial restructuring plan on October 26th, 2011. The plan has twoparts. Firstly, the company plans to stage a capital reduction, which will involve cancelling66% of its issued shares and reducing its share capital from around SAR14.0bn to SAR4.8bn.The capital reduction will allow Zain to eliminate its accumulated losses, which stood atSAR9.2bn at the end of Q3 2011. Post capital reduction, the implied market price of Zainwould be SAR16.5, well above its par value of SAR10.0. This will allow Zain to proceed to acapital increase, since in <strong>Saudi</strong> Arabia new share issues cannot be made at a discount to thepar value. The capital increase is intended to raise Zain’s capital from approximatelySAR4.8bn to SAR10.8bn, i.e. by around SAR6.0bn or 125%. We believe restructuring shouldtake place in Q1 2012 as an accumulated loss of Zain is expected to reach 69% of its paid upcapital by the end of this year. Zain stands at a risk of being delisted as according to the rulesof CMA, a stock could be delisted if accumulates losses of a particular company reaches 75%of its paid up capital.Figure 16.1 Zain: no. of shares(m)Current shares 1,400.0Share reduction -919.9Interim new share base 480.1Rights issue and debt-for-equity swap (new shares) 600.0Final new share base 1,080.1Source: Company data, Al Rajhi CapitalFigure 16.2 Zain: share capital(SAR mn)% chg.Current share capital 14,000Capital reduction -9,199 -65.7%Interim new share capital 4,801Rights issue and debt-for-equity swap (new capital) 6,000 125.0%Final new share capital 10,801Source: Company data, Al Rajhi CapitalWe have assumed that 50% of the capital increase will come from founding shareholders and50% from rights issue. We haven’t discussed this yet with the company and hence cannotconfirm. However, we are positive on our understanding as this was the strategy of thecompany when it was originally announced a year back. So, proceeding with thisunderstanding, we believe that 50% contribution of founding shareholders will be arrangedby swapping their debt with equity shares. As per Q2, founding shareholders have providedaround SAR2.5bn in loans.Similarly, other strategic investors like Almarai and <strong>Saudi</strong> Plastic Company etc. also haveloans amounting to SAR1.5bn will also be given shares in exchange of debt. This move shouldbe sensible as these shareholders might be unwilling to contribute new funds into thecompany. With regard to rights issue, we think minority shareholders should subscribe fornew shares which will come at a discount of 39% to the market price; i.e., at SAR10 comparedto SAR16.5 (based on share price SAR5.65) after the initial capital reduction. Raising SAR3bnshould not be a problem for Zain as the issue should be fully underwritten.Disclosures Please refer to the important disclosures at the back of this report. 20