- Page 4 and 5:

N E D N A M I B I AH O L D I N G SH

- Page 6 and 7:

N E D N A M I B I AH O L D I N G SG

- Page 11 and 12:

06 | Christopher J PearceIndependen

- Page 13 and 14:

Left to Right: Andre Ventér; Nevil

- Page 15 and 16:

35,1% increasein net profit after t

- Page 17 and 18:

APPRECIATIONOur thanks are due to o

- Page 19 and 20:

Major improvementin the quality of

- Page 21:

LOOKING AHEADOur strategic focus in

- Page 24 and 25:

N E D N A M I B I AH O L D I N G SA

- Page 26 and 27:

N E D N A M I B I AH O L D I N G SA

- Page 28 and 29:

N E D N A M I B I AH O L D I N G SA

- Page 30 and 31:

N E D N A M I B I AH O L D I N G SA

- Page 32 and 33:

N E D N A M I B I AH O L D I N G SA

- Page 34 and 35:

N E D N A M I B I AH O L D I N G Su

- Page 36 and 37:

N E D N A M I B I AH O L D I N G SV

- Page 38 and 39:

N E D N A M I B I AH O L D I N G SC

- Page 40 and 41:

N E D N A M I B I AH O L D I N G SC

- Page 42 and 43:

N E D N A M I B I AH O L D I N G SC

- Page 44 and 45:

N E D N A M I B I AH O L D I N G SC

- Page 46 and 47:

N E D N A M I B I AH O L D I N G SC

- Page 48 and 49:

N E D N A M I B I AH O L D I N G SC

- Page 50 and 51:

N E D N A M I B I AH O L D I N G SC

- Page 52 and 53:

N E D N A M I B I AH O L D I N G SC

- Page 54 and 55:

N E D N A M I B I AH O L D I N G SC

- Page 56 and 57:

N E D N A M I B I AH O L D I N G SC

- Page 59:

NEDNAMIBIA HOLDINGS GROUPAUDIT COMM

- Page 62 and 63:

N E D N A M I B I AH O L D I N G SS

- Page 64 and 65:

N E D N A M I B I AH O L D I N G SR

- Page 66 and 67:

N E D N A M I B I AH O L D I N G SC

- Page 68 and 69:

N E D N A M I B I AH O L D I N G SC

- Page 70 and 71:

N E D N A M I B I AH O L D I N G SC

- Page 72 and 73:

N E D N A M I B I AH O L D I N G SN

- Page 74 and 75:

N E D N A M I B I AH O L D I N G SN

- Page 76 and 77:

N E D N A M I B I AH O L D I N G SN

- Page 78 and 79:

N E D N A M I B I AH O L D I N G SN

- Page 84 and 85:

N E D N A M I B I AH O L D I N G SN

- Page 88 and 89:

N E D N A M I B I AH O L D I N G SN

- Page 90 and 91:

N E D N A M I B I AH O L D I N G SN

- Page 92 and 93:

N E D N A M I B I AH O L D I N G SN

- Page 94 and 95:

N E D N A M I B I AH O L D I N G SN

- Page 96 and 97:

N E D N A M I B I AH O L D I N G SN

- Page 98 and 99:

N E D N A M I B I AH O L D I N G SN

- Page 100 and 101:

N E D N A M I B I AH O L D I N G SN

- Page 102 and 103: N E D N A M I B I AH O L D I N G SN

- Page 104 and 105: N E D N A M I B I AH O L D I N G SN

- Page 106 and 107: N E D N A M I B I AH O L D I N G SN

- Page 108 and 109: N E D N A M I B I AH O L D I N G SN

- Page 110 and 111: N E D N A M I B I AH O L D I N G SN

- Page 113: 32. OPERATING EXPENDITUREExpenses i

- Page 118 and 119: N E D N A M I B I AH O L D I N G SN

- Page 122 and 123: N E D N A M I B I AH O L D I N G SN

- Page 124 and 125: N E D N A M I B I AH O L D I N G SN

- Page 126 and 127: N E D N A M I B I AH O L D I N G SN

- Page 128 and 129: N E D N A M I B I AH O L D I N G SN

- Page 130 and 131: N E D N A M I B I AH O L D I N G SN

- Page 132 and 133: N E D N A M I B I AH O L D I N G SN

- Page 134 and 135: N E D N A M I B I AH O L D I N G SN

- Page 136 and 137: N E D N A M I B I AH O L D I N G SN

- Page 138 and 139: N E D N A M I B I AH O L D I N G SN

- Page 140 and 141: N E D N A M I B I AH O L D I N G SN

- Page 142 and 143: N E D N A M I B I AH O L D I N G SN

- Page 144 and 145: N E D N A M I B I AH O L D I N G SN

- Page 146 and 147: N E D N A M I B I AH O L D I N G SN

- Page 148 and 149: N E D N A M I B I AH O L D I N G SS

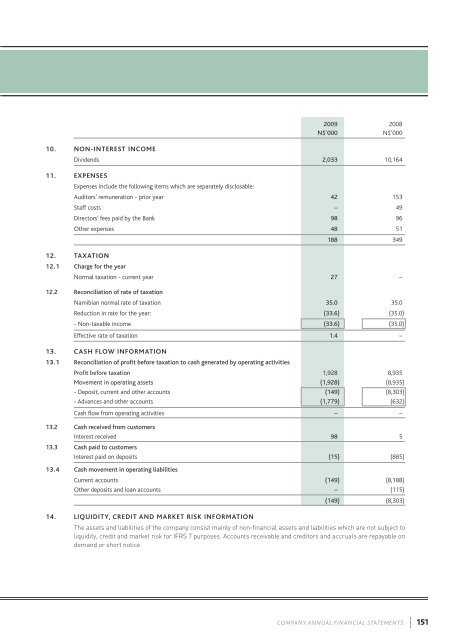

- Page 150 and 151: N E D N A M I B I AH O L D I N G SS

- Page 154 and 155: N E D N A M I B I AH O L D I N G SN

- Page 156 and 157: N E D N A M I B I AH O L D I N G SC

- Page 158: 32N E D N A M I B I AH O L D I N G