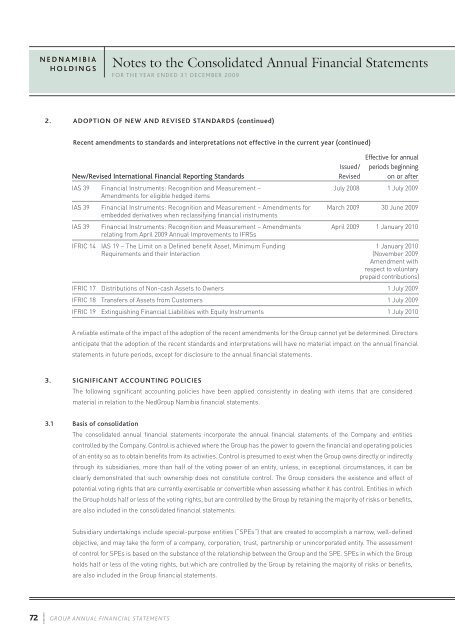

N E D N A M I B I AH O L D I N G SNotes to the Consolidated <strong>Annual</strong> Financial StatementsFOR THE YEAR ENDED 31 DECEMBER <strong>2009</strong>2. aDOPTION OF NEW AND REVISED STANDARDS (continued)Recent amendments to standards and interpretations not effective in the current year (continued)Effective for annualIssued/ periods beginningNew/Revised International Financial Reporting Standards Revised on or afterIAS 39 Financial Instruments: Recognition and Measurement – July 2008 1 July <strong>2009</strong>Amendments for eligible hedged itemsIAS 39 Financial Instruments: Recognition and Measurement – Amendments for March <strong>2009</strong> 30 June <strong>2009</strong>embedded derivatives when reclassifying financial instrumentsIAS 39 Financial Instruments: Recognition and Measurement – Amendments April <strong>2009</strong> 1 January 2010relating from April <strong>2009</strong> <strong>Annual</strong> Improvements to IFRSsIFRIC 14 IAS 19 – The Limit on a Defined benefit Asset, Minimum Funding 1 January 2010Requirements and their Interaction (November <strong>2009</strong>Amendment withrespect to voluntaryprepaid contributions)IFRIC 17 Distributions of Non-cash Assets to Owners 1 July <strong>2009</strong>IFRIC 18 Transfers of Assets from Customers 1 July <strong>2009</strong>IFRIC 19 Extinguishing Financial Liabilities with Equity Instruments 1 July 2010A reliable estimate of the impact of the adoption of the recent amendments for the <strong>Group</strong> cannot yet be determined. Directorsanticipate that the adoption of the recent standards and interpretations will have no material impact on the annual financialstatements in future periods, except for disclosure to the annual financial statements.3. significant ACCOUNTING POLICIESThe following significant accounting policies have been applied consistently in dealing with items that are consideredmaterial in relation to the Ned<strong>Group</strong> Namibia financial statements.3.1 Basis of consolidationThe consolidated annual financial statements incorporate the annual financial statements of the Company and entitiescontrolled by the Company. Control is achieved where the <strong>Group</strong> has the power to govern the financial and operating policiesof an entity so as to obtain benefits from its activities. Control is presumed to exist when the <strong>Group</strong> owns directly or indirectlythrough its subsidiaries, more than half of the voting power of an entity, unless, in exceptional circumstances, it can beclearly demonstrated that such ownership does not constitute control. The <strong>Group</strong> considers the existence and effect ofpotential voting rights that are currently exercisable or convertible when assessing whether it has control. Entities in whichthe <strong>Group</strong> holds half or less of the voting rights, but are controlled by the <strong>Group</strong> by retaining the majority of risks or benefits,are also included in the consolidated financial statements.Subsidiary undertakings include special-purpose entities (“SPEs”) that are created to accomplish a narrow, well-definedobjective, and may take the form of a company, corporation, trust, partnership or unincorporated entity. The assessmentof control for SPEs is based on the substance of the relationship between the <strong>Group</strong> and the SPE. SPEs in which the <strong>Group</strong>holds half or less of the voting rights, but which are controlled by the <strong>Group</strong> by retaining the majority of risks or benefits,are also included in the <strong>Group</strong> financial statements.72 G RO U P A N N U A L F I N A N C I A L STAT E M E N T S

Acquisitions of subsidiaries and businesses are accounted for using the purchase method. The cost of the businesscombination is measured as the aggregate of the fair values (at the date of exchange) of assets given, liabilities incurredor assumed, and equity instruments issued by the <strong>Group</strong> in exchange for control of the acquiree, plus any costs directlyattributable to the business combination. The acquiree’s identifiable assets, liabilities and contingent liabilities that meetthe conditions for recognition under IFRS 3: Business Combinations are recognised at their fair values at the acquisitiondate, except for non-current assets (or disposal groups) that are classified as held for sale in accordance with IFRS 5: NoncurrentAssets Held for Sale and Discontinued Operations, which are measured at fair value less cost to sell.Goodwill arising on acquisition is recognised as an asset and initially measured at cost, being the excess of the cost ofthe business combination over the <strong>Group</strong>’s interest in the fair value of the acquiree’s identifiable assets, liabilities andcontingent liabilities recognised. If, after reassessment, the <strong>Group</strong>’s interest in the fair value of the acquiree’s identifiableassets, liabilities and contingent liabilities exceeds the costs of the business combination, the excess is immediatelyrecognised in profit or loss. The interest of minority shareholders in the acquiree is initially measured at the minority’sproportion of the net fair value of the assets, liabilities and contingent liabilities recognised.The <strong>Group</strong> consolidated financial statements include the assets, liabilities and results of NedNamibia Holdings <strong>Limited</strong>and its subsidiaries (including SPEs) controlled by the <strong>Group</strong>. The results of subsidiaries acquired or disposed of during theyear are included in the consolidated statement of comprehensive income from the effective date of acquisition or up to theeffective date of disposal, as appropriate.Where necessary, adjustments are made to the annual financial statements of subsidiaries to bring their accountingpolicies into line with those of the <strong>Group</strong>. All intra-group transactions, balances, and profits and losses arising from intragrouptransactions, are eliminated in the preparation of the <strong>Group</strong> consolidated annual financial statements. Unrealisedlosses are not eliminated to the extent that they provide evidence of impairment.The difference between the proceeds from the disposal of a subsidiary and its carrying amount as of the date of disposal,including the cumulative amount of any exchange differences that relate to the subsidiary in equity, is recognised in the<strong>Group</strong> statement of comprehensive income as the gain or loss on the disposal of the subsidiary.Non-controlling interest in the net assets of consolidated subsidiaries are identified separately from the <strong>Group</strong>’s equitytherein. Non-controlling interest consist of the amount of those interests at the date of the original business combination andthe minority’s share of changes in the equity since the date of the combination. Losses applicable to the minority in excess ofthe minority’s interest in the subsidiary’s equity are allocated against the interest of the <strong>Group</strong> except to the extent that theminority has a binding obligation and is able to make an additional investment to cover the losses.3.1.1 Investment in associateAn associate is an entity, including an unincorporated entity such as a partnership, over which the <strong>Group</strong> has significantinfluence and that is neither a subsidiary nor an interest in a joint venture. Significant influence is the power to participate inthe financial and operating policy decisions of the investee, but is not control or joint control over those policies.The results and assets and liabilities of associates are incorporated in the <strong>Group</strong> financial statements using the equitymethod of accounting, from the date significant influence commences until the date significant influence ceases. Under theequity method, investments in associates are carried in the consolidated statement of financial position at the cost asGROUP ANNUAL FINANCIAL STATEMENT S 73