Form for furnishing particulars of income under section ... - Sa-Dhan

Form for furnishing particulars of income under section ... - Sa-Dhan

Form for furnishing particulars of income under section ... - Sa-Dhan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

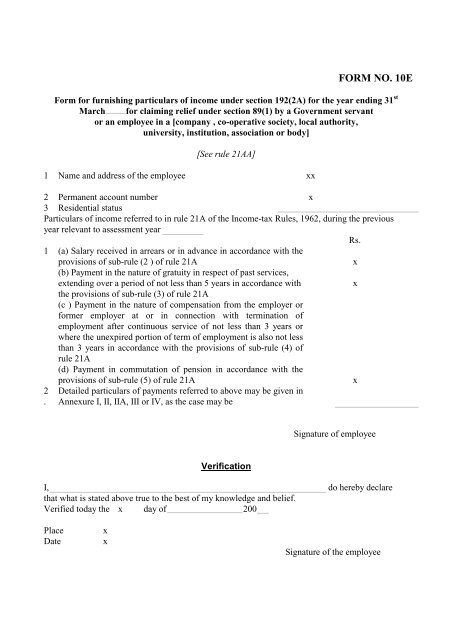

<strong>Form</strong>Number 10E <strong>Form</strong>Section 192(2A) <strong>Form</strong>Law Income Tax & Direct Tax FORM NO. 10E<strong>Form</strong>Title <strong>Form</strong> <strong>for</strong> <strong>furnishing</strong> <strong>particulars</strong> <strong>of</strong> <strong>income</strong> <strong>under</strong> <strong>section</strong> 192(2A) <strong>for</strong> the year ending 31st March x <strong>for</strong> claiming<strong>Form</strong> <strong>for</strong> <strong>furnishing</strong> <strong>particulars</strong> <strong>of</strong> <strong>income</strong> <strong>under</strong> <strong>section</strong> 192(2A) <strong>for</strong> the year ending 31 stMarch x <strong>for</strong> claiming relief <strong>under</strong> <strong>section</strong> 89(1) by a Government servantor an employee in a [company , co-operative society, local authority,university, institution, association or body]relief <strong>under</strong> <strong>section</strong> 89(1) by a Government servant or an employee in a [company , co-operative society, local authority,[See rule 21AA] <strong>Form</strong>ParentAct IncomeTax Act, 1961university, institution, association or body]1 Name and address <strong>of</strong> the employee xx2 Permanent account number x3 Residential status xParticulars <strong>of</strong> <strong>income</strong> referred to in rule 21A <strong>of</strong> the Income-tax Rules, 1962, during the previousyear relevant to assessment year xRs.1 (a) <strong>Sa</strong>lary received in arrears or in advance in accordance with theprovisions <strong>of</strong> sub-rule (2 ) <strong>of</strong> rule 21Ax(b) Payment in the nature <strong>of</strong> gratuity in respect <strong>of</strong> past services,extending over a period <strong>of</strong> not less than 5 years in accordance withxthe provisions <strong>of</strong> sub-rule (3) <strong>of</strong> rule 21A(c ) Payment in the nature <strong>of</strong> compensation from the employer or<strong>for</strong>mer employer at or in connection with termination <strong>of</strong>employment after continuous service <strong>of</strong> not less than 3 years orwhere the unexpired portion <strong>of</strong> term <strong>of</strong> employment is also not lessthan 3 years in accordance with the provisions <strong>of</strong> sub-rule (4) <strong>of</strong>rule 21A(d) Payment in commutation <strong>of</strong> pension in accordance with the2.provisions <strong>of</strong> sub-rule (5) <strong>of</strong> rule 21ADetailed <strong>particulars</strong> <strong>of</strong> payments referred to above may be given inAnnexure I, II, IIA, III or IV, as the case may bexxxSignature <strong>of</strong> employeeVerificationI, Xx do hereby declarethat what is stated above true to the best <strong>of</strong> my knowledge and belief.Verified today the x day <strong>of</strong> 200 xPlaceDatexxSignature <strong>of</strong> the employee

ANNEXURE IIICOMPENSATION ON TERMINATION OF EMPLOYMENTCondition : After continuous service <strong>of</strong> three years and where unexpired portion <strong>of</strong> term <strong>of</strong>employment is also not less than three years1. Compensation received x2. Total <strong>income</strong> (including compensation) x3. Tax on total <strong>income</strong> mentioned against item 2 x4. Average rate <strong>of</strong> tax applicable on total <strong>income</strong>x[Divide amount mentioned against item 3 by amountmentioned against item 2 ]5. Tax payable on compensation by applying the average rate<strong>of</strong> tax [ Multiply average rate <strong>of</strong> tax mentioned againstitem 4 with amount <strong>of</strong> compensation mentioned againstitem 1 ]x6. Total <strong>income</strong> <strong>of</strong> three previous years immediatelypreceding the previous year in which compensation isreceived7. Add one-third <strong>of</strong> the compensation mentioned against item1 in the total <strong>income</strong> <strong>of</strong> each <strong>of</strong> the three precedingprevious years mentioned against item 68. Tax on total <strong>income</strong> <strong>of</strong> each <strong>of</strong> the preceding previousyears mentioned against item 79. Average rate <strong>of</strong> tax on the total <strong>income</strong> <strong>of</strong> each <strong>of</strong> the threepreceding previous years as increased by one-third <strong>of</strong>compensation calculated <strong>for</strong> that year as mentioned againstitem 7 [Divide the amount mentioned against items 8(i) ,8(ii) and 8(iii) by the amount mentioned against items 7(i),7(ii) and 7(iii)respectively ]10 Average <strong>of</strong> average rates <strong>of</strong> tax mentioned against item 9[ Divide by three, the total <strong>of</strong> averages <strong>of</strong> tax mentionedagainst items 9(i) to (iii) ]11 Tax payable on compensation by applying the average <strong>of</strong>average rates <strong>of</strong> tax [ Multiply the average against item 10by the amount <strong>of</strong> compensation mentioned against item 1 ]12 Relief <strong>under</strong> <strong>section</strong> 89(1) [ Indicate the differencebetween the amounts mentioned against item 11 and 5 ](i)(ii)(iii)(i)(ii)(iii)(i)(ii)(iii)(i)(ii)(iii)xxxxxxxxxxxxxxx

ANNEXURE IVCOMMUTATION OF PENSION1. Amount in commutation <strong>of</strong> pension received x2. Total <strong>income</strong> ( including amount in commutation <strong>of</strong>xpension)3. Tax on total <strong>income</strong> mentioned against item 2 x4. Average rate <strong>of</strong> tax applicable on total <strong>income</strong> [ Dividexamount mentioned against item 3 by amount mentionedagainst item 2 ]5. Tax payable on amount in commutation <strong>of</strong> pension byapplying the average rate <strong>of</strong> tax [ Multiply average rate <strong>of</strong>tax mentioned against item 4 with amount in commutationx<strong>of</strong> pension mentioned against item 1]6. Total <strong>income</strong> <strong>of</strong> each <strong>of</strong> the three previous yearsimmediately preceding the previous year in which amount incommutation <strong>of</strong> pension is received7. Add one-third <strong>of</strong> the amount in commutation <strong>of</strong> pensionmentioned against item 1 in the total <strong>income</strong> <strong>of</strong> each <strong>of</strong> thethree preceding previous years mentioned against item 68. Tax on total <strong>income</strong> <strong>of</strong> each <strong>of</strong> the preceding previous yearsmentioned against item 79. Average rate <strong>of</strong> tax on the total <strong>income</strong> <strong>of</strong> each <strong>of</strong> the threepreceding previous years as increased by one-third <strong>of</strong> theamount in commutation <strong>of</strong> pension calculated <strong>for</strong> that yearas mentioned against item 7 [Divide the amount mentionedagainst items 8(i), 8(ii)and 8(iii) by the amount mentionedagainst items 7(i) , 7(ii) and 7(iii), respectively ]10.11.12.Average <strong>of</strong> average rates <strong>of</strong> tax mentioned against item 9[ Divide by three , the total <strong>of</strong> averages <strong>of</strong> tax mentionedagainst items 9(i) to (iii) ]Tax payable on amount in commutation <strong>of</strong> pension byapplying the average <strong>of</strong> average rates <strong>of</strong> tax [ Multiply theaverage against item 10 by the amount in commutation <strong>of</strong>pension mentioned against item 1 ]Relief <strong>under</strong> <strong>section</strong> 89(1) [Indicate the difference betweenthe amounts mentioned against items 11 and 5 ](i)(ii)(iii)(i)(ii)(iii)(i)(ii)(iii)(i)(ii)(iii)xxxxxxxxxxxxxxx