2009 Annual report - Nedbank Group Limited

2009 Annual report - Nedbank Group Limited

2009 Annual report - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

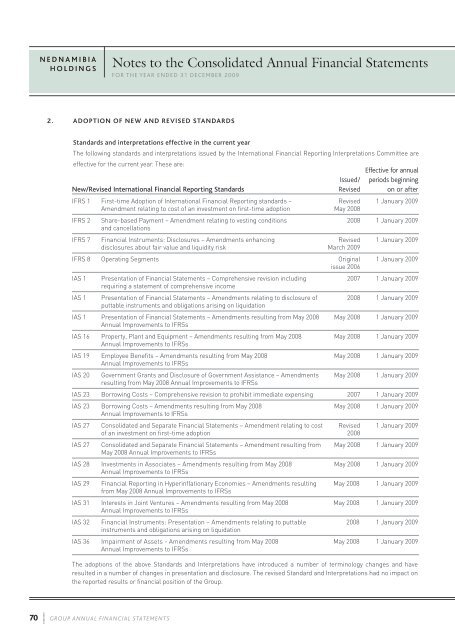

N E D N A M I B I AH O L D I N G SNotes to the Consolidated <strong>Annual</strong> Financial StatementsFOR THE YEAR ENDED 31 DECEMBER <strong>2009</strong>2. ADOPTION OF NEW AND REVISED STANDARDSStandards and interpretations effective in the current yearThe following standards and interpretations issued by the International Financial Reporting Interpretations Committee areeffective for the current year. These are:Effective for annualIssued/ periods beginningNew/Revised International Financial Reporting Standards Revised on or afterIFRS 1 First-time Adoption of International Financial Reporting standards – Revised 1 January <strong>2009</strong>Amendment relating to cost of an investment on first-time adoption May 2008IFRS 2 Share-based Payment – Amendment relating to vesting conditions 2008 1 January <strong>2009</strong>and cancellationsIFRS 7 Financial Instruments: Disclosures – Amendments enhancing Revised 1 January <strong>2009</strong>disclosures about fair value and liquidity risk March <strong>2009</strong>IFRS 8 Operating Segments Original 1 January <strong>2009</strong>issue 2006IAS 1 Presentation of Financial Statements – Comprehensive revision including 2007 1 January <strong>2009</strong>requiring a statement of comprehensive incomeIAS 1 Presentation of Financial Statements – Amendments relating to disclosure of 2008 1 January <strong>2009</strong>puttable instruments and obligations arising on liquidationIAS 1 Presentation of Financial Statements – Amendments resulting from May 2008 May 2008 1 January <strong>2009</strong><strong>Annual</strong> Improvements to IFRSsIAS 16 Property, Plant and Equipment – Amendments resulting from May 2008 May 2008 1 January <strong>2009</strong><strong>Annual</strong> Improvements to IFRSsIAS 19 Employee Benefits – Amendments resulting from May 2008 May 2008 1 January <strong>2009</strong><strong>Annual</strong> Improvements to IFRSsIAS 20 Government Grants and Disclosure of Government Assistance – Amendments May 2008 1 January <strong>2009</strong>resulting from May 2008 <strong>Annual</strong> Improvements to IFRSsIAS 23 Borrowing Costs – Comprehensive revision to prohibit immediate expensing 2007 1 January <strong>2009</strong>IAS 23 Borrowing Costs – Amendments resulting from May 2008 May 2008 1 January <strong>2009</strong><strong>Annual</strong> Improvements to IFRSsIAS 27 Consolidated and Separate Financial Statements – Amendment relating to cost Revised 1 January <strong>2009</strong>of an investment on first-time adoption 2008IAS 27 Consolidated and Separate Financial Statements – Amendment resulting from May 2008 1 January <strong>2009</strong>May 2008 <strong>Annual</strong> Improvements to IFRSsIAS 28 Investments in Associates – Amendments resulting from May 2008 May 2008 1 January <strong>2009</strong><strong>Annual</strong> Improvements to IFRSsIAS 29 Financial Reporting in Hyperinflationary Economies – Amendments resulting May 2008 1 January <strong>2009</strong>from May 2008 <strong>Annual</strong> Improvements to IFRSsIAS 31 Interests in Joint Ventures – Amendments resulting from May 2008 May 2008 1 January <strong>2009</strong><strong>Annual</strong> Improvements to IFRSsIAS 32 Financial Instruments: Presentation – Amendments relating to puttable 2008 1 January <strong>2009</strong>instruments and obligations arising on liquidationIAS 36 Impairment of Assets - Amendments resulting from May 2008 May 2008 1 January <strong>2009</strong><strong>Annual</strong> Improvements to IFRSsThe adoptions of the above Standards and Interpretations have introduced a number of terminology changes and haveresulted in a number of changes in presentation and disclosure. The revised Standard and Interpretations had no impact onthe <strong>report</strong>ed results or financial position of the <strong>Group</strong>.70 G RO U P A N N U A L F I N A N C I A L STAT E M E N T S