2009 Annual report - Nedbank Group Limited

2009 Annual report - Nedbank Group Limited

2009 Annual report - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

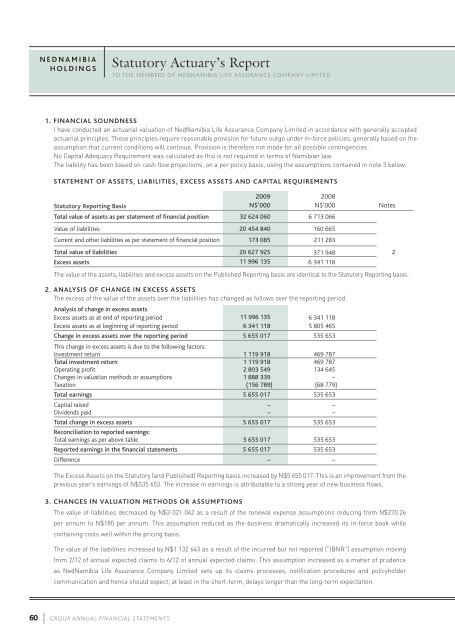

N E D N A M I B I AH O L D I N G SStatutory Actuary’s ReportTO THE MEMBERS OF NEDNAMIBIA LIFE ASSURANCE COMPANY LIMITED1. FINANCIAL SOUNDNESSI have conducted an actuarial valuation of NedNamibia Life Assurance Company <strong>Limited</strong> in accordance with generally acceptedactuarial principles. These principles require reasonable provision for future outgo under in-force policies, generally based on theassumption that current conditions will continue. Provision is therefore not made for all possible contingencies.No Capital Adequacy Requirement was calculated as this is not required in terms of Namibian law.The liability has been based on cash flow projections, on a per policy basis, using the assumptions contained in note 3 below.Statement of Assets, Liabilities, Excess Assets and Capital Requirements<strong>2009</strong> 2008Statutory Reporting Basis N$’000 N$’000 NotesTotal value of assets as per statement of financial position 32 624 060 6 713 066Value of liabilities 20 454 840 160 665Current and other liabilities as per statement of financial position 173 085 211 283Total value of liabilities 20 627 925 371 948 2Excess assets 11 996 135 6 341 118The value of the assets, liabilities and excess assets on the Published Reporting basis are identical to the Statutory Reporting basis.2. Analysis of Change in Excess AssetsThe excess of the value of the assets over the liabilities has changed as follows over the <strong>report</strong>ing period.Analysis of change in excess assetsExcess assets as at end of <strong>report</strong>ing period 11 996 135 6 341 118Excess assets as at beginning of <strong>report</strong>ing period 6 341 118 5 805 465Change in excess assets over the <strong>report</strong>ing period 5 655 017 535 653This change in excess assets is due to the following factors:Investment return 1 119 918 469 787Total investment return 1 119 918 469 787Operating profit 2 803 549 134 645Changes in valuation methods or assumptions 1 888 339 –Taxation (156 789) (68 779)Total earnings 5 655 017 535 653Capital raised – –Dividends paid – –Total change in excess assets 5 655 017 535 653Reconciliation to <strong>report</strong>ed earnings:Total earnings as per above table 5 655 017 535 653Reported earnings in the financial statements 5 655 017 535 653Difference – –The Excess Assets on the Statutory (and Published) Reporting basis increased by N$5 655 017. This is an improvement from theprevious year’s earnings of N$535 653. The increase in earnings is attributable to a strong year of new business flows.3. Changes in Valuation Methods or AssumptionsThe value of liabilities decreased by N$3 021 042 as a result of the renewal expense assumptions reducing from N$270.26per annum to N$180 per annum. This assumption reduced as the business dramatically increased its in-force book whilecontaining costs well within the pricing basis.The value of the liabilities increased by N$1 132 643 as a result of the incurred but not <strong>report</strong>ed (“IBNR”) assumption movingfrom 2/12 of annual expected claims to 6/12 of annual expected claims. This assumption increased as a matter of prudenceas NedNamibia Life Assurance Company <strong>Limited</strong> sets up its claims processes, notification procedures and policyholdercommunication and hence should expect, at least in the short-term, delays longer than the long-term expectation.60 G RO U P A N N U A L F I N A N C I A L STAT E M E N T S