Pilot Project on Farm Income Insurance Scheme - Sa-Dhan

Pilot Project on Farm Income Insurance Scheme - Sa-Dhan

Pilot Project on Farm Income Insurance Scheme - Sa-Dhan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

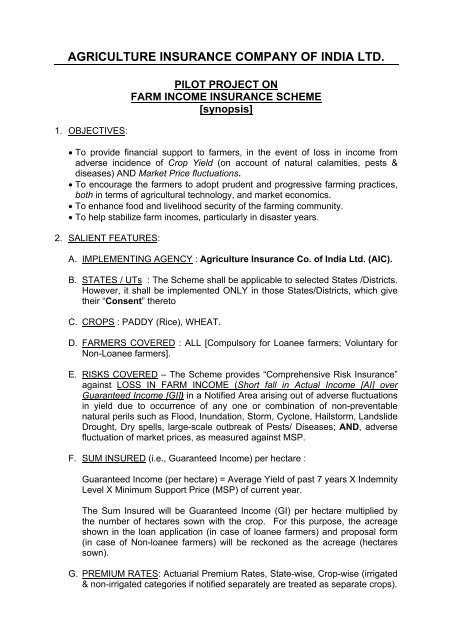

AGRICULTURE INSURANCE COMPANY OF INDIA LTD.1. OBJECTIVES:PILOT PROJECT ONFARM INCOME INSURANCE SCHEME[synopsis]• To provide financial support to farmers, in the event of loss in income fromadverse incidence of Crop Yield (<strong>on</strong> account of natural calamities, pests &diseases) AND Market Price fluctuati<strong>on</strong>s.• To encourage the farmers to adopt prudent and progressive farming practices,both in terms of agricultural technology, and market ec<strong>on</strong>omics.• To enhance food and livelihood security of the farming community.• To help stabilize farm incomes, particularly in disaster years.2. SALIENT FEATURES:A. IMPLEMENTING AGENCY : Agriculture <strong>Insurance</strong> Co. of India Ltd. (AIC).B. STATES / UTs : The <strong>Scheme</strong> shall be applicable to selected States /Districts.However, it shall be implemented ONLY in those States/Districts, which givetheir “C<strong>on</strong>sent” theretoC. CROPS : PADDY (Rice), WHEAT.D. FARMERS COVERED : ALL [Compulsory for Loanee farmers; Voluntary forN<strong>on</strong>-Loanee farmers].E. RISKS COVERED – The <strong>Scheme</strong> provides “Comprehensive Risk <strong>Insurance</strong>”against LOSS IN FARM INCOME (Short fall in Actual <strong>Income</strong> [AI] overGuaranteed <strong>Income</strong> [GI]) in a Notified Area arising out of adverse fluctuati<strong>on</strong>sin yield due to occurrence of any <strong>on</strong>e or combinati<strong>on</strong> of n<strong>on</strong>-preventablenatural perils such as Flood, Inundati<strong>on</strong>, Storm, Cycl<strong>on</strong>e, Hailstorm, LandslideDrought, Dry spells, large-scale outbreak of Pests/ Diseases; AND, adversefluctuati<strong>on</strong> of market prices, as measured against MSP.F. SUM INSURED (i.e., Guaranteed <strong>Income</strong>) per hectare :Guaranteed <strong>Income</strong> (per hectare) = Average Yield of past 7 years X IndemnityLevel X Minimum Support Price (MSP) of current year.The Sum Insured will be Guaranteed <strong>Income</strong> (GI) per hectare multiplied bythe number of hectares sown with the crop. For this purpose, the acreageshown in the loan applicati<strong>on</strong> (in case of loanee farmers) and proposal form(in case of N<strong>on</strong>-loanee farmers) will be reck<strong>on</strong>ed as the acreage (hectaressown).G. PREMIUM RATES: Actuarial Premium Rates, State-wise, Crop-wise (irrigated& n<strong>on</strong>-irrigated categories if notified separately are treated as separate crops).

AGRICULTURE INSURANCE COMPANY OF INDIA LTD.H. PREMIUM SUBSIDY :The Premium Subsidy allowed is:Small / Marginal farmersOther farmers: 75% of Premium: 50% of PremiumThe Premium Subsidy is borne by the Government of India, and is released toAIC at the beginning of the Seas<strong>on</strong> based <strong>on</strong> estimates.I. SCHEME APPROACH :The <strong>Scheme</strong> shall operate <strong>on</strong> “Area Approach” basis.• The Yield shall be calculated at the District/Taluka/Block/Circle etc. level.• The Market Price shall be measured at District/State level.J. SEASONALITY DISCIPLINE :• Loanee farmers: As per the criteria to be fixed by the State LevelCoordinati<strong>on</strong> Committee <strong>on</strong> Crop <strong>Insurance</strong> (SLCCCI)• N<strong>on</strong>-loanee farmers: As decided by the SLCCCI, keeping in mind the<strong>on</strong>set of m<strong>on</strong>so<strong>on</strong>, sowing period etc.• The seas<strong>on</strong>ality discipline can be same for loanee and n<strong>on</strong>-loanee farmersK. INDEMNITY PROCEDURE :• Actual <strong>Income</strong> = current seas<strong>on</strong>’s Actual Yield x current seas<strong>on</strong>’s MarketPrice.• Market Price of a crop = the current sales price of its “comm<strong>on</strong> (i.e.,generic) variety” in the Market.• These prices are recorded by the ‘Agricultural Produce MarketCommittees’ [APMC].• From the first arrival of grain in the Market, each APMC shall record theDaily Modal Price of grain. This exercise shall be d<strong>on</strong>e for 8 weeks.• This DMP with quantity transacted shall be sent to AIC <strong>on</strong> a weeklybasis.• AMB / Mandi Board shall work out the APMC-wise weighted average ofthe DMP (weighted with quantity transacted) for the entire 8 weeks.• Finally, AMB / Mandi Board will submit the Market Price of the Districtbased <strong>on</strong> weighted averages of all APMCs in the District.• To limit the effects of external pressures <strong>on</strong> the market prices, a“capping” & “ cupping” range of 20% of MSP shall be applied <strong>on</strong> thecurrent seas<strong>on</strong>’s Market Price.• “Capping” is a limiting factor <strong>on</strong> the rising graph of prices.• “Cupping” is a limiting factor <strong>on</strong> the falling graph of prices.

AGRICULTURE INSURANCE COMPANY OF INDIA LTD.• Claims (i.e., ‘Shortfall in <strong>Income</strong>’) = Guaranteed <strong>Income</strong> – Actual<strong>Income</strong>.L. SHARING OF CLAIMS:The Product is new with unforeseen financial liabilities, as the Actual <strong>Income</strong>is based <strong>on</strong> Market price, while Guaranteed <strong>Income</strong> is based <strong>on</strong> MSP, (anoti<strong>on</strong>al price without a link to Market Price). Moreover, appropriate ratingmethodology is also not available at this stage. In view of the above, all claimsexceeding 100% of premium, will be borne by the Government of India. Thepremium for the purpose will be 100% of premium less the comp<strong>on</strong>ents ofloading towards administrative and marketing expenses.M. AGENTS COMMISSION AND BANK SERVICE CHARGES :• Agents Commissi<strong>on</strong> – 5% of Gross Premium, ONLY in respect of N<strong>on</strong>-Loanee farmers. This is available to Rural Agents who are authorized toprocure the business directly from farmers.• Bank Service Charges – 2.5% of Gross Premium, in respect of ALLfarmers. This is available to Banks who are directly serviced by them.N. REVIEW OF SCHEME : Review shall be d<strong>on</strong>e before launching a countrywide<strong>Scheme</strong>.O. REINSURANCE : AIC shall make efforts to obtain reinsurance cover in theinternati<strong>on</strong>al market.P. AREAS FOR PILOT PROJECT :• The Crop-wise and State-wise Districts selected for pilot project to bec<strong>on</strong>ducted during RABI 2003-04 seas<strong>on</strong> are:CROP STATE DISTRICTWHEAT BIHAR BuxarCHATTISGARHDurg & Rajanandaga<strong>on</strong>GUJARATBanaskanthaJAMMU & KASHMIR JammuJHARKHANDHazaribagh & <strong>Sa</strong>hebganjMADHYA PRADESH Hoshangabad, Thikamgarh & RaisenMAHARASHTRAParbhaniRAJASTHANKota & PaliUTTAR PRADESHEtawah, Kannauj, Mirzapur & MathuraUTTARANCHALDehradunRICE ASSAM KamrupKARANATKAMysoreTAMIL NADUMadurai• In these experimental districts/crops, NAIS shall be suspended ; in the restof the country, NAIS shall c<strong>on</strong>tinue.

AGRICULTURE INSURANCE COMPANY OF INDIA LTD.BENEFITS EXPECTED FROM SCHEMEThe “<strong>Farm</strong> <strong>Income</strong> <strong>Insurance</strong> <strong>Scheme</strong>” is expected to:• BE a critical instrument of development in the field of Crop Producti<strong>on</strong>,providing financial support to the <strong>Farm</strong>ers in the event of loss of farm income.• ENCOURAGE <strong>Farm</strong>ers to adopt progressive farming practices, both in termsof agricultural technology, and market ec<strong>on</strong>omics.• HELP in maintaining flow of Agricultural Credit.• PROVIDE significant benefits not merely to the insured <strong>Farm</strong>ers, but to theentire community directly and indirectly through spillover and multiplier effects,in terms of maintaining crop-producti<strong>on</strong> & farm-employment, generati<strong>on</strong> ofmarket fees & taxes, and net accreti<strong>on</strong> to ec<strong>on</strong>omic growth.• STREAMLINE Yield assessment procedures and Pricing mechanisms, thushelping to build up huge and accurate statistical database.