2009 Annual report - Nedbank Group Limited

2009 Annual report - Nedbank Group Limited

2009 Annual report - Nedbank Group Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

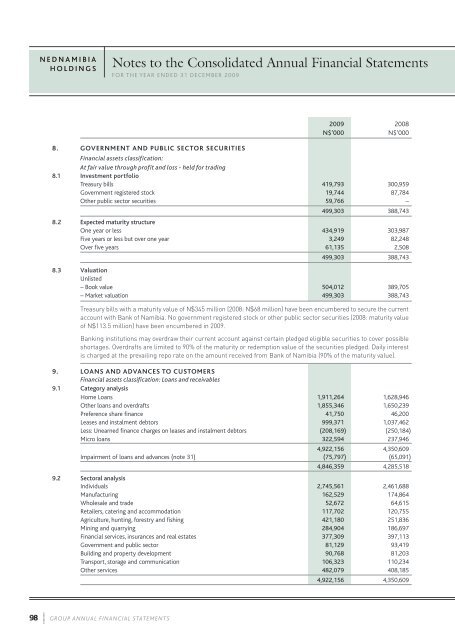

N E D N A M I B I AH O L D I N G SNotes to the Consolidated <strong>Annual</strong> Financial StatementsFOR THE YEAR ENDED 31 DECEMBER <strong>2009</strong>8. government and public sector securities<strong>2009</strong> 2008N$’000N$’000Financial assets classification:At fair value through profit and loss - held for trading8.1 Investment portfolioTreasury bills 419,793 300,959Government registered stock 19,744 87,784Other public sector securities 59,766 –499,303 388,7438.2 Expected maturity structureOne year or less 434,919 303,987Five years or less but over one year 3,249 82,248Over five years 61,135 2,508499,303 388,7438.3 ValuationUnlisted– Book value 504,012 389,705– Market valuation 499,303 388,743Treasury bills with a maturity value of N$345 million (2008: N$68 million) have been encumbered to secure the currentaccount with Bank of Namibia. No government registered stock or other public sector securities (2008: maturity valueof N$113.5 million) have been encumbered in <strong>2009</strong>.Banking institutions may overdraw their current account against certain pledged eligible securities to cover possibleshortages. Overdrafts are limited to 90% of the maturity or redemption value of the securities pledged. Daily interestis charged at the prevailing repo rate on the amount received from Bank of Namibia (90% of the maturity value).9. loans and advances to customersFinancial assets classification: Loans and receivables9.1 Category analysisHome Loans 1,911,264 1,628,946Other loans and overdrafts 1,855,346 1,650,239Preference share finance 41,750 46,200Leases and instalment debtors 999,371 1,037,462Less: Unearned finance charges on leases and instalment debtors (208,169) (250,184)Micro loans 322,594 237,9464,922,156 4,350,609Impairment of loans and advances (note 31) (75,797) (65,091)4,846,359 4,285,5189.2 Sectoral analysisIndividuals 2,745,561 2,461,688Manufacturing 162,529 174,864Wholesale and trade 52,672 64,615Retailers, catering and accommodation 117,702 120,755Agriculture, hunting, forestry and fishing 421,180 251,836Mining and quarrying 284,904 186,697Financial services, insurances and real estates 377,309 397,113Government and public sector 81,129 93,419Building and property development 90,768 81,203Transport, storage and communication 106,323 110,234Other services 482,079 408,1854,922,156 4,350,60998 G RO U P A N N U A L F I N A N C I A L STAT E M E N T S